At last week’s council meeting, Mayor Robb Davis emphasized the fact that passing a parcel tax or really any revenue measure is an efficient way for the city to raise revenue for the city.

Mayor Robb Davis pointed out that “these taxes are an extremely efficient way of funding our local infrastructure.”

Indeed, the mayor pointed out that normally only about 27.5 cents or so on the dollar of local taxes stay local.

He said, “The money that we’re generating locally flows out of this community and when we tax ourselves, when we say we’re going to put $250 of our taxes in, we keep all of it – we keep every single dollar.”

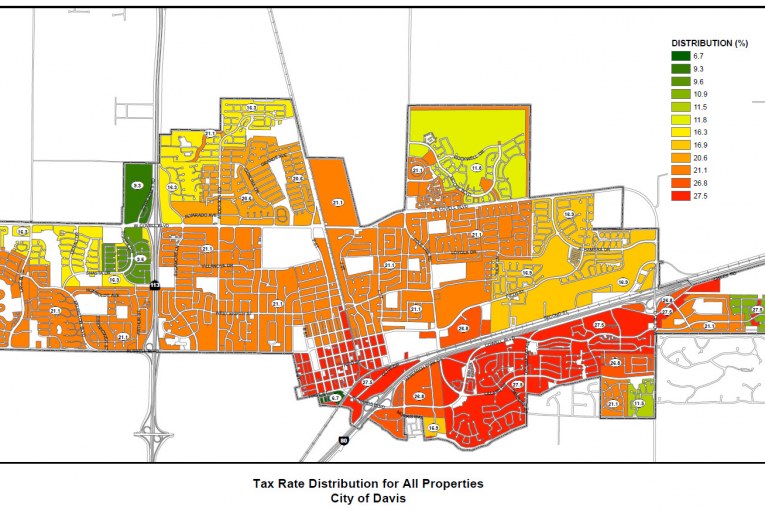

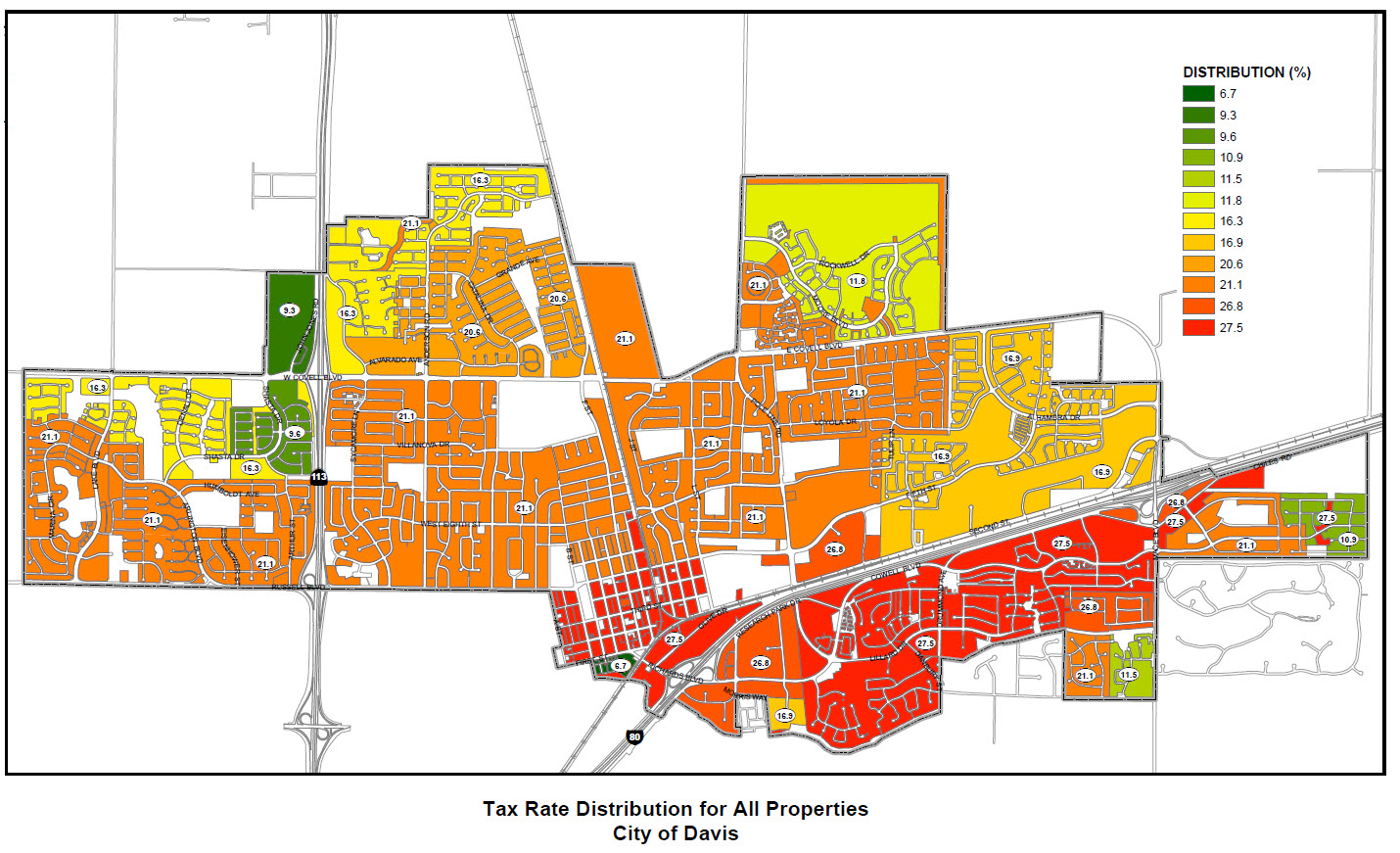

The city in the staff report notes: “As background for the revenue discussion, staff has included a map that shows the distribution of property tax throughout the city.”

They write: “Many people believe that 100% of property tax generated in Davis comes to the City of Davis. Based on California law, only a small portion of property tax revenue stays in the city, and that amount varies per location. The remainder of the property tax is allocated to the state, county, school district and other public functions.”

In fact, while Mayor Davis noted that the city only keeps 27.5 cents per dollar, in fact, that represents the maximum possible tax. Only a few areas mostly south of I-80 have that high a take. A more typical take is about 20 to 21 percent which would include most of the central portion of the city as well as much of west Davis. But there are areas where the city is only taking about 16 percent and even some areas where it is less than 10 percent.

By passing local tax measures, then, the city has the ability to take and keep all collected taxes local.

—David M. Greenwald reporting

What many residents are trying to emphasize is the fact that we’re already highly taxed and any new taxes just adds to that burden. Add to that is the fact that most homeowners will no longer be able to deduct these taxes off of their income tax because of the new tax plan being implemented next year.

https://www.usatoday.com/story/money/taxes/2017/12/22/tax-overhaul-leads-end-year-rush-pay-property-bills/977693001/

The council made clear on at least several occasions that the community needed to back economic development projects or there would likely be revenue measures. They actually put it off by four years, which I think, will end up costing more money in the long run.

“The council made clear on at least several occasions that the community needed to back economic development projects”

Economic development is not just a series of projects, and the failure to understand that is why we have failed miserably in the process. Economic development is a process of expanding commercial activity with the primary goal of creating new private sector jobs. It is a process of creating opportunities for all residents to improve their quality of life. It isn’t about major projects, it is about changing our mindset, moving from a culture of preservation of what ‘I have,’ to one that focuses on expanding opportunities for those who ‘don’t have’ and those in generations yet to come. Economic development, like zoning, is about preparing for the needs of the future and not about the wants of the person you see in the mirror.

Well said. The mindset of economic development (i.e. increasing the economic vitality of the community) is largely missing.

Mark: Seems like the same problem described differently

When the focus is on projects, the CC can claim ‘we did our job’ by putting the project on the ballot (Nishi) and then blame the public for not supporting it, thus justifying raising taxes. The problem is that while everyone was focusing on the big project, no one was working on changing zoning to expand commercial and retail activities all around town or amending the municipal code to remove protectionist language preventing new business from opening, or reducing fees, taxes and other costs for opening a new business, or implementing accountability standards on the Planning Department to ensure that projects are analyzed in a timely fashion.

Davis has this massive driver of new business ideas sitting right next door, but we have spent the past five decades or so thinking up ways to prevent those new businesses from opening or staying in town out of fear of them somehow harming what few we have downtown. We need to change that mindset, but it is hard work, sometimes messy and might require difficult decisions involving putting the needs of the broader community above the wants of the loud and politically connected. It is far easier to simply say, ‘see, we tried’ and now our only option is to raise your taxes.

‘Davis has this massive driver of new business ideas sitting right next door, but we have spent the past five decades or so thinking up ways to prevent those new businesses from opening or staying in town out of fear of them somehow harming what few we have downtown. We need to change that mindset, but it is hard work“

On this point I agree.

Mark

“It is a process of creating opportunities for all residents to improve their quality of life.”

Economic development can be this, but it is not necessarily so. If a resident does not, for whatever reason have a stake in that development, then the development may not improve and in fact may detract from their quality of life. For example, gentrification, while certainly of benefit to developers, contractors and those wealthy enough to live in or conduct business in the ares gentrified, is of detriment to those who are displaced. This process can clearly be seen in Redwood City where my daughter is living now. There are upscale shops and restaurants gradually replacing the mom and pop and less modern businesses such as barber shops giving way to salons, and bodegas giving way to chain stores.

I believe there must be a balance between the needs of existing residents and businesses and those that are envisioned by those wealthy or well connected enough to have a stake in development. Not all existing residents/business owners are either rich or greedy. Some just want to be able to enjoy what they have worked their entire life for. I do not see that as too much to ask.

Partially true… but in Davis, not sure that “most” individuals pay over $10k in state income and property taxes…

But, to the extent it is true, it is “courtesy” of the Administration and the GOP controlled House and Senate… so, they should get credit for that, and you support that action, right?

[their way of getting back at primarily “blue” states… and still increasing the deficit by over a trillion dollars… thank god (Mammon?) for their ‘protection’ of the middle class! And for financial responsibility!]

Howard, I’m retired and I pay more than $10,000 in RE, local and state income taxes. Working homeowners pay much more because they’ll have much higher state income taxes on top of the other taxes.

But either way, with the new $24,000 standard deduction most people won’t write off any RE, state or local income taxes because they won’t have more write-offs than $24,000. So in most cases any new taxes won’t be written off anymore and people will pay the full brunt.

If you’ve been following my posts, and I know that you do, you should know that I was against the GOP Tax Plan. I can post comments I made to that effect if you don’t believe me.

Fine…

I did pay off our mortgage and prepaid all the 17-18 property tax (and pre-paid the City MR assessments), anticipating loss of deductibility of mortgage interest, and loss of deductibility of property taxes/assessments [next tax year], this calendar year. Glad we did.

But, correcting me as to your support (acknowledged), you appear to acknowledge that the changes in the tax code were 100% GOP Congress and Administration. And that in doing so, they passed on 1 trillion+ dollars to the national debt… the fiscal equivalent of “unfunded liabilities”.

And the prez hails it as a victory for middle America. Right. Sounds like you agree this was not the ‘finest moment’ for federal fiscal policy, nor California residents.

But unlike the City, counties, or State, they [Feds] can just print more money… maybe we’ll see the 70’s inflation again… [Nixon/Ford admins]

Said my piece. On this aspect of the topic.

I also prepaid my 2017-2018 taxes, smart move.

California and other high cost blue states got screwed with this tax law which is why I was against it, but most of the rest of the nation will see tax cuts.

Did you mean the Carter Administration? When he took office in 1977 the rate was 5.2% and it went up to 14.8% in March of 1980 and when Carter left office it was 11.8%.

Keith… (and all) here are the numbers…

http://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Draw any conclusion you wish… Carter took office in 1977… there is “inertia” to inflation… doesn’t start overnight, doesn’t end overnight.. Look at cumulative over any given administration, and realize it takes 1-2 years after a new admin comes on board where you can expect any changes…

Two years into Carter’s admin he had the highest inflation numbers this country has ever seen since 1947 and before that 1919 and they’ve never been that bad since Carter left office. Howard, you claim to deal in facts but you often attempt to be a spin master.

I gave a link to facts… what president had a “Whip Inflation Now” message? Hint: it was a Republican…

Spin that if you wish, I care not…

Remember, cumulative inflation is not additive… it is multiplicative…

Regarding the tax plan that was just passed:

Davis shares some commonalities with the Bay Area. I guess we’ll see how this plays out. But, I suspect it’s a “game-changer”, regarding California housing markets and economic development. (Not necessarily a bad thing, in my view.)

http://www.sfgate.com/business/article/Redfin-s-Glenn-Kelman-predicts-a-mass-tech-12459845.php

You are correct… but it also “shares” as many or more differences… ex. temperature/climate is more moderate in the BA (grew up there ~ 1/3 of my life)… they have earthquakes… we sometimes get a hint of them… in 2002, housing costs (purchase) were ~ $540/sf of structure area… in 2017, Davis is nowhere near that.

The BA has a ‘cachet’… the Valley doesn’t…