By Rik Keller

Based on extensive analysis of the Nishi project I did using my long-term professional experience as an affordable housing and city planning consultant, I found that there is a lot of dishonesty in how the project is being marketed by its proponents as “affordable.” The Yes on J campaign website touts its “groundbreaking, privately-funded affordable housing program.” However, when the numbers are looked at more closely, it is just marketing lingo that is covering up for the developers proposing to charge substantially more by running the project with a bed-lease arrangement rather than a room-lease or unit-lease arrangement. Fundamentally, the way the project is structured provides a large profit margin for the developer for the provision of expensive, exclusive housing compared to existing Davis rental rates.

The bottom line is that the ‘market rate’ units–consisting of 90% of the units in the project–will be among the most expensive, if not THE most expensive rental units in town, and even the majority of the ‘affordable’ units will be more expensive than average current city rental rates.

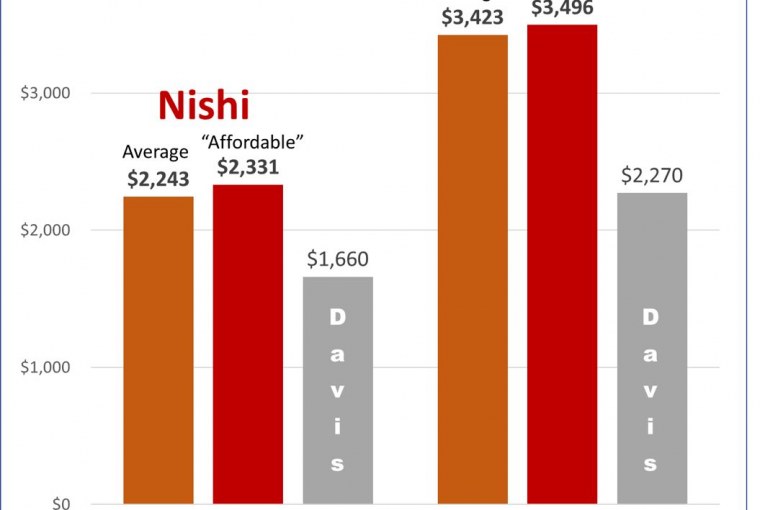

Overall, the projected average unit rents for the whole project (including both the ‘market’ and the ‘affordable’ beds) are 35% and 51% higher than the Davis average for 2-bedroom and 3-bedroom unit leases, respectively:

- $2,243/month for Nishi 2-bedroom units (35% higher than the existing Davis average of $1,660)

- $1,122 per bedroom compared to $830/bedroom

- $3,423/month for Nishi 3-bedroom units (51% higher than the existing Davis average of $2,270).

- $1,141 per bedroom compared to $756/bedroom

- No 4-bedroom units in Nishi; Davis 4-bedroom units have an average rent of $2,858, or $715/bedroom

Also, the project calls for mandatory dense living conditions in which all of the ‘affordable’ beds and a portion of the ‘market’ beds are double-occupancy at two beds per bedroom. When considering just the portion of ‘market’ units that are designated for double-occupancy the affordability gets even worse than the single-occupancy units: the equivalent unit rents are more than twice existing Davis average unit rents. This is because that while with unit leases one can often double-up beds in rooms to reduce rent costs per bed, the Nishi project will charge a much higher rate for the same room with two beds in it.

Because the Nishi project calls for doubling-up of beds in bedrooms for all of the ‘affordable’ beds and a portion of the ‘market’ beds in the project, actual costs per bedroom are significantly higher. In an irony, whereas usually market rate units subsidize the affordable units, for the Nishi project, because the ‘affordable’ units are all doubled-up, the renters in the majority of the “affordable” units would actually be providing more of a per-unit profit for the project than the the majority of “market rate” units.

The following are detailed points of my analysis (I have developed a substantial amount of backing material to support these claims and while  some of this is explained and source listed in the asterisked endnotes, I am not including much of it in this article for the sake of brevity. Anyone wanting to drill-down into the points made in the body will find the supporting information in the endnotes.

some of this is explained and source listed in the asterisked endnotes, I am not including much of it in this article for the sake of brevity. Anyone wanting to drill-down into the points made in the body will find the supporting information in the endnotes.

Expensive Housing

- In general, individual bed/bedroom leases have a high rent premium compared to leases by the unit converted to per-bedroom or per-bed rates. This results in higher profit margins per unit of housing for developers/property owners. Leasing individual beds masks the true cumulative collected rent per unit, thus obscuring actual per-unit costs;

- An example of how leasing by the bed serves to increase profit margins is that while the single-occupancy ‘market’ bedrooms for the Nishi project are projected at a $1,000/month lease* (still far in excess of existing Davis unit leases converted to bedroom basis), because the project leases by the bed, the projected lease rates for double-occupancy ‘market’ bedrooms are $1,700 ($850 per bed). This means these double-occupancy units would have rents at $3,400/month for 2-bedroom units (2.04 times the existing Davis average of $1,660) and $5,100/month for 3-bedroom units (2.25 times the Davis average of $2,270);**

- Contrary to the Yes On J promotional materials, the ‘market beds’ are projected to rent for substantially more than actual existing market rates for all rental units across Davis, This will make the market rate units substantially less affordable than overall current Davis rental rates. When comparing the project to existing market rents in Davis, the Nishi marketing materials compare it only to the tiny portion of the existing rental housing stock in the city of Davis that consists of bed leases in an attempt to mislead the public into thinking the project is more affordable than it is compared to actual overall existing Davis rents;***

- Average 2017 Davis rental rates for unit leases were $1,660 for 2-bedroom units, $2,270 for 3-bedroom units, and $2,858 for 4-bedroom units**. These are equivalent to $830, $757, and $715, respectively, when converted to per-bedroom rates. However, there is no survey data for below market rate units, which would lower these averages further. This also does not account for bedrooms which may be doubled up at two persons per room (many rentals with families with children and college student rentals), which would lower the averages calculated on a per-bed basis even more.****

- Because the Nishi project calls for doubling-up of beds in bedrooms for all of the ‘affordable’ beds and a portion of the ‘market’ beds in the project, actual costs per bedroom are significantly higher. When calculated for each rental unit, the projected average unit rents (based on 2017 market conditions/income limits) for the whole project (including both the ‘market’ units and the ‘affordable’ units are: $2,243/month for 2-bedroom units (35% higher than the Davis average of $1,660) and $3,423/month for 3-bedroom units (51% higher than the Davis average of $2,270).* These rates are a bit below the maximum unit rent in Davis of $2,600 for a 2-bedroom unit while far exceeding the maximum $2,860 for a 3-bedroom unit in the 2017 BAE survey.** The bottom line is that these ‘market rate’ units will be among the most expensive, if not THE most expensive rental units in town.

The Fake Affordability Component and Required Doubling-Up

- The developer is proposing requiring two students per bedroom in the ‘affordable’ bedrooms while the vast majority of rest of the project will be one student per bedroom.***** However, because the affordability component of the project is being calculated by the bed, the project is attempting to get away with providing a smaller amount of affordable housing than if the affordability requirement applied on a more equitable basis to housing units. Because of this, the provision for 15% affordability in the project (which itself required a temporary “bridge” reduction to the City of Davis’ affordable housing ordinance requirement of 35%******) works out to only about 10% of the actual bedrooms in the project being designated as ‘affordable’. Overall with double-occupancy of rooms and 2- to 3- bedroom units, there will only be about 70 affordable units on the site in total;

- Because of the doubling up of beds for the ‘affordable’ leases, the students who qualify and win the lottery will be treated as second-class citizens, with two to a room for the privilege of paying a combined room rent that far exceeds existing market rents in Davis as well as the rents for the single-occupancy ‘market’ rooms in the project.

- Compared to average 2017 Davis rental rates for unit leases, 2/3 of the ‘affordable’ units (for the designated very low-income (VLI) students) would be renting at per-unit rates far in excess of existing Davis unit rental rates: $2,688 for a 2-bedroom unit (compared to $1,660) and $4,032 for a 3-bedroom units (compared to $2,270).

- Even when compared on a per-bed basis, 2/3 of the ‘affordable’ units (for the VLI students) will be renting at projected rates ($672) comparable to the existing citywide leased unit averages converted to a per bed rate for a 3-bedroom unit ($709/bed) and more than in a 4-bedroom unit ($595/bed) [note: the existing units also have far below 2 persons/bedroom);

- To add insult to injury, these rates for the designated VLI double-occupancy bedrooms ($672 x 2 = $1,344) are even more than the projected single-occupancy room lease rates for the project ($1,000). In a very real way and in an ironic twist, the majority of low-income students will thus be subsidizing the ‘market rate’ students;

- The remaining 1/3 of the ‘affordable’ bed (for the Extremely Low-Income (ELI)) students will be paying per-room lease rates of $808 rent ($404 x 2)–all while crammed in at two students per bedroom–compared to Davis existing average rents when converted to per-bedroom rates of $830 (2-bedroom), $757 (3-bedroom), and $715 (4-bedroom)’

Conclusion

This project seems to me a deeply cynical and exploitative scheme to provide expensive housing using bed leases as cash cow, and collect huge profit margins while claiming “affordability.” If the developers were really responding to the need for more affordable rentals in Davis as they are marketing the project, they would be building a range of 2-, 3-, and 4-bedroom units where rental rates calculated per bed would be at the $600-700 level, in-line with current average Davis market rates, and allow doubling-up on a selective basis while charging the same room rent. Instead, they will be leasing by the bed at massive premiums.

I have seen arguments that attempt to apply simplistic Econ 101 thinking about an increasing supply of housing cutting overall costs, saying essentially that “even if the project isn’t affordable, at least it will still increase the housing supply and will cause downward pressure on rents.” This sort of trickle-down thinking for affordable housing provision is the subject for another analysis. However, I can say that it does not take into the many complex dynamics and characteristics of housing markets. While a supply “shock” of the magnitude of the Nishi project could theoretically put downward pressure on rents, the effect is likely to be much less than we would hope for.

Among the reasons for this include the fact that local housing markets do not exist in a vacuum and are subject to regional influences (and sometime international influences in the case of investment properties). Furthermore, there isn’t one monolithic “housing market” at the local level, but rather multiple markets based on income level. For example, there is increasing research about the bifurcation of housing markets where an increase in the high-end expensive housing supply can keep prices contained in that market, but have little no effect on the middle- to low-income housing markets.

The “filtering” mechanism for housing works only in the long term, and there are many factors such as latent/pent-up demand and assumptions about the price elasticity of consumer demand that can keep an increased housing supply, especially high-end housing, from mitigating price increases significantly. There is some evidence that high-end housing especially, while increasing supply (at least for that tier of housing), can actually induce demand for more housing and shift the market demand curve such that there are price increases.

Finally, we have limited opportunities for affordable housing projects in Davis. To the extent that an exclusive high-end project that doesn’t address affordability gets built on a site, it means that a good project that addresses affordability and inclusivity cannot. That represents a lost opportunity for the affordable units that COULD be built on the Nishi site (if it is indeed an appropriate site for residential uses at all: a whole different debate) with a project that paid more than lip service to the issue.

Rik Keller has 17+ years of experience in affordable housing policy & analysis in Texas, Oregon, and California after obtaining his master’s degree in city planning; he is also a 10+ year Davis resident and a current renter.

Notes:

* From the memo dated 2/1/2018 included as Attachment 10 “Economic Analysis Summary” in the City Staff Report to City Council for the project

** City of Davis rent averages from the BAE Urban Economics study “2017 Apartment Vacancy and Rental Rate Survey”

http://housing.ucdavis.edu/_pdf/vacancy-report/2017-vacancy-report.pdf

*** Project proponents have also stated that the Nishi ‘market rate’ rent would be around $900 per bedroom and that is is in-line with existing rental costs in Davis. This claim is false in two ways: 1) the projected rents for the project are higher, and 2) existing Davis rents are significantly lower.

As described in the 2017 BAE rent survey only 13 percent of units in Davis are rented under bed lease arrangements and they are much more expensive than the vast majority of rental units. While the Nishi project will be leased by the bed, the use of the “average rent by the bed” statistic is a misleading comparison as it does not provide an accurate indication of actual existing rents across Davis, because bedroom leases make up only a small fraction of all rental units, because they did not convert unit leases to a per-bed equivalent, and because below market rate units were not included in the average rents in the BAE analysis at all.

Interestingly the text changed on the campaign website when I started making comments about a week ago on various social media posts about how deceptive the marketing was. On the “Facts” page of the campaign website and in on-line ad campaigns, there was previously a claim made that average rents in Davis were $890. I had commented in several social media and other online locations about this deception and I see that, as of this writing, the campaign changed the claim to remove any specific dollar amount and replace it with this more vague (but still misleading) statement ”According to the 2017 Vacancy and Rental Rate Survey, this would be the lowest bed rent in all of Davis.”

**** Using data in the BAE report, I calculated the average rents per bed for market rate leased units (making up 87% of the units in the BAE survey) by bedroom size by using the beds per bedroom rate for bed lease units in the survey as the following: $790/bed for 2-bedroom, $709/bed for 3 bedroom, and $595/bed for 4-bedroom units.These numbers are likely still high as doubling-up is more likely in unit leases than in bed leases.

***** See the “Affordable Housing Plan” on p. 61 of the Approved Development Agreement (http://cityofdavis.org/home/showdocument?id=9031)

“There will be no distinction made between the Affordable Beds and beds rented at market rate, except that market beds may in one-bed bedrooms while all Affordable Beds are anticipated to have two beds per bedroom.” What I make of it is: that’s a pretty big exception! What it means is that the developer is proposing to cram two students per bedroom in the ‘affordable’ bedrooms while the vast majority of rest of the project will be one student per bedroom.

******* A temporary amendment to the City oF Davis affordable housing requirements put in place a 15% “alternative requirement” that could be met instead of the standard 35% requirement.There are apparently other project amenities that address some of 9 different criteria laid out in the City’s ordinance. However, I have not seen any analysis about what exactly these consist of, nor a fiscal analysis of these benefits compared to the opportunity cost of not providing the 35% affordable housing component. And I have not seen any fiscal analysis that a 35% affordable component would not be achievable on that site.

What is the point of this article? The market will determine what the developers can charge for beds at Nishi regardless of what they are proposing to charge. UCD students have a number of options including Davis, Dixon, Woodland, and towns further afield. If the price projections are not correct they will have to reduce the price to fill the beds.

It’s really none of our business. Availability will necessarily drive affordability.

I think the point is “I’m an expert, so a thousand arguments of mine trump simple supply and demand, so less housing is better for low income people”.

Kinda like that air expert guy.

Alan Miller:

Please provide a detailed analysis of the elasticity assumptions you are using for your supply/demand analysis and your results so that we may be better informed. A detailed discussion of the effects of pent-up demand and induced demand would also help.

Letting the market address affordability hasn’t really worked out so well.

My article points out that the developers are targeting the highest end of the Davis rental market and that the promised “affordability” is just a smokescreen. They apparently think their projected rents will be met as they came hat in hand to the City Council claiming that their project barely penciled out. David Greenwald is also on record as agreeing that, given pent-up demand, these types of high-end projects can essentially act as price-setters: “In essence, the problem is this. In a more equitable market, the home buyer could negotiate the cost of the CFD off of the cost of the initial purchase. But the problem in Davis, with limited supply and large amounts of demand, the seller doesn’t have to agree to reducing the cost to offset the future CFD costs; instead, they can simply find someone willing to pay their asking price and eat the cost of the CFD later.” https://davisvanguard.org/2015/03/analysis-cannery-developer-stood-to-make-a-large-profit-even-before-cfd/

If we want affordable housing, let’s advocate for affordable housing and hold developers to high standards in this regard, rather than accept these kinds of Trojan horse projects that are “affordable” in marketing only. Let’s not pretend that an increased supply at the high end of the market can help overall affordability. This article written by the co-directors of San Francisco’s Council of Community Housing Organizations touches on the debate on the market effects of high-end housing. The article references a nexus study done for SF by economic consultants in which it was found that high-end housing actually induces a greater need for affordable housing that increases prices more than the dampening effect that an overall increased supply would have: http://www.sfexaminer.com/dont-believe-the-hype-affordable-housing-does-not-depend-on-market-rate-development/

What if the net result of that is that nothing gets built? How many rental units have been constructed in Davis in the last decade or so?

Don,

Are we really going to say that we don’t care about affordable housing to such a degree that we will just accept any ol’ project that comes that pays only lip service to affordability? Why have public policy or standards at all?

And I’m thinking that the Great Recession and slow recovery for much of the last decade or so, along with the typical very inelastic housing supply curve explains rental construction rates.

California Annual Housing Construction Starts

Do you think Davis multi-family housing construction has kept pace with the MFH rate shown on this chart?

Our Affordable Housing policies don’t work. They don’t provide affordable housing. Why retain policies that inhibit housing growth in a desperately tight rental market if they aren’t working? We need to increase housing supply now. I’d guess that the very high affordable housing requirement has been one of the impediments that has caused Davis multi-family housing starts to lag behind the state’s, and lag way behind what we need to reduce the apartment vacancy rate.

Don,

That chart you posted shows that multifamily housing construction has only just recently recovered to 2004-2006 levels. Single-family construction is still way below any dates shown on the chart going back to 1992. I’d say that my statement that housing construction has been highly depressed in the last decade or so since the Great Recession was accurate.

Without a scale on the side though, it ‘s tough to draw any other conclusions.

Don,

Looking up some data really quick from the California DOF in their annual population/housing estimates, interestingly, the city of Davis shows a higher percentage of housing growth from 2010 to 2018 in both single family and multifamily categories than the city of Sacramento. That’s a possible argument that Davis is doing more than its regional share and/or there are forces beyond Davis policies that are influencing construction rates. If you dug into this data a bit to do more comparisons, I’m sure you’d find some interesting stuff.

Yeah, like we can dig in the day before election day… fraud?

Rik

I am always interested in differing points of view from individuals with expertise in a subject.

I have a couple of questions for you.

1. Given that “affordability” is a subjective term, I only saw a comparison with comparable housing units in Davis. I saw no comparison with similar units on campus or the total costs for rental of a similar unit + cost of commuting from another community. Surely both are worth considering.

2. “While a supply “shock” of the magnitude of the Nishi project could theoretically put downward pressure on rents, the effect is likely to be much less than we would hope for.”

I am wondering what your thoughts are since Nishi is not occurring in isolation but rather within the same general time frame as Lincoln 40 & Sterling. Would these 3 taken together theoretically create the downward pressure that is hoped for. How about these 3 projects + the universities intended contribution.

Tia,

Thanks.

1) those would be worth considering, but were beyond the scope of the article and my time. I don’t know how readily that information is available. Secondly, I was using existing data sources that have been used in the City staff reports and by the developer and trying to determine what they were really saying if we dig a little deeper and don’t accept the numbers at face value or out of context.

2) the following paragraph in the article goes on to list some reasons why that might be the case. I would also refer people to this article written by the co-directors of San Francisco’s Council of Community Housing Organizations that touches on the debate on the market effects of high-end housing. The article references a nexus study done for SF in which it was found that high-end housing actually induces a greater demand for affordable housing that increases prices than the dampening effect of an increased supply would have: http://www.sfexaminer.com/dont-believe-the-hype-affordable-housing-does-not-depend-on-market-rate-development/

3) I am not familiar with those project details. A lot of it depends on the targeted demographic. As I stated, housing markets aren’t monolithic and should be thought of instead as separate (but somewhat interacting) markets. A project that is competing in the highest-end student rental market like Nishi might keep prices more stable in that segment, but could do nothing for more affordable workforce/family/ student markets. See the link under #2 above too.

The BAE report Rik links to has other “by the bed” leases in town that average $2,294/unit for 2br and $2,694/unit for 3br and the price per bed to lease on campus is available with a quick Google search so I’m wondering why he responded to Tia: “I don’t know how readily that information is available.”. Just like the cost of a single soda at 7-11 will always cost more than a six pack at Safeway (or a case at Costco) I’m wondering why anyone would compare “by the bed leases” with “unit leases”. Just like some people want to buy a single soda (and are OK paying more since they don’t want to deal with selling the other sodas since they only want one) some people just want to rent one bedroom (and are OK paying more since they don’t have to deal with finding a roommate or being on the hook financially for the rent of a roommate that skips town owing rent, and money to PG&E and Comcast).

P.S. I’m wondering if Rik can show us the numbers he used to get to the “current average Davis market rates” before he wrote: “they would be building a range of 2-, 3-, and 4-bedroom units where rental rates calculated per bed would be at the $600-700 level, in-line with current average Davis market rates” when I divide the number of bedrooms by the rents in the BAE report I come up with “average Davis market rates” a lot higher.

P.P.S. The BAE report is “last years” market rents that are with rare exceptions lower than “current market rents”. I was just talking to a an apartment manager that said the 40% increase in the minimum wage has pushed expenses up for all the office staff, assistant managers, leasing consultants, janitorial and grounds maintenance staff and the 40%+ increase in the minimum wage going to $15 is just going to push future rents higher…

Ken

1) The BAE report didn’t have data comparisons to “similar units on campus” or the “total costs for rental of a similar unit + cost of commuting from another community” If you have accurate survey data for that, please provide.

2) the figures you quote for existing bed lease units are the exact type of misleading statements that I called on the Yes On J campaign for. Existing bed leases make up a tiny fraction of the existing Davis rental stock (~13%) and are priced much higher: they are some of the most expensive beds in Davis! To elaborate, there are only 252 two-bedroom unit with bed leases reported in the survey. That is less than 2.5% of the total rental units surveyed in Davis. A much more accurate picture of existing conditions is obtained by looking at the full range of the city’s housing stock.

3) current average Davis unit rates (excludes affordable units) are clearly listed in the report. They come from the BAE survey:

2-bedroom units $1,660/ $830/bedroom

3-bedroom units $2,270/ $756/bedroom

4-bedroom units $2,858/ $715/bedroom

Those are weighted averages for all non-affordable units by the room. The report also states that “four-bedroom bed-leased apartments have a higher prevalence of “double-ups,” with an average of 4.8 beds per unit.”. So the per-bed lease rate equivalent would be $595. That’s the $600-700 per bed equivalent rate I mentioned. Also, The BAE report provide rental ranges. A truly affordable project would provide some rates below the average.

4) Yeah, the BAE report is for last year. So are the projected rents for Nishi.

I’m not trying to make any “misleading statements” I’m just pointing out that comparing the rent at a typical/older Davis apartment where the residents have to rent the entire thing signing a lease that makes then jointly and severally liable” for the ENTIRE year of lease payments PLUS have to pay ~$100/month for PG&E & Comcast (and often get another ~$100 charge for water, sewer and trash) to a newer/renovated unit where you are just responsible for your own bed lease and the landlord pays for PG&E, Water Trash and often Comcast is “misleading”.

P.S. I no defender of developers who like politicians are knows to make a lot of “misleading statements”. don’t care if they build 2,000 units on the Nishi site or if they let it sit empty for another 40 years. It sounds like Rik does not want the current Nishi proposal to move forward and he is fighting fire with fire “misleading statements with more “misleading statements”…

Rik

Thanks for responding. This statement brought up another issue for me.

“Let’s not pretend that an increased supply at the high end of the market can help overall affordability.”

How did you feel about the Trackside project?

Tia,

I don’t know much of anything about that project and didn’t have an opinion one way or another. Sorry!

Ken,

You make an interesting point. It would be good if we had data regarding what the relative amenity levels/utility payments were for various housing configurations and could compare cost structures even more accurately. But we don’t, so I am using the best data available to try to make apples-to-apples comparisons.

While some existing bed leases may have some utilities paid for, it seems just as likely many of the units in apartments complexes that make up that vast majority of rental units have that too. And it may be that that the small proportion of existing bed leases in town have fewer amenities such as living room area and are located in older converted houses. Without some hard data, we’d both be making guesses.

A key point though is that there is no evidence that the Nishi project would have any extra amenity levels/utility payments/etc. that would make its projected rent levels more in line with Davis average market rates. They are just structuring the leases in such a way as to increase profit margins while obscuring their true per-unit rent rates.

I have not heard of a single place in town that leases by the bed that does not include utilities and I have not heard of a single traditional apartment in Davis that leases by the unit that includes utilities.

When you say “some existing bed leases may have some utilities paid for” if you think about it they all have to have utilities paid for since PG&E will not meter per bedroom (or per bed).

When you say the “vast majority” of apartments in town have the landlord paying utilities can you name a few of them (should be easy if it is the “vast majority/almost all” of the close to 200 apartments in town.

Ken A.

Anecdotes are not data. If you want to provide a more accurate cost-comparison across units, you’ll need to provide some survey data that breaks down the different structures and what is paid for and what isn’t. This should also include a comparison of living area across units. It is a possibility, for example, that a significant number of existing bed leases are in older converted houses with a lack of adequate living areas. People are just paying a high premium out of desperation or a desire not to be on a shared lease. If there was a higher amenity level provided in the Nishi project because of the bed lease arrangement, we can be sure it would have been promoted by the campaign.

The larger point that you are losing sight of is that bed leases make up a tiny fraction of the overall rental stock in Davis and it is completely disingenuous to use their rates to describe the overall rental costs in Davis. For example, existing 2-bedroom leases are only about 2.5% of the rental stock as described in the BAE report.

There are two main reasons for the high premium for bed leases unit leases: 1) the inconvenience of multiple people on the lease, and 2) the increased risk to the property owner for premature move-outs. Since in Davis any vacated unit would likely have no problem getting filled, this eliminates a big reason why there should be a premium for bed leases. It is just pure extra profit for the developer.

That would be super shock — and require a more-shockingly non-scientific conclusion

Here is what we had put together as of November 2017 for new housing project totals. Matt probably has a more current list. Combined with what the university is promising to do, I think it is safe to say that there will be some impact on the vacancy rate and possibly some stabilizing of rents.

One of the big issues with this article is all of the price comparisons are, frankly, cherry picked. It only discusses the price of bed leases even though Student Housing at Nishi will have bed leases and traditional unit leases (about a 50/50 split). It then compares the sum of bed leases per unit to the average unit lease in the city, which is like comparing apples to oranges. Bed leases include all utilities, city services, wifi, etc. in one flat rate. Additionally, the tenant only has to worry about their rent. If their roommate or housemate does not pay their share, they won’t be affected. This is unlike traditional leases where if one tenant does not pay. the whole apartment suffers.

For a more relevant comparison, the average bed lease for a two-bedroom apartment in Davis is $1,147/month–a figure conveniently left out. In fact, the per bed cost the article quotes is less than that for an equivalent apartment. That being said, it should also be relatively expected for the market rate units to be more expensive than the average. Brand new apartments are objectively nicer and should catch a higher price. What does happen is that similarly priced apartments that are not as new will have to compete with nicer and newer units. The only way to compete would be to drop prices.

In terms of the affordability argument, doubling up is not a foreign concept to college students. In fact, University housing has triple-occupancy rooms for $900/month per tenant, not including any meal plans. And again, looking at the average bed lease in Davis, $892 (this includes all apartment unit sizes), the affordable units priced at $404, and $672, seem very reasonable. This private subsidy is over $800,000/year paid by the project partners.

And finally it is important to remember, this is a letter to the editor, which means this is, at its heart, an opinion article. This isn’t meant to invalidate the article or its points, but its important to distinguish this from something like an official city staff report, for instance.

Aaron,

The point of the article was to set the record straight on the cherry-picked data that the developer is using to promote the project. The price of existing bed leases is a red herring. They make up a tiny fraction of the existing Davis rental stock and are priced much higher: they are some of the most expensive beds in Davis. There are only 252 two-bedroom unit with bed leases reported in the survey. That is less than 2.5% of the total rental units surveyed in Davis. You also conveniently leave out the price of bed leases in 3-bedroom and 4-bedroom units that make up over 86% of all the existing bed leases in town. Using the stat that you did is the very definition of cherry-picking. It is incredibly disingenuous for you to try to use that to make a point.

As I discussed, doubling-up is a common voluntary choice for people with unit leases. They are able to save money. However, the Nishi project would charge people a giant premium for this. There is a reason why the project proponents not do not talk about the projected unit lease rates buried deep in the attachments of the Staff Report.

As recently as mid-day today on another on-line forum you denied that the affordable beds are proposed to be 100% doubled-up in the Nishi project at all. Your comments about the project are not credible. They just highlight the dishonesty and deception that project proponents are using to try to sell this fake affordable project.

Question… are beds provided for the “bed leases”? What size? I recall having to suppy my own bed (fold-up “single”) in a Bay area Apt… late 1970’s, unfurnished… worked fine, especially when my girlfriend (later, spouse) was visiting overnight… had an excuse to be “cozy”…

When I was a student @ UCD, furnished apartments were the “norm” in town… have no clue about today…

I believe the apartments at Nishi like that at Lincoln40 would be furnished.

I think that’s unknown. I have not seen any reference to furnished bedrooms/units in any of the project documentation (and I have found a lot of stuff that other people have apparently not noticed).

Flaky roommate risks can be mitigated with deposits to the master lessee.

In theory, yes….

Unless the roommates pay in advance for the term of the lease (good luck with that) the master lessee is still on the hook for the rent if a roommate moves out (until they find a new roommate)…

“Letting the market address affordability hasn’t really worked out so well”

That is just dumb, really dumb. We have artificially constrained supply to keep prices high. Having been through pricing discussions for actual marketed products and services dozens of times in my career you can forecast yield but actual revenue is still a crapshoot.

I stand by my comments. The market will determine what they charge and and market is driven by supply and demand. More options is better for students. No matter what they quote now they will raise or lower prices based on demand.

Based on extensive analysis of the Nishi opponents I did using my long-term professional experience as an expert in real estate financing, I found that there is a lot of dishonesty in how all significant development projects in and around Davis are being marketed by their opponents as “un-affordable”, “toxic”, “scary”, “mean”, “elitist”, [you fill in the blank]. The No on J campaign touts disingenuous nonsense hoping something will stick to the wall and frighten all the easily alarmed Davis reactionaries.

What I really don’t understand is how anyone can call themselves an expert in affordable housing development unless they have actually put their own financial skin in the business of developing housing… and why these so called experts cannot recognize the absurdity of their insistence that they have the magical power to force people that do have financial skin in the game to do what they, they outside experts, say they should do.

I think Jeff you may find this cartoon on point. http://dilbert.com/strip/1994-09-01

My wife has a masters in economics. She told me what an expert she was with money with her masters. in 2009, in the depths of the market I put $5K in an etrade account for her to see what she could do. It now has less than $1K in it. She and Rik could have long talks about economics.

Nice… posted the day before elections… no real time to vet or refute, respond.

Now we all know how the VG deals with last minute “hit pieces”… welcomes them…

I sort of don’t care about the outcome of J… but it frosts me about “late hits”… feels better knowing that Rik’s post, and responses, might change 0.01 % of the vote… [0.0001]

Impotent power!

Howard,

I would have loved to publish the piece earlier. But here’s the thing: none of the project proponents could provide me with the basic information about the projected “market rate” rents. Thanks to running some back of the envelope calculations, I knew the vague number I was being told ($800-900 per bed) was wrong and substantially low., but I had no documentation of the actual numbers.

I was finally able to track down the numbers yesterday afternoon. They were hiding in a 2-page memo that was listed as Attachment 10 in the Staff Report for the project for the 2/6/2018 City Council Meeting. Here’s another thing though: the link to that attachment on the City website was wrong as it just downloaded the MOU for the project instead (probably just a clerical error, nothing nefarious; but that tells me probably no one went looking for it before). I managed to get a copy of the 300+ pages of the full staff report and then dug around to find the memo, and finally had the numbers that I presented.

Now… you tell me: what’s a good explanation for these numbers not being in wide circulation earlier? I didn’t spring a last-minute “hit piece”. Instead, I was finally was able to track down information that the campaign has purposely kept hidden because it shows their story about providing “affordable” housing to be a lie. There’s nothing to “refute,” by the way, I am just presenting the project’s own numbers that they should have been honest about from the start

As far as the Davis Vanguard being in on it, have you seen David Greenwald’s commentary on the project? He is a big supporter. He is running ads on this site for the campaign! I’m glad that he was kind enough to provide a forum for my analysis.

Do commode and commodity have the same root?

Guano is a commodity.

Rik, where did you get the Davis average rents?

Did you get it from the American Community Survey?

Never mind. Found it.