Back in October, the developers of the Nishi project submitted a preliminary project narrative and conceptual site plan for development of the Nishi property. At this time, the proposal includes approximately 2,200 beds in perhaps 700 apartment units.

In order to get this onto the June ballot, it will have to go to the Planning Commission in two weeks, followed by the City Council no later than February 6.

On Monday, staff asked the Finance and Budget Commission to comment on the fiscal model. The commission voted 5-2 on a motion in which they found: “We also generally concur with the estimate that annual ongoing revenues and costs for the city from the project would be modestly net positive over time.”

According to the staff analysis: “The Nishi project is anticipated to be revenue positive according to the fiscal model analysis. The project will contribute property taxes to the City’s General Fund based on the value of the property. The new property tax revenue for this project would be $2.6 million over 15-years with a valuation of $266 million and a tax rate share of 6.9275%. If the tax rate share went to 10.3912%, the revenue over 15-years period would be $3.9 million. Sales tax revenue over 15-years is $ 2.8 million.”

Staff finds: “Over a 15-year period, the project will contribute $13.8 million in revenue projections while expensing $12.2 million in expenditures. Parks, greenbelts, street trees, all residential street and connectors will be maintained by the development.”

Given the preliminary nature of the project, there are caveats here.

As the commission notes, “the commission did not have available to it a complete and detailed description of the project, a supplemental environmental analysis, or a development agreement with the city. Therefore, any conclusions we have reached should be considered preliminary and subject to change and our commission will continue to review these numbers.”

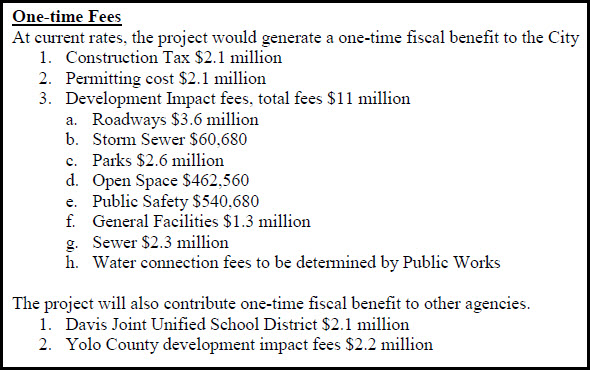

The commission found the estimate developed by staff of one-time fiscal benefits from the project of $13 million in construction tax revenues and impact fees to be “generally reasonable given the data currently available.”

They write: “These resources are to be used to offset unspecified future costs of the city’s growth. However, we note that the city has significant flexibility under city ordinances to use these

resources to address infrastructure needs, like improving roads and parks.”

In addition to finding the project “modestly net positive over time,” they note the potential that the revenues could be either higher or lower than estimated.

For example, “the estimate does not reflect additional revenues that could result if Davis voters approve an increase in parcel taxes. Also, the estimate does not include revenues from Proposition C cannabis taxes or possible community enhancement funds that could result from the negotiation of a development agreement.”

Furthermore, “the EIR adopted for the original, larger, version of the Nishi project suggests that police and fire costs for serving the new residents could be nominal.”

Therefore, they conclude that “the net fiscal benefit of the project could be greater than estimated.”

However, on the other hand, “revenues generated from the project could be less than estimated if Davis voters reject renewal of the parcel tax. Moreover, the estimate assumes voter renewal in 2020 of the full rate currently imposed in Measure O sales taxes. Council or voter actions to reject or reduce Measure O revenues would also reduce the revenues generated by this project and its net fiscal impact.”

When the development agreement is written, it could contain important fiscal provisions “such as a Community Services District assessment, community enhancement funds, and the potential refund of the city’s pre-development costs should the new project be approved by voters.”

They recommend that “these negotiations be informed by an updated residual land value analysis of the revised project.”

Finally they recommend the commission be provided with the opportunity to review and comment on the fiscal provisions of the proposed development agreement.

They also recommend “the inclusion in any development agreement of language to deter master leasing of Nishi apartments by the campus because of the potential negative impact on city property tax revenues. A similar provision was included for the Sterling apartment project.”

—David M. Greenwald reporting

The Nishi financial analysis (from one of the city’s finance and budget commission members) shows a net deficit to the city in the amount of $11,157,205 at year 15 (which would continue to increase every year after that). (The deficit starts in year 1.)

http://documents.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/Finance-And-Budget-Commission/Agendas/20180108/Item-7Ai-Salomon-Revised-Nishi-Model-(1-3-18).pdf

Meaning – that’s the percentage that the city actually receives from property taxes.

Again, there was significant disagreement at this meeting, regarding the revenues and costs to the city. Ultimately, the commission seemed far more interested in meeting the council’s deadline, to get this on the June ballot.

The commissioner who performed the $11 million deficit calculation offered to provide additional analysis, and the commission has agreed to consider it. However, the offer to conduct another meeting prior to the council’s decision does not seem likely to be accepted.

The same phenomenon occurred during the previous budget and commission meeting. Some seemed to want to “move it along”, even before the proposal was actually defined.

It’s unfortunate that the Vanguard continues to (only) tell “one side of the story”, even for important city issues such as fiscal impacts. Anyone coming here for unbiased/object reporting is looking in the wrong place.

I asked staff about the model you keep linking, here’s the response I got: “Commissioner Ray Salomon made changes to the original Nishi fiscal model that I took to FBC in December. He had Finance add his changes to the agenda for January’s meeting. We talked about his changes but it wasn’t voted on it was his point of view. Since the project changed it really has no basis now.”

Again, the proposal wasn’t even adequately defined in December. I recall that even Matt noted that, during that meeting. (Matt did not attend the meeting on January 8th.) Despite that, some of the commissioners seemed to want to “move it along” at that December meeting.

Salomon’s analysis is not even included in the December meeting agenda. It’s included in the January 8th agenda (which I believe is the first time it was actually discussed). A couple of the other commissioners downplayed his concerns and analysis. Salomon offered to provide additional analysis (some of which he noted might show more revenues – e.g., from cannabis sales, as I recall). The commission (led by Dan Carson) agreed to consider additional analysis on their own, but would not commit to Salomon’s suggestion for another meeting to discuss the additional analysis, prior to the council’s deadline to put this on the ballot for June.

No other commissioner even attempted to create an analysis. They all just referred to the staff analysis. (But, as you noted, at least one other commissioner besides Salomon apparently voted against the motion that you referred to.)

I have inquired further, but on the surface, the numbers don’t make a lot of sense given the size of the project and the size of the General Fund as a whole.

At least, no other analysis was presented, other than staff’s and Salomon’s.

As I understand it, Ray used expenditure estimates that were significantly higher than the ones reflected in the city model. So this is a big problem as it accounted for the majority of the negative figure. And if those estimates are higher, than they are going to be higher across the city – which gets to my point from yesterday- a big negative is going to mean a citywide revenue/expenditure problem not a site specific one.

Ray analyzed the site, not the entire city.

Regardless, your argument is akin to knowing that there’s an air quality issue in a particular area, but approving more development anyway (because similar developments already exist).

Not that the air quality argument has any relationship to the comment above, since it’s been pointed out that Nishi may be even even more impacted than some other freeway-adjacent sites.

“Ray analyzed the site, not the entire city.”

But the site is not an island, the staff costs are not isolated to the site.

“Regardless, your argument is akin to knowing that there’s an air quality issue in a particular area, but approving more development anyway (because similar developments already exist).”

No, not at all. The point that I made is that if the problem is related to costs for service versus revenue, then the solution is a citywide one to fix increases in costs to service. In this case, the alternative model has wide ranging policy implications that if true, would have to be addressed at the city level because they would impact the entire city. However, I think that Leland’s analysis is more accurate and hence we have the staff recommendation.

That’s the problem. Costs to provide city services for any given development are eventually paid by the entire city, as its costs exceed revenues. There is nothing to prevent that from continuing to occur.

You have this wrong. The entire city isn’t having to pay for the development, the entire city has to pay for city staffing over time. Until we contain costs and match revenue to their increase over time, that’s not going to happen.

I did not say that the city has to “pay for the development”. (I don’t know what that statement means to you.) Regardless, the city has to pay to provide services for the development. If the costs to provide services for a given development exceed the revenues that the city receives from a given development, than the entire city is forced to make up the difference.

In the case of Nishi, we have an analysis from one of the finance and budget commissioners which shows an ever-increasing deficit (which would be borne by the city) of approximately $13 million, by year 15.

That commissioner has offered to provide additional analysis. I would think that the Vanguard (and the city itself) might be interested in it.

You said: “Costs to provide city services for any given development are eventually paid by the entire city”

I responded, the entire city has to pay for city staffing over time.

“In the case of Nishi, we have an analysis from one of the finance and budget commissioners which shows an ever-increasing deficit (which would be borne by the city) of approximately $13 million, by year 15. ”

Which is based on overly inflated cost inflation estimates and double-counting certain administrative costs. I think I posted some of this yesterday. After reading Dan Carson’s analysis, I am convinced that the commissioner’s analysis greatly overstates the costs over time. You keep repeating a number that you like because it backs up your view, but you failed to probe what that number was based on. After looking at the differences between the two, I think the city’s estimate is far more reasonable and that the one you keep citing has serious factual errors.

Well, you’re certainly entitled to your opinion. I believe that Dan Carson did not agree with the analysis from the entire commission or the external consultant (more than once), for Nishi 1.0. Not sure, but I believe that there’s also been some changes in commission membership, since that time.

Regarding the Salomon analysis, I’ve actually not said anything to defend or criticize it. But, it’s pretty difficult to just ignore it. And again, he has offered to perform additional analysis, to include anything that might impact the conclusion in either direction.

If there’s factual errors, you should probably point them out (perhaps at the next commission meeting, especially if there is one before the council decides to put Nishi on the ballot.) That goes for any analysis, including the one performed by city staff.

“If there’s factual errors, you should probably point them out ”

Why would I do that when they were pointed out to me by Dan Carson?

You haven’t even mentioned what those supposed errors are.

At this point, we don’t even know if it’s simply a $14.4 million dollar difference of opinion (one resulting in a $13 million dollar deficit, and one resulting in a $1.4 million surplus), regarding calculations and allocations of costs and revenues.

However, we do know (from other developments) that housing proposals generally result in long-term, ever-increasing deficits (e.g., Sterling). It’s difficult to believe that this one would be any different. Not to mention the fact that existing developments in the city are not supporting the rising costs of city services.

Actually I did Ron: “Which is based on overly inflated cost inflation estimates and double-counting certain administrative costs””

Repeating generalized statements from one individual does not provide useful information, and can actually undermine the arguments of those who may support the proposal for reasons unrelated to the fiscal impact on the city.

Again, Salomon offered to provide additional analysis to the commission, which might affect the conclusion (in either direction).

I’m not sure why you (or anyone) would resist that, except for the reason alluded to above.

I’m tired of this Ron, you want specifics but never offer them yourself. Do your own work here, you’ve never backed up Salomon’s analysis with any kind of detail. I’ve told you that the commission chair let me know a number of problems with his analysis. I’ve told you that if his analysis is correct, then it is a problem that goes well beyond the development. For one thing, Bob Leland assumes a 2 percent growth rate in costs, if costs go up faster than that, then the least of the city’s problem is Nishi.

I’m sorry that you’re “tired of this”.

As I already noted, I have not defended or criticized any of the analyses. I’ve just pointed out the existence of an analysis from one of the commissioners, which shows an ever-increasing deficit of $13 million at year 15 (vs. a staff analysis, which shows a modest surplus). And, that commissioner has offered to provide additional analysis, which might impact the conclusion (in either direction).

This wasn’t even mentioned in your article, above.

As a side note, I’m not sure that the inflation assumptions in the Leland model were used in one analysis, but not in the other analysis. Nor do we know if that accounts for much difference, or the impact of other assumptions.

It is likely a complicated subject, which can’t be instantly dismissed on a blog. Perhaps we can try to keep an open mind, regardless of our general views regarding development issues. (But, I’m not very hopeful, given the tone of your communications regarding this issue.)

Basically you posted one link and I have done all of the work here chasing down what it meant and you keep saying very little and backing it up with no actual information.

You’ve provided no useful information, while (for some reason) claiming that you have. Again, I have not defended or criticized either analyses. You have, however, completely ignored the existence of one of the analyses (until I pointed it out).

I would think that those who are interested in an impartial analysis would (at least) like to know of the existence of both. Again, your initial article, as well as your subsequent comments seem to indicate that you’re not interested.

You’ve provided no information. It’s confirmation bias. You like the number. What’s it based on? Give me something. You’ve provided nothing.

Actually, this statement more accurately applies to you. You seem much more interested than I am, in defending one of the analyses.

Again, I doubt that this can be adequately analyzed on a blog. But, the information/calculations (for both analyses) is publically available. (Again, however, Salomon offered to provide further analysis to the commission, which might impact the conclusion in either direction.)

Looks like my link above isn’t working, so I’m reposting it below.

When NPV is considered, the projected net deficit for Nishi is actually almost $13 million at year 15.

http://documents.cityofdavis.org/Media/Default/Documents/PDF/CityCouncil/Finance-And-Budget-Commission/Agendas/20180108/Item-7Ai-Salomon-Revised-Nishi-Model-(1-3-18).pdf

Well, the link still doesn’t seem to be working. It seemed to be o.k. when I previously posted it.

I’ll try “going up a level” to the agendas and minutes link (below). Click on the January 8th agenda for the finance and budget commission. Within that document, you’ll find the link to the analysis that I’m referring to.

If that doesn’t work, anyone interested can search for the Davis finance and budget commission, and find the analysis on their own. It’s definitely there.

http://cityofdavis.org/city-hall/city-council/commissions-and-committees/finance-and-budget-commission/agendas-and-minutes

Error message 404 content not found:

Sorry, your request cannot be located at this time. The City of Davis web page is undergoing a system-wide upgrade…

Cathy: Thanks for letting me know. Seems to be working for me, at the moment.

Housing is not intended as a revenue source, it is instead a service that City’s provide to area residents. The goal is for housing to be net neutral following the one-time fees collected at construction. It is commercial development and business growth that provide the recurring and sustainable revenues to fund City services.

Problems arise when cities budget the onetime fees from residential construction as if they were a recurring revenue source, thus requiring the city to jump on the merry-go-round of non-stop expansion in order to replicate those onetime fees. Davis has been guilty of this approach in the past. Instead, we should be working to match the rate of housing expansion to the rate of local population growth and housing demand. Done well, this allows for controlled growth, or as some would say, smart-growth, maintaining property values and preventing ‘sprawl’ while also offering the opportunity for more people to find appropriate housing, and if they choose, to become property owners.

The clear need in Davis is for high-density multi-family housing. With the community’s desire to control the expansion of the City’s borders, that new housing necessarily must come primarily from in-fill projects, just as is stated in our General Plan. Instead of continuing the silly side arguments that some here seem to prefer, we need to focus on addressing our community’s obvious need for more housing in a rational way.

Agreed.

Regarding Nishi, Sterling, Lincoln40 (and possibly a couple of others) – those are almost exclusively designed to accommodate UCD’s expansion, primarily resulting from their pursuit of non-resident students (who pay triple the amount of tuition). UCD’s plans are impacting the entire city.

Below is an article regarding population growth in the region, during 2016. The article shows that Davis grew by 1.5%, thereby exceeding the 1% growth cap.

Regarding your statement, housing demand apparently exceeds the city’s growth cap, as well as SACOG “fair share” growth requirements.

Wondering what rate of growth/development you’d propose, to meet demand.

http://www.sacbee.com/news/local/article148080179.html

“UCD’s plans are impacting the entire city”

What impacted the entire city was the lack of new rental housing for 15 years. UCD is growing about at its historic rate, the city for the most part, has not.

Just to clarify, you’re suggesting that the city should accommodate UCD’s plans (largely due to its recent pursuit of non-resident students), vs. the city’s own plans.

UC Davis is part of our community as we are the host city for the campus. That part seems to be forgotten. I believe the approach that has emerged with both sides providing housing is in the best interest of all involved.

The city had been providing the bulk of housing, for years now. If I’m not mistaken, the city of Davis is already housing approximately 63% of total students.

As previously noted, UC Santa Cruz is providing financial assistance to their adjacent city to help offset that UC’s off-campus impacts, and to limit both enrollment and motor vehicle trips generated by that UC.

http://lrdp.ucsc.edu/settlement-summary.shtml

What a difference, compared to the city of Davis’ approach.

But the city’s share of housing is reduced now. UCD goes from 29 to 46 percent of housing.

It’s an improvement, but again total numbers of students are increasing (including those housed by the city), largely due to UCD’s pursuit of non-resident students who pay triple the amount of tuition.

And, with UCD making no contribution to help offset its impacts. Would we even be talking about taxes and peripheral commercial development (which would likely include even more housing), if UCD was helping to offset its off-campus impacts?

Ron, The greatest emphasis has been on increasing the numbers of CA resident students. UCD has the greatest number of CA resident students of any UC. We are at currently at around 24,000 CA resident students at UCD with an additional small percentage of international/out of state student (around 14% of the total enrollment). So I don’t get your point here.

Sharla: Roberta already responded to your post, in another article today:

https://davisvanguard.org/2018/01/commentary-uc-davis-city-plans-get-us-near-five-percent-vacancy-level/#comment-375501

Also, I recall that 4,500 of the 5,000 students that UCD is pursuing as part of its “2020 Initiative” are non-resident students.

Yes, that 2020 initiative, which proposed accepting more international students over many years, but still a fraction of the total enrollment and you are not mentioning the increase in CA residents at all. 2016 dipped in relation to 2015, but was higher than 2014, so the trend is still going up. Do you think UC Davis should not accept out of state or international students at all and, instead, only accept CA residents?

Sharla: As I recall, the state legislature provided additional funds at one point to the UC system to accept a slightly higher number of California residents, system-wide. They did so out of concern that the UC system as a whole was using different (lower) standards, for higher paying, non-resident students. Perhaps I’ll try to find those articles again, if you’d like.

I would ask you if the city should abandon its own plans (including conversion of industrial/commercial space, and/or sacrificing space that might be used to house a wider population of residents, exceed growth caps and SACOG fair share growth requirements, and incur costs and impacts just because UCD wants to pursue full-tuition students? (And, without providing adequate housing on campus, and/or compensation to help offset its off-campus impacts, as UC Santa Cruz is doing?)

Do you think that’s in the interest of the city, as a whole? If so, then we likely have very different ideas, regarding city planning.

Apparently, I’m not allowed to respond.

That statement does not include Affordable rental housing. Nor does it consider the impacts of the recession.

And now, all we have are primarily student housing proposals, to accommodate UCD’s plans. Nothing intended for anyone else. Some of which require zoning conversions, from industrial/commercial, and which exceed SACOG “fair share” growth requirements. Not to mention shortchanging the city’s Affordable housing program, as well as development impact fees (due to multi-bedroom structures, some of which are double-occupied per bedroom).

That’s o.k. I’m reasonably sure that the Vanguard will step up its efforts for peripheral development (which will include housing), very soon. All while subtly threatening Measure R.

Sounds like “a plan”, all right.

Affordable housing rentals don’t rent to students. I should have clarified market rate units. UC Davis’ enrollment reflects the slowdown during the recession so it balances out. Basically both stopped, UCD started growing again, the city didn’t keep up.

I don’t know exactly when UCD (and other UCs) started pursuing full-tuition, non-resident students, but that’s why the growth is occurring.

Some apparently think it’s the city’s responsibility to accommodate that growth and its resulting impacts. I still wonder what will happen when that “well” eventually dries up (due to competition from other universities worldwide, changes to political and/or economic conditions in this country – and/or other countries, currency exchange rates, etc.).

It is growing because of the large demand from CA residents who want to study at UCD. UCD turns away thousands of qualified students each year. The well will not dry up in the foreseeable future, but, if it does, the vacancy rate will rise to healthier levels.

Sharla:

As noted above (and in the link below), fewer California residents were admitted to UCD this year, compared to last year.

https://davisvanguard.org/2018/01/commentary-uc-davis-city-plans-get-us-near-five-percent-vacancy-level/#comment-375501

Also, I recall that 4,500 of the 5,000 students that UCD is pursuing as part of its “2020 Initiative” are non-resident students.

I can repost articles regarding state audits which are highly critical of UC’s enrollment decisions (which disadvantage California residents), if you’d like. But, do you really want to challenge this, again?

[moderator: edited]

Ron, Slightly fewer students were enrolled in 2016 than 2015. However, more students were enrolled in 2016 than 2014. Enrollment is trending up over many, many years. Offers of admission were made to thousands more who did not select, for whatever reason, to attend UCD.

A comment of mine was removed? I’d like an explanation.

[moderator: edited]

Read more here: http://www.sacbee.com/news/politics-government/capitol-alert/article68782827.html#storylink=c

http://www.sacbee.com/news/politics-government/capitol-alert/article68782827.html

As a side note, I see some links to related stories off to the side of this article (apparently regarding rising costs and impacts on all renters throughout California – not just students in Davis). I understand there’s an effort to overturn the Costa Hawkins law, which would enable cities throughout California to enact tougher rent control ordinances.

It seems like Ron understands the concept that UCD can get more money by letting in more out of state kids (that pay ~3x more) or spend less money buy hiring less expensive graduate teaching assistants. As I mentioned yesterday the city can do the same thing to get more money by jacking up the cost of permits and fees or spend less money by hiring less expensive non union labor (or not filling positions like “Sustainability Manager” since few in town would notice if we didn’t have a FTE managing our “sustainability”)…

P.S. Actual “fortune tellers” (with tarot cards and a crystal ball) often come closer to the actual numbers when making predictions 10 to 15 years in the future than “economists” (with econ degrees from Ivy League schools)…

P.P.S. Almost every business “predicts” they will make a profit year after year, but most don’t and they fail. A recent HBS study of companies funded by VCs said that 75% of the start ups fail (a success rate just a little better than restaurants started by people that never went to college).

I think that the net budget impact of higher-tuition students was a definite factor when Chancellor Katehi announced the 2020 Initiative in 2011. The added diversity that they bring is another benefit. But keep in mind what the state was doing to their share of UC’s budget at that time. Encouraging out-of-state and international student enrollment made great sense from a fiscal standpoint. I’m not sure why people construe it as a negative in any way. UCD has an international reputation in some fields and that is enhanced when students come here from other countries to study.

Don: It’s not an argument against the pursuit of international students, per se. It’s just that some of us want UCD to assume the costs and impacts of that (new) plan. If they’re pursuing full-tuition students, they’re essentially acting as a partially privatized business (without assuming responsibility for housing those students, and without paying taxes to offset the impacts off-campus). (Not to mention the private grants that they pursue.)

Of course, we could also argue if pursuing non-resident/international students is the mission of the UC system, in the first place. (Even if UCD was more willing to help offset the resulting impacts.)

That is, unless some believe the city should incur those costs/impacts, exceed growth caps and SACOG requirements, convert industrial/commercial space (and/or taxpayer-funded social service facilities that were demolished to accommodate student housing), displace non-student renters, shortchange impact fees and Affordable housing, etc.

Other than that, everything is “just fine”.

“It’s just that some of us want UCD to assume the costs and impacts of that (new) plan. ”

That raises more questions than answers. Naturally there are costs and impacts involved in every decision you make. There are also benefits. I firmly believe that this is the cost of being a host city but that the benefits of being a host city far outweigh the costs.

David: I’m inclined to agree in some ways. For example, there’s clearly some benefits for those with a direct connection to UCD. There’s also benefits for others.

Not sure that the benefits to the city as a whole (e.g., fiscal and other impacts already discussed). As we know, other cities (e.g., Santa Cruz and Berkeley) may also be finding that the drawbacks of continued “voluntary” UC growth (e.g., pursuit of higher paying, non-resident students) are starting to outweigh the benefits. (Also at the expense of California resident students, at times. That applies to the vacancy rate, as well.)

You’ve also acknowledged this type of friction between San Luis Obispo (and its adjacent university), which I recently described as a “U.C.”, before I caught my error.

Probably happening elsewhere, as well. Trends and concerns within Davis are rarely totally unique to this town.

The University is a constant source of new revenue-generating opportunities and all the City needs to do to benefit is provide space for businesses to start and prosper. If we are not receiving sufficient benefit from being the host of a world-class university, we have no one to blame but ourselves.

Mark: Those “revenue-generating” activities have (for the most part) consisted of new housing proposals. (Even proposals that are associated with commercial development.) Unfortunately, it’s not the city that gets the revenue, to say the least. (Perhaps temporarily they do, as you noted in an earlier comment above. Until costs start exceeding revenue.)

Strange, how the folks who are concerned about economic development are so quiet, regarding the complete elimination of an innovation center component at Nishi. (Not to mention the other large industrial/commercial sites in town, that are proposed for conversion to housing. One of which has already been approved.)

Ken…

El Wrongo! In California, permit costs and fees have to be reflective of actual costs to provide services… ‘full recovery’ is OK… exaction/’profit’ is “verboten”… what you seem to suggest is patently illegal… that may not bother you, but it bothers me big time!

Tuition is a different world… don’t know what the laws are on that, but as to City fees for either processing or ‘impacts’, you are flat out WRONG!

I think Howard is “El Wongo” the Yolo County Sheriff has never seen our dog and cat yet we have paid them over $500 in the last 10 years to to have our pets “licensed”. The city charges business $50- $500 every year to be “licensed” (that is THOUSANDS a year for each real estate office CPA firm and beauty salon full of independent contractors), The Davis fire department charges every business in town $125/year for an “inspection” yet only “inspects” (for about 10 minutes) every few years. We all know that “government accounting” is a lot like “hollywood accounting” and the Sheriff could easily find a way to jack the cost of a pet license up to $100/year and still not have “full recovery”…

https://www.theatlantic.com/business/archive/2011/09/how-hollywood-accounting-can-make-a-450-million-movie-unprofitable/245134/

The fee went from $40 per year to $125 a couple of years ago. Takes them about five minutes to inspect my store. But they do it annually.

What you may be encountering may be a ‘breach’ of the law… I stand by my statement…

Murder is against the law… but still happens…

Perhaps you advocate for “breaking the law”? In order to generate revenue, and open the City up to lawsuits? Fine. You are entitled to your opinion.

And feel perfectly free to sue the county for what you feel are “outrageous” and disproportionate fees . On the pet thing, either we don’t license animals, or a $50/year, for multiple pets, cry me a river.

I wonder if Howard has ever asked why the city of Davis charges ~10x more to license a successful attorney in town than a not very successful cleaning lady? Are the ” actual costs to provide services” more for an attorney that makes a lot of money (or who may not make a penny in profit but has a lot of gross revenue)?

Ken A writes:

As attorneys are ‘licensed’ not by the City, assume you mean “business license” charged by the City. Which is based on category and gross receipts… it is not actually a “fee”… it is, in fact, a “tax”. One might as well ask why the State and Feds charge more for someone who makes $200 k/year than someone who makes $20,000/yr. Yet, in all likelihood, the lower paid person gets same (or more) services from the State/Feds as the higher compensated person. Strike 2…

Weird response, Ken… shows a lack of understanding.

I have pointed out many times that the city can get more money by charging people more in fees and what they charge to permit people to do business (or anything else) in town. Howard first said I was “El Wongo” but now says I have a “lack of understanding” when he basically agrees that my original statement was correct and no one is going to win a suit to the city trying to argue that it does not cost over $1,000/hour for a fireman to walk down the street poking his head in each business for ~5 min or that that “actual cost” to permit an successful attorney to have a business is not any more to permit an unsuccessful attorney (who does not bill a single hour of work) to have a business in town.

You originally cited FEES. You were wrong as to what can be charged.

Then to defend your assertion you cited something that turns out to be a TAX.

Then you cite my answers to each being in conflict, hence proving your original assertion.

Strike 3. No more at bats on this topic.

My comment re ‘lack of understanding’ remains.

You are correct… AB 1506 (Bloom)… it died in committee, 3-2 [may come back as an initiative]… you neglected to note that the tenants present chanted “housing is a human right”… wouldn’t that also apply to all students, staff, others working in Davis, and the homeless? Or, is that too “progressive?”

Correction… 3-2-2… 3/7 means it didn’t pass. 3 voted for, two against, two abstentions…

[Source: a SacBee article yesterday]

Howard: I guess you’re addressing your comment to me.

AB 1506 was an effort to overturn Costa-Hawkins, which (currently) places restrictions on the ability of cities to enact local rent control ordinances. You are correct, in that it may come back as a statewide initiative.

I have not made any arguments for, or against such efforts. (I am aware of the “pros and cons”.) One of the “pros” is that rent control has significantly helped some long-term renters to remain in their units, with very low monthly rent. I’ve witnessed that, as well.

Recall, my post ‘called you out’ as correct. Did not undermine you. Affirmed you. Did ask a follow up question out of curiosity… you have clarified… thank you. Have a great day!

This just in:

As of 1:00 P, 32 comments/posts:

Ron 56%

David 22%

Sharla 16%

All others 6%

And, how many of those other commenters directed comments to me? In other words, how many were a response to those commenters? Including yours, which is about me?

More importantly, does your comment serve any purpose, other than to undermine my responses?

Moderator?

It’s so funny seeing Howard calculate how much other people comment.

Like he doesn’t comment a LOT.

Don’t worry about it Ron. It’s just his usual trollish behavior.

Thanks, Keith. As always, your supportive comments are appreciated. (And, I realize that’s not an “endorsement” of my arguments/points.) If more folks were as respectful as you generally are, there’d be a whole lot less “time-wasting” and negative reactions. (And, less work for a moderator.)

The comment section of the Vanguard would be much more useful and productive if everyone would please focus on the issues at hand and avoid the personal conflicts.

VCs expect a high percentage of their investments to fail, it’s built into their business model. If 75% fail quickly and 22% sputter along slowly dying and 2% break even and 1% become Apple or Google or Facebook or Instagram, they’re gazillionaires. Even if the 1% only become modestly successful — generally defined as successful enough to get bought — the VCs do okay. By and large, they’re neither stupid nor inept, and their “failure rate” isn’t an indictment of the practice of economic prediction.

Jim is correct that VCs (who have lots of data and understand probability) expect a high percentage of the firms they invest in to fail. My point is that NONE of these guys run numbers that show a firm WILL fail before they invest millions of their investors (more often than not including their own money). People should remember this and keep in mind that even VCs that are worth millions (sometimes Billions) working with some of the smartest (and well paid) people in the world are almost always wrong when they do economic forecasts before they decide that a spreadsheet prepared by the assistant to the assistant development planner shows what will really happen in 10-15 years (or even 10-15 MONTHS)…