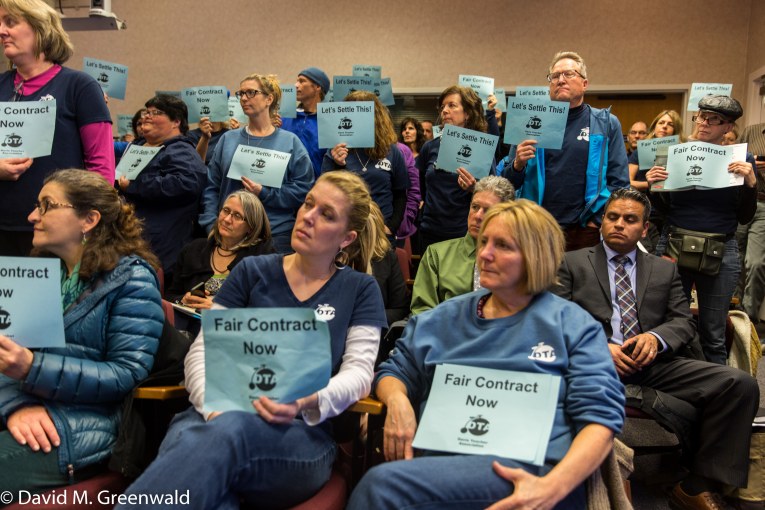

This evening the Davis School Board will look further into whether to put a parcel tax, that would fund teacher and employee compensation increases, on the ballot for November 3, 2020. This continues a long discussion that began last year, where teachers complained that the district had a compensation gap.

Last spring the district reached an agreement for a temporary increase in compensation in order to close that gap, but without long-term local revenue increases, the district will likely face structural deficits.

In addition to raising the parcel tax, the district continues to explore other ways to increase local revenue but also manage its budget. These include: improving efficiency of operations, maximizing state funding, and committing to making strategic reductions, in addition to raising local revenue.

In a separate item on Thursday evening’s agenda, the board will look to authorize DJUSD’s Legislative Representative to work with legislators to develop and seek sponsorship on a number of possible bills.

Among those include clarifying “California statutes in Education Code that school district parcel taxes may be placed on the ballot by registered voter signature just as city and county voters can do and which is meant to take advantage of the California Supreme Court’s recent City of Upland court case that clarified the voting threshold for such measures are a majority vote and/or support support a Constitutional Amendment to lower the vote threshold for school parcel taxes.”

They are also looking to either support or sponsor legislation “that would improve the attendance system to save costs and add funding to DJUSD and/or adopt a pilot program regarding attendance calculation through a waiver for certain districts to provide an independent study program that would allow for increased average daily attendance (ADA).”

The district is looking at legislation that would allow districts with parcel taxes “to require inter-district transfer students to pay the annual parcel tax to the district.”

The district is looking for legislation that could add “special education services to the definition of unduplicated students” which would provide potentially additional funding for special education services for the district.

However, the district would have the most control over its own local revenue sources and thus they will continue looking at a parcel tax increase. With the increase, they would be looking to take the parcel tax up another $360 per year to $980 per year.

In 2016, when the voters approved the parcel tax by over 70 percent of the vote, the voters raised the parcel tax to $620 per year. Several board members at that time, especially Alan Fernandes, argued that the district should “go big” and consider a $960 parcel tax.

The summary ballot measure would read: “To attract and retain quality teachers by keeping compensation competitive; provide outstanding instruction in math, science, reading, writing, and technology; support athletics, arts and music; limit class sizes; and support student health and safety; shall a Davis Joint Unified School District measure be adopted to replace the existing parcel tax with a permanent tax of $980/year, with inflationary adjustments, raising approximately $15 million/year, with senior, disability, employee exemptions and citizens oversight; for the exclusive use of District schools?”

Alan Fernandes last spring put forward the idea of a citizen’s initiative for a parcel tax that would allow a majority of voters to approve a measure. However, there were a number of downsides to that proposal, including the fact that the measure would have to be a city measure rather than a district measure (something that could be fixed legislatively this year).

While the boundaries of the city and district are similar, there are a number of residents who live in the district but not the city. Only they would be assessed the parcel tax.

As it turned out, getting the 6000 needed signatures for November was impossible, and even getting them for a spring vote this year proved difficult. The district is now reconsidering looking at a standard two-thirds parcel tax.

In November, Mr. Fernandes told his colleagues: “In embarking on a year long study session, I for one have become pretty resolute that in order to meaningfully close the compensation gap once and for all, do it with some degree of ‘nowness’ because this is an issue that we need to start working on now.”

The district is disadvantaged by the LCFF system, and as a result the district only receives about 77 cents on the dollar from the state. A portion of that is made up by local parcel taxes, but that has proven insufficient in order to increase compensation for teachers, many of whom are strongly disadvantaged in their compensation as compared to the compensation paid in other school districts.

He made it clear: “We need a local source of revenue.” Mr. Fernandes said that relying on the state is “never going to allow us as a district to catch up, particularly in light of the way LCFF [Local Control Funding Formula] is structured.”

Alan Fernandes explained: “One of the most efficient and best ways to close the gap once and for all is to get a local source of revenue. There are really only two ways under California Law that a district can get a local source of revenue and that’s a school bond which is limited in its use to just facilities and a parcel tax measure.”

—David M. Greenwald reporting