by Alan Pryor and Pam Nieberg

by Alan Pryor and Pam Nieberg

Davis already has by far the oldest average population in the region and this project will compound that population imbalance. Despite the abundance of young University students, according to 2016 US Census Bureau estimates the percentage of people in Davis under the age of 18 is 16.1% compared to 25.5% in West Sacramento and 26% in Woodland. Looking at younger children, the disparity is even greater with 3.8% of the Davis population under the age of 5 compared to 8.1% in West Sacramento and 6.7% in Woodland.

“I do think that this community is growing older and that we need to start thinking about how to make Davis affordable and accessible once again for families with children.” David Greenwald – Commentary: If You Think the Community is Angry and Divisive Now… You Should Have Seen Twelve Years Ago – June 28, 2018

Clearly, because of the age-restrictions imposed on buyers, this project will do little to directly increase the housing stock for young families. And because of this dearth of kids in town, our schools are so starved for young students that we need to import over 650 students per day just to keep school doors from shuttering and moth-balling our existing neighborhood schools. And we pay dearly for schooling those imported students with the highest school-related parcel taxes in the region. We clearly need more young families with children in town to fill our schools and maintain  our vibrancy in Davis yet few families can afford to come to Davis because of sky-rocketing home purchase and rental prices.

our vibrancy in Davis yet few families can afford to come to Davis because of sky-rocketing home purchase and rental prices.

What Davis really needs is smaller-scale, more dense, and affordable housing designed for both seniors AND families of modest means. The last thing we need is a sprawling, senior-only Sun City-lite developments like you see in sunbelt states. A development with smaller homes laid out in a curvilinear fashion with different designs (instead of rows and rows of near-identical box-like houses) would attract far more seniors AND the families preferred if the project were designed with a close-knit neighborhood setting in mind.

- WDAAC Does Not Meet our City’s Real Demographic Needs for More Diverse and Affordable Housing for Working Families and Those of Moderate Income.

If there is a demonstrable need for senior housing in Davis, that should first be a component integrated in every future housing development proposed for our city, with affordable and accessible, age-in-place accommodations that are close to services and the downtown with excellent connectivity.

The criteria for senior-focused housing and housing developments were first clearly articulated in the City’s “Guidelines for Housing that serves Seniors and Persons with Disabilities” recommended by the City’s Senior and Social Services Commissions and adopted by the Davis City Council on July 27, 2010. As discussed later, this development falls far short on many of those criteria including those concerning location and connectivity.

What Davis really lacks is more diverse and affordable housing suitable for BOTH seniors and working families of more modest means. It has become increasingly more difficult for even middle income families to afford a home in Davis.

Middle income generally includes those who earn between 60% and 120% of the area’s median income The median family household income for Davis is roughly $114,000. That would mean that middle income would range from $68,000 to $137,000 in Davis.

Home Values and Affordability in Davis(1)

The cost for a median priced home in Davis in June 2018 is $658,600.

To determine what a middle-income family (defined above as between $68,000 and $137,000 per year) can afford in Davis, we used the following assumptions:

Length of mortgage: 30 year fixed, including taxes and insurance

Interest rate: 4.4% (current)

Down payment: $20,000

Other Assumptions: $1000 of other monthly debt (insurance, other loan payments, etc.) /

36% Maximum Debt to Income Ratio

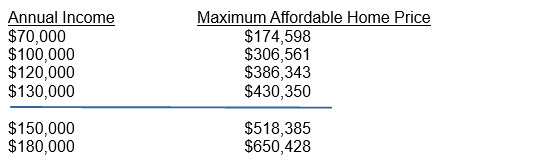

Using these values and assumptions in a standard affordability calculator, the following Maximum Affordable Home Prices are obtained for different income levels

Thus, to be able to buy the median price Davis home (currently $658,600), a family would need an annual salary of at least $180,000, depending on size of down payment and other debts.

Thus, to be able to buy the median price Davis home (currently $658,600), a family would need an annual salary of at least $180,000, depending on size of down payment and other debts.

Middle income workers include school teachers, some office workers and university low- and mid-level staff, medical support personnel, and some retail workers, among others. These moderate or middle income jobs are essential to a strong functioning economy and quality of life in Davis.

And yet these critical jobs do not generate enough income to buy any homes in Davis much less a median priced home. Most of these middle-income families cannot easily afford a home above $400,000. But only 7 out of the 75 homes recently listed for sale in Davis were even in the mid $400,000s according to a recent survey of local homes for sale.

For comparison purposes, the median cost to rent a home in Davis is $2,400/mo or $28,800 per year. Without doubt, there is a demonstrable need more affordably priced work force housing in Davis.

The Critical Need for Affordable Family Housing in Davis

The term “affordable family or workforce housing” refers to housing for those who are sufficiently gainfully employed to be not eligible for low-income housing programs. Affordable family housing is based on income levels ranging from 50% to 120% of the Area Median Income or AMI.(2)

The maximum cost of a house affordable to such a family is determined by mortgage lenders who typically require that a maximum of 28% to 36% of household income be used for principal, interest, taxes and insurance.

When a community’s workforce chooses to live elsewhere due to high housing costs such as exist in Davis, our community also loses tax revenue to neighboring jurisdictions because people typically spend money where they live, not where they work. Thus, the lack of affordable housing options in a community poses an existential threat to the ultimate prosperity of that community.

It is important that people have the ability to live near where they work, in particular those workers who are essential to the local economy but find that the housing is priced beyond their reach. When people can live near their jobs, the entire community benefits.

Neighborhoods are more diverse and economies strengthen when employers can attract and retain workers. Insuring a supply of affordable workforce housing is thus a critical component, and should be a priority in the City’s economic development program. Because employers will want to locate in a community in which their employees can thrive, it is unlikely that new high tech companies will want to relocate or start up in Davis just because we got our own Leisure World-lite subdivision.

West Davis Active Adult Community Does Not Fill This Need

The majority of homes proposed for the West Davis Active Adult Community are in the range of 1,400 to 1,800 square feet. At $384 per square foot (average new home construction sales price in Davis), a 1,800 square foot home would be $691,200. Even the smallest 1,400 square foot home will be $537,600.

And these costs are just for the homes. The large lot sizes for the 161 Greenway homes are nearly 4,600 square feet and for the 51 “custom builder” lots almost 5,200 square feet. Because of the costs of these huge lot sizes and landscaping and other amenities needed to fill the excessive space, net sales prices would increase costs by about 15% – 20%. These are hardly “affordable” units and would not even be obtainable by most middle income seniors. Thus one could expect that WDAAC will be populated almost entirely by wealthy seniors.

Davis must begin to make greater efforts to provide housing for its working citizens and young familes AND non-wealthy seniors – those earning middle incomes who cannot afford to live in the community where they work or want to retire. This is the type of housing that the City Council must begin demanding from those who want to build in Davis. This is the type of housing Davis needs. The WDAAC is just another example of the expensive single-family, single-story, expensive, and exclusionary sprawl development that Davis does not need.

Footnotes:

- (1) Figures for housing costs and affordability were obtained from Zillow, Trulia, and realtor.com.

- (2) Information on importance of helping the middle class, middle income families is from the Urban Land Institute’s Advisory Services Report on Collier County’s (Florida) workforce housing strategy.

- WDAAC Does Not Meet the Needs of Seniors of Ordinary Means.

First, because no independent marketing analysis was ever done for this project, the question is whether seniors even desire this type of housing. According to a 2015 survey by the American Association of Retired Persons (AARP), 78% of aging adults want to age in place in their current own homes, meaning only 22% are interested in moving within the city where they currently live or relocating to another City. Even fewer state they are interested in moving into a “senior-only” community.

Second, this proposal does not meet the needs of most local seniors who might otherwise want to move to a senior-only development because most could not afford homes in this expensive, expansive development unless “poor old mom” happens to be a millionaire.

The project developer asserts that the proposed sprawling single-home layouts will meet the needs of most seniors even on limited budgets. But in reality, the proposed single-story homes in WDAAC will hardly be “affordable”. At a build-out sales price of $400/sq ft, a 1,800 sq ft home will cost $720,000.

Knowing full well that a developer would lack objectivity, the City’s “Guidelines for Housing that serves Seniors and Persons with Disabilities” specifically calls for an independent consultant (not the developer) to determine true market need. That document states:

“INDEPENDENT MARKET ANALYSIS – Market analysis of the true community need for housing should be done by an independent consultant. This analysis is paid for by the project applicant and contracted by the City in order to ensure its independence.

The analysis should speak to:

Affordability – in which the term is used in its broadest sense to include households of any income within the City of Davis and their existing cost burdens including consideration of expenses such as medical, care-giving, utilities, etc.

Marketability – a project-specific determination if there is a true local and current demand for the specific types of housing proposed.

Preferences of Seniors and Persons with Disabilities – For age-restricted and age-qualified senior housing include:

- consideration of senior majority preference to remain in their own homes in Davis, known as aging-in-place.

- other senior preferences related to amenities and unit size/downsizing.

For housing to serve persons with disabilities consider:

- housing features necessary for the person being served and whether space for a caregiver is necessary.

- preferences for independent living with support services available.

Current Wait Lists – current wait lists for similar projects existing within Davis should be considered and this information should be included in the analysis.

In determining the local need for senior housing, age definitions and restrictions must be well defined (e.g. age 55 and over, or age 62 and over).”

In fact, by ignoring these specific City “Guidelines,” no such quantitative needs assessment was performed by an independent entity, and the only estimates of senior housing needs in Davis were made by the developer himself.

Get Tickets To Vanguard’s Immigration Rights Event

As noted by another commenter, the site might be well-suited for commercial or mixed-use development (due to its proximity and ease of access to Highway 113, as well as its proximity to UCD).

But, as long as the city simply responds to development proposals, we’ll simply get what developers propose. (That has a nice “circular ring” to it.)

This documents in great detail the sham that the developers are trying to perpetrate.

Yesterday, sitting and talking with friends, the issue of how the actual need for this type of project arose prior to having read this article. I had previously asked the question of Jason Taormino, in response to a Vanguard article, how this “need” was determined, but as of a few days of the question, had received no response. Sorry if I missed it, but I am genuinely curious and would like to know how the developers decided that this type of project was: 1. Needed by the community 2. The best use of that particular parcel of land.

“Best use”… who defines, how defined? What is the highest and best use of property ANYONE owns? Should the “state” or voters decide?

Or should a property owner seek what they believe is highest and best use for their property, consistent with rules in place, as might be reasonably modified? With impacts addressed/mitigated.

I tend to believe in the Constitution, and don’t believe “the people” can tell me what to do on my land… if consistent with rules and procedures to change the rules…

The current “rules in place” are “agricultural”. As usual, I haven’t seen anyone advocating for a change, other than the developer/owner.

When seeking a change in zoning/use, developers/property owners generally seek the highest rate of return $. This is not necessarily the best use, regarding the community as a whole. (The same community that has to deal with the impacts.)

When a developer seeks a change in zoning/usage, its perfectly reasonable to ask if that’s the best outcome for the community as a whole. That’s part of living in a society.

I still haven’t seen anyone address Tia’s suggestion (from yesterday), to allow a change to accommodate commercial use – especially since the Vanguard constantly harps on the need for economic development.

Ron… curious…

Yes.. makes sense, was proposed, and the proponents felt it was “shot down” in Davis… applied to Woodland, instead. Your point? Did you support that proposal? … guess I’m missing it (the point)… probably my bad… same with Mace Ranch IC proposal… did you support that?

I understood that to be a different site in Davis. (Somewhere near the Binning Tract?) Are you stating that WDAAC is at the same site as the innovation center that was proposed, earlier?

I’m normally reluctant to refer to what the proponents (of any given development proposal) claim to be factual at face value. Especially when discussing commercial development (without housing).

In any case, the “need” (in regard to the city itself) is for economic development, according to some. And, we’re already witnessing resistance to WDAAC. If there’s going to be resistance regardless, why not advocate for something that the city arguably needs?

How about one development at a time? We also lost an opportunity for commercial at Nishi (not to mention several other sites around town that have been, or will be converted to housing).

Actually, the Davis Innovation Center was proposed for a very close, but different site. The website is still up and running:

http://davisinnovationcenter.org/the-project/project-location/

Here’s another question: What’s to become of the Davis Innovation Center site? (Since the city relies upon developers regarding city planning, I guess “we’ll see”, when yet another development proposal of some type arises.)

Oh – and what might the “seniors” who live at WDAAC (if approved) think of an innovation center at the nearby site? (Do ya think they “might” complain about it, thereby completely eliminating any remaining chance for it to be located there?)

So, since the Davis Innovation Center was proposed for a site that is very close to the WDAAC site, why isn’t there advocacy (by the Vanguard in particular) for an innovation center at the WDAAC site?

If anything, the WDAAC site is even more accessible to Covell and the freeway than the Davis Innovation Center site.

And, unless the Davis Innovation Center site is now envisioned as permanently off-limits to development, how about a more holistic view regarding the possibility of development and integration at both sites, in the future?

For that matter, who owns the Davis Innovation Center site?

I’m glad that you brought up the topic of the Davis Innovation Center, Howard. It seems that the Vanguard had no plans to do so (despite its constant harping on the supposed need for this type of development).

As I understand it, the land is owned by Parlin Development (same company that tried to develop Wildhorse Ranch a decade ago). The developers for Davis Innovation Center had an option buy but have dropped their pursuit of the project and no longer have an option to buy and have since moved on to Woodland.

Some comments on Alan’s assumptions:

> The cost for a median priced home in Davis in June 2018 is $658,600.

That is typically higher when a lot of new (expensive) homes hit the market (like with the Cannery with many homes close to $900K). There is no law forcing a family making the median income to buy a median priced home (they can buy the cheapest fixer upper in town if they want).

> Down payment: $20,000

Anyone that only has $20K in cash has no place buying a home in Davis and should keep renting, get a roommate (like I did before AND after I bought my first home) and do some weekend bartending (like I did before AND after I bought my first home). The WDAAC is a “senior” development and anyone that is a “senior” and only has $20K to put down on a home has either made a LOT of bad choices in life or has had a LOT of bad luck in life.

> Other Assumptions: $1000 of other monthly debt (insurance, other loan payments, etc.)

If you have ~$1K a month in other loan payment that is $300K at 4% (or $150K at 8%) and you should first pay off your debt before buying a home.

> 36% Maximum Debt to Income Ratio

A good idea for poor people buying a cheap home in a red state, but if you are making over $100K it is easy to make ends meet with a much higher DTI ratio (like almost every first time homebuyer in CA).

https://www.sfchronicle.com/business/networth/article/Fannie-Mae-making-it-easier-to-spend-half-your-11260142.php

I’m reluctant to admit it, but this type of thought has crossed my mind more than once, as well. (Notwithstanding those who have a disability, etc.)

And, the strange thing is that I actually know of some seniors (who earned much more than I ever did) who made some unbelievably bad choices.

Seems like Warren Buffet knows what he’s doing. Doesn’t he keep his expenses in check (and still lives in a modest home, drives an old car, etc.)?

Another good way to lose money is to move around a lot (rent, or sell/buy). (One of the senior couples I’m thinking of did just that.)

But, the “ship has sailed” regarding purchasing a home in California, with the hope that it will save you. (Especially for seniors.)

If only we could time-travel, back in time.

The average senior in America is worth about a million dollars (higher in CA) with about $100K in home equity (more in CA) so not many (if any) will be buying in the WDAAC with a $20K down payment and worried about hitting the banks DTI number to get a loan.

https://dqydj.com/net-worth-by-age-calculator-united-states/

P.S. If I went back in time in addition to a lot of sports betting, tech stocks and Bay Area Real estate I would have warehouse full of V12 Ferraris from the 1960’s (a 1963 Ferrari 250 GTO that was worth less than $10K in the early 70’s just sold for $70 million)…

Yeah.

The other thing that I’ve noticed is that some folks (who made poor choices) sometimes can’t admit it – even to themselves. I’ve witnessed that up close. I suspect we all do that, at times.

And, some of it is luck. If everyone knew what the future held, the future would be different! (Something like that.)

If I was starting out today, I’d probably get the heck out of California entirely (unless I earned some pretty big bucks). (No, I’m not just saying that because I’m a slow-growther. It just no longer makes sense for lower-to-middle wage workers – at least for some of the “nicer” areas, and areas with decent job opportunities.)

We have all made some bad choices and had some bad luck, but when you are getting close to the halfway point in life it is a good time to take a look at where you are and decide where you want to live. People have the option to stay where they are having a hard time paying for housing or moving somewhere where housing is cheaper. I moved to Davis since (like so many people) we could not afford a home we liked west of El Camino in a nice part of the Peninsula on one income. The good news is that if you are “making it” in CA you have a lot of options where you can lower your housing costs (and are in a lot better place than someone in Detroit or Cleveland that is having a hard time paying the rent). For less per month than an the cost to “rent” an average apartment in Davis you can “buy” a real nice home in most of America…

Ken.. we bought a ‘fixer-upper’ in 1980 for $71,000… 3 bd/2 ba. East Davis… SF detached, 1/6 acre… get what you are saying, but am thinking the reality has changed… not sure you could find a “fixer-upper” for less than $500 k, unless a condo unit… today…

I agree that times have changed, regarding the relationship between income and housing costs (statewide, with some areas more so than others).

A primary reason that low-to-middle income workers are leaving California. (I’ve previously posted several articles regarding this trend.)

There are a few sub $500K single family homes in Davis on Realtor.com, but not many…

It is actually easier for most people to buy a $550K home in Davis today than it was to buy a $70K home in 1980 due to a combination of the overall increase in wages (the “minimum” wage has gone from $3.10 in 1980 to $12.00 90 days from now) AND the 30 year fixed rate has gone from over 15% to under 5% (and underwriting requirements have been relaxed see link above)…

It is super easy to spend every penny (and more with credit cards) that you make and saving is hard (so is missing fun stuff because you don’t want to spend the money and/or you are working at your part time job) but just like college is hard but usually “worth it” saving to buy a home when you find a place you hope to live for a decade or more is also usually “worth it”…

The following article is essentially a “fluff piece” regarding the Creekside Affordable housing development (and notes that the same Affordable housing developers have signed on to WDAAC).

And yet, this article notes the following, regarding Creekside:

So, if there was only one award in the six-county region in that round of funding, why would anyone assume that the Affordable component at WDAAC would be selected for funding anytime soon? Especially with the elimination of RDA funds?

Also, might the fact that the Creekside site remained empty for a couple of decades (after being identified as an Affordable site) have resulted in it being put on some kind of priority list – which wouldn’t apply at the WDAAC site?

https://www.davisenterprise.com/local-news/construction-set-to-begin-on-latest-affordable-housing-site-in-davis/

Define what “fluff piece” means to you? Honest question, as it means different things to different people…

Howard: In my opinion, the article attempts to put a positive spin on the entire situation at Creekside, and notes that the same Affordable housing developers are responsible for the proposal at WDAAC.

Make of that what you will.

And yet, the article inadvertently noted the challenges regarding funding.

You gave your purportedly honest answer to my question. Fair enough. I’ll not “make anything” of it.

How I “purportedly” describe the article and the manner in which Creekside is discussed is far less-important than the implications regarding funding available for the site at WDAAC:

Also still wondering if the Creekside development was put on a priority funding list due to the decades-long delay (after being identified as an Affordable site) – which (hopefully) wouldn’t apply at WDAAC.

Again – why not ask the people who are actually involved in this and who have been posting on the Vanguard?

As you’ve noted, they’ve been posting on the Vanguard. Perhaps they’ll see this, and respond. Presumably, the answer might be of interest to those relying upon the claims that the Affordable component is essentially a “sure thing”. So, I’m not sure why you’d suggest a private conversation between me and the Affordable housing developers.

(Of course, they still have a vested interest in advocating for the proposal. Perhaps you don’t have any concerns regarding totally relying upon such a source.)

In any case, you’re the one who was haranguing Alan P., regarding the use of the phrase “no guarantee”.

From the article, above: