Part 1 – Our City Councilmembers are Drinking Like Sailors Again…And They’re Spending your Money!

Part 1 – Our City Councilmembers are Drinking Like Sailors Again…And They’re Spending your Money!

by Alan Pryor

FORWARD – In a recent article in the Davis Enterprise (9/27/22), Councilmember Dan Carson said while promoting his reelection bid, “The city’s annual deficit — an estimated $8 million a year over the next 20 years — is down to $4 million to $5 million a year…We made a significant dent… and our financial condition has significantly improved.”

The article went on to state that Carson credits “a lot of good policies… including restraint in labor negotiations…It’s been sound fiscal management.” But is this true?

Well, the simple fact is that the City of Davis is still in a budget crisis and one has to do nothing more than look at the deplorable state of our streets and bike paths as examples. According to independent verification, City of Davis streets are in worse condition than any of the other cities or towns in Yolo County including Woodland, West Sacramento, and Winters. If left further unmanaged by our City Council, the budget crisis  and our streets and infrastructure will undoubtedly deteriorate further over the coming years.

and our streets and infrastructure will undoubtedly deteriorate further over the coming years.

Of course, the City Council absolve themselves of any responsibility for this budget morass claiming, “It’s the economy!..It’s the pandemic!…It’s Acts of God!”, without nary a thought given to the notion that maybe it is just their plain fiscal mismanagement that has brought the City to its financial knees.

Indeed, what is not disclosed nor explained to the public is that over the past decade, our City Councils have granted City of Davis employee compensation increases to our highest paid employees that are far in excess of increases required to maintain pace with inflation. This has resulted in increased costs to the City totaling tens of millions of dollars that could have otherwise been beneficially used to provide the infrastructure maintenance the City Council claims they are unable to afford.

This is Part 1 of a 2-part series investigating how overall City of Davis’ employee compensation levels risen over the past decade far in excess of inflation and the extremely adverse impacts this has had on our City’s budget as a result.

Part 2 will be published soon and looks at how these excessive compensation increases have favored top City management and public safety personnel while salary increases given to lower paid employees have barely kept pace with inflation. Further comparisons are made between total compensation rates in Davis vs Woodland showing how upper management in the City of Davis receives far greater compensation than their counterparts in Woodland.

I. EXECUTIVE SUMMARY

In January of 2022, the author published an analysis of annual compensation and raises given to City of Davis employees from 2011 through 2020 and compared them to a government-calculated inflation rate (the Bay Area Urban Wage Earners & Clerical Workers Consumer Price Index) to determine the impacts these raises had on the City budget (see https://davisvanguard.org/2022/01/effects-of-excessive-increases-in-city-of-davis-employee-compensation-from-2011-to-2020-on-the-citys-ongoing-budget-crisis/). That article only looked at compensation data through calendar year 2020. This article updates those disclosures through the calendar year ending 2021.

a. Summary of Increases in Total Compensation (Pay and Benefits)

The actual average total compensation (Pay and Benefits) in 2021 for City of Davis full-time, employees was $176,949 (see Appendix B). This is an 8.4% increase from 2020 and far exceeds the annual rate of inflation of 4.1% in 2021 as determined by the US Bureau of Labor Statistics for Bay Area Urban Wage Earners & Clerical Workers (“Bay Area CPI “- see https://data.bls.gov/timeseries/CWURS49BSA0).

The average increase in total annual compensation (Pay and Benefits) for City of Davis full-time employees has been 6.3% per year over the decade from 2011 through 2021. This is more than twice the average annual rate of inflation of 2.8% during the same period as determined by the Bay Area CPI.

If annual total compensation increases to full-time employees over that 10-year period had instead been limited to the Bay Area CPI rate of inflation from 2011 to 2021 (i.e. 2.8%), the average total compensation otherwise received by FT City of Davis employees in 2021 would have been $129,262 – or about 26.9% less than the $176,949 in average total compensation actually received in 2021.

b. Summary of Increases in Pay Compensation (without Benefits)

Similarly, the actual average annual Pay (without Benefits) paid to City of Davis FT employees in 2021 was $114,572. This is a 6.4% increase from 2020. The average increase in annual Pay (without Benefits) for City of Davis full-time, year-round (FT) employees has been 4.8% per year from 2011 through 2021 compared to the average annual rate of inflation of 2.8% during the same period as determined by the Bay Area CPI.

If annual Pay increases to FT employees had been limited to the Bay Area CPI rate of inflation from 2011 to 2021 of 2.8%, the average Pay otherwise received by FT City of Davis employees in 2021 would have instead been $96,228 – or about 16.1% less than the $114,572 average Pay actually received.

c. Summary of Impact of the Excessive FT Employee Compensation on the City’s Budget

The annual differences (i.e. payroll savings) between the actual total Pay and Benefits paid by the City to all FT employees from 2012 through 2021 and that which would have been paid if annual increases had instead been held to the CPI is very substantial and ranges from $3.645 Million in 2015 to $14.449 Million in 2021.

On a cumulative basis, the City has paid in excess of almost $69 Million more to FT employees in Pay and Benefits from 2012 through 2021 compared to if annual total compensation increases otherwise been held to increases based on the Bay Area CPI.

That additional $69 million could have been very beneficially used in the intervening years to resurface many additional miles of the Davis streets and bike paths in most need of repair while still providing adequate and fair annual increases in employee compensation to match inflationary pressures on their costs of living.

The most recent trend in accelerating employee salaries and total compensation is ironic given the current City Council’s self-proclaimed fiscal responsibility and laser-focus on cost containment.

II. INTRODUCTION AND BACKGROUND

The Corona virus pandemic initially caused substantial reductions in revenue starting in in mid 2020. These affected all sectors of local government and forced drastic reductions in spending to accommodate these shortages.

Once the immediate depth of the local fiscal problem became apparent, the City’s budget consultant, Bob Leland, presented one option to help Council overcome the City’s expected budget deficit due to the pandemic. That option was a one-day per month furlough for non-safety City employees. This was expected to produce near-term annual savings of $1.6M. This one-day per month furlough would result in an average reduction of 4.62% in pay to FT City employees. But employees would also be working one less day each month so their comparative hourly pay would not be reduced.

In response, the Davis City Council instead negotiated what was presented to the public, with great fanfare, as a belt-tightening measure under which the employees were to take only 7 unpaid furlough days off during FY 20-21 beginning on July 1. This would result in a 2.7% annual reduction in payroll for non-safety -related employees. The Council lauded the “sacrifices” made by the employees to help the fiscal crisis it was seemingly facing.

But the reality is quite different than the proclamations from City Hall. For one thing, the employees were already scheduled to receive a 2% salary increase beginning on that same July 1 which the Council let stand.

So in effect, the employees took a 2.7% annual reduction in salary (but also worked 2.7% less days for the year). But then they simultaneously received a 2% raise which almost completely offset the savings realized by requiring employees to take the 7 furlough days off. So, of course, there was almost no net decrease in the City’s payroll despite the employee furlough. In fact, the total compensation paid to City employees increased by 8.4% in 2020 despite an increase in total full-time City employees of 312 to 317 or 1.02%. Similarly, while total compensation (salary + benefits) increased by 4.6% from 2020 to 2021, the actual number of full-time City employees decreased during this time period from 317 employees to 303 employees.

That said, in order to achieve a required balanced budget in FY 20-21, it was instead decided by Council that the Capital Improvement Project (C.I.P.) budget would otherwise be reduced by over $7 Million during that coming 20-21 FY. That postponed many already-scheduled and desperately needed street and bike path maintenance and improvement projects.

This further increased the City’s then current $259 million long-term budget shortfall in capital maintenance for road and building repair and other infrastructure items. A portion of this infrastructure budget shortfall over the past decade past can certainly be attributed to increasing employee salaries in excess of then existing rates of inflation.

III. ANNUAL COMPENSATION INCREASES OF CITY OF DAVIS FT EMPLOYEES FROM 2011 – 2021 COMPARED WITH INCREASES IF BASED ON ANNUAL CONSUMER PRICE INDEX

To determine the overall financial impacts on City finances, it is instructive to determine the extent of actual payroll and benefit increases granted employees compared to if compensation increases had instead been based on the actual rates of inflation over the same 2011-2021 time-frame.

Payroll and benefits information necessary to conduct such an investigation is reported annually through Public Records Act requests by all California state, county, municipal, and UC system employers to the independent non-governmental, non-profit watchdog organization, Transparent California (www.transparentcalifornia.org). Summary information showing total employee compensation for all of the City’s employees downloaded over the 2011 – 2021 are shown in Appendix A.

In addition to the summary data reported in Appendix A, regular payroll and overtime pay (collectively referred to as Pay) and total compensation including payroll benefits (including Pay and Benefits) are reported each year for each individual employee of the City (e.g. see https://transparentcalifornia.com/salaries/2021/davis/ for employee salary records for 2020).

By segregating the annual payroll data for individual FT city employees from part time employees, the average Pay and average total compensation (Pay and Benefits) for FT City employees can then be calculated. This in turn allows the average annual percent increases or decreases in Pay and Pay and Benefits for all employees of the City to be determined and compared to annual increases in the CPI as reported for Bay Area Urban Wage Earners & Clerical Workers by the US Bureau of Labor Statistics (https://data.bls.gov/timeseries/CWURS49BSA0).

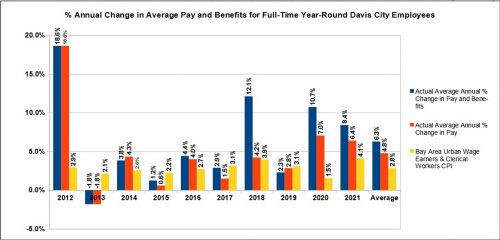

The differences between the actual average annual percentage changes in compensation received by FT City employees as reported by the City to Transparent California and the corresponding annual increases in the specified CPI rate are shown in the following graph. Also see Appendix B for the details of these and other compensation calculations discussed below.

To summarize the above information, the average annual increase in the Bay Area CPI from 2011 through 2021 as reported for Bay Area Urban Wage Earners & Clerical Workers by the US Bureau of Labor Statistics is 2.8%. The actual annual average increase in Pay and Benefits for City of Davis FT employees is 6.3% and the actual annual average increase in Pay for FT City employees is 4.8%.

Keep in mind that the Bay Area Urban Wage Earners & Clerical Workers CPI is unusually high compared to other local measures of CPI because it very strongly is influence by soaring housing costs in the Bay Area. These impacts are generally more muted in the Sacramento region. For additional comparison, the CPI used by the Social Security Administration over the same time period for determining annual cost-of-living increases to pensioners is about 1.7%.

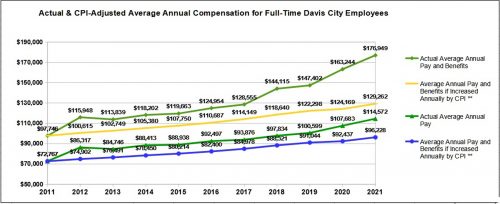

Using the above information, the differences in average annual compensation between what was actually paid to City employees can then be compared to the compensation that would have been paid if Pay and Pay and Benefits were instead increased only by the CPI as shown in the following graph.

For example, the actual average annual total compensation (Pay and Benefits) paid to all FT City of Davis employees in 2020 was $176,949. If annual increases in total compensation were otherwise held to the annual Bay Area CPI Index, the average annual total compensation would instead be $129,262.

Similarly, the actual average annual Pay paid to all FT City of Davis employees in 2020 was $114,572. If annual increases in Pay were otherwise held to the annual Bay Area CPI Index, the average annual Pay would instead be $96,228.

As is obvious, the greater percentage of annual increases in Pay and total Pay and Benefits actually given to FT City of Davis employees over and above the Bay Area CPI-defined inflation rate has resulted in an increasing spread between compensation actually paid to FT employees compared to that which would have otherwise been paid if annual increases had instead been held to the percentage increases in the CPI.

IV. TOTAL COSTS OF EMPLOYEE COMPENSATION INCREASES TO THE CITY

These increases in employee compensation over and above increases based on CPI has had a profoundly deleterious effect on City finances and the City’s ability to pay for other services such as infrastructure maintenance.

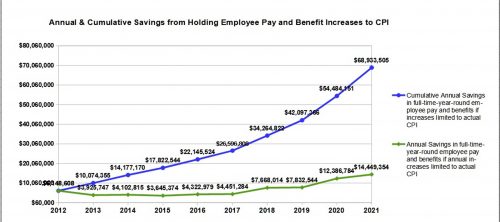

The difference between the actual total Pay and Benefits paid by the City to all FT employees from 2012 through 2021 and that which would have been paid if annual increases in Pay and Benefits had instead been held to the benchmark CPI is very substantial ranging from $3.645 Million in 2015 to $14.449 Million in 2021.

On a cumulative basis, the City paid in excess of almost 69 Million more to employees in Pay and Benefits from 2012 through 2021 compared to if the annual increases in compensation had otherwise been held to annual increases in CPI. This is shown in the following graph.

The $69 Million that would have been saved by the City had employee compensation increases only been held to the CPI from 2011 through 2021 would have paid for an awful lot of infrastructure and road repair that was otherwise deferred by the City and now accumulates as increasing unfunded liabilities.

V. MISREPRESENTATION OF EMPLOYEE COMPENSATION INCREASES AND CONTINUED FAILURE TO ACCOUNT FOR UNFUNDED PENSION LIABILITIES BY THE CITY HAS BEEN OCCURRING FOR MANY YEARS

The City has not been disclosing or has been been misrepresenting the extent of annual employee compensation increases for a very long time and has failed to properly account for associated unfunded pension liabilities for some time.

For example, in an article published on June 26, 2018 in the Davis Vanguard entitled “Sunday Commentary: The MOUs We Signed Should Not Be Cause for Alarm” (https://davisvanguard.org/2018/06/sunday-commentary-mous-signed-not-cause-alarm/), it was reported that the City recently signed Memorandum of Understandings (MOUs) with the City’s employee labor groups ostensibly granting, according to the Staff Report at that time, only a 2% retroactive salary raise and three years of future 2% annual salary increases.

These MOUs were approved at that time despite a number of citizen complaints (including by this author) that the process of approving the long-term MOUs with excessive employee compensation increases was inconsistent with the stated goals of cost containment that the Council had been touting because the actual net increase in total compensation granted to employees had a net impact on the City budget far greater than the reported 2% per year.

The Vanguard article stated at that time,

“The notions of thinking about the contract in terms of total compensation and using the contract to mitigate risk are highly innovative and the council deserves a lot of credit.”

Matt Williams (then on the Finance and Budget Commission) commented in response,

“There is absolutely nothing innovative about thinking about employee costs in terms of total compensation … absolutely nothing! The community dialogue, especially here in the Vanguard over the last 3-4 years has been almost 100% in terms of total compensation…So, all the council was doing was catching up with what their constituents had already been doing for 3-4 years.

What risk did the contract mitigate? The simple answer to that question is no risk whatsoever.

Why no risk mitigation? For the following reasons …

(1) The 2% annual COLA (8.25% over the 3 year and 12 day term of the MOU) is 68% higher than the average annual COLA granted by the Social Security Administration over the last 9 years.

(2) The 6/30/2016 CalPERS Actuarial Valuation report shows 245 “active” members of the City of Davis Miscellaneous Plan. Over 31% of those “active” members will actually not receive an 8.25% increase, but instead will receive in excess of an 18% increase.

(3) Another 40% of those “active” members will actually not receive an 8.25% increase, but instead will receive in excess of a 12.5% increase.

(4) Only 28% of the “active” members will actually receive the 8.25% increase.

(5) The 18% increase bumps up the Pension Qualifying annual compensation by at least 18% (possibly more), which means the City’s Pension liability goes up substantially thanks to these MOUs.

It will take a Masters in Political Spin to transform those factual realities of the MOUs into “highly innovative risk mitigation.”

And so here we are today, almost four years after the City was reporting annual total compensation increases of only 2% per year, and we find out that actual compensation increases were far greater – just as Mr. Williams indicated would happen and verified by the compensation levels reported by the City to Transparent California.

Under-reporting of the City’s pension fund liabilities was also the subject of a Yolo County Grand Jury Report in 2018 which explored pension liabilities in all Yolo County cities. As reported in the Davis Enterprise on July 19, 2018 in an article entitled, Grand jury explores Yolo cities’ rising public pension costs, “Pension and retiree health insurance costs for the cities of Davis, West Sacramento, Winters and Woodland are consuming increasing portions of city budgets, putting extreme pressure on other city service priorities, according to a Yolo County grand jury report released Tuesday. In Davis, 19 percent of the city’s general fund budget now goes to pensions and retiree health benefits, a share that will rise to approximately 26 percent by 2025.”

That report further stated, “Yolo County’s four cities are facing 67 to 90 percent increases in pension costs over the next seven years. In dollars, these increases are projected to amount to $8.7 million for Davis…The projections are taken from CalPERS and city annual financial reports.

The increases are needed for cities to catch up on the revenues they will need to pay pension costs through mid-2025. Currently, Davis has only 64 percent of the funds invested with CalPERS that it will need to cover its pension obligations, and it has been falling behind. Three years ago, the city had 72 percent of the needed funds invested…

Overall, Davis faces $110.1 million in unfunded accrued pension liabilities, CalPERS data and city annual financial reports show…

The picture is even worse for retiree medical insurance, the grand jury found…Davis has assets to fund only a quarter of its obligation.”

The root cause of the problem was addressed in the Grand Jury Report, “Historically, elected city councils have been pressured to agree to pension benefit enhancements based on overly optimistic, often inaccurate investment earnings projections,” the report states. “As a result, too many decision makers failed to realize that pension contributions would eventually become a significant burden on cities, counties and other governmental entities, and by extension, taxpayers.”

Further information on the extent of the under-reporting of the City’s unfunded pension liabilities is discussed in Appendix C.

Additional updated information will be provided when 2022 payroll data is made available by Transparent California sometime in 2023.

APPENDIX A – SUMMARY OF ANNUAL COMPENSATION OF CITY OF DAVIS EMPLOYEES AS REPORTED BY TRANSPARENT CALIFORNIA

The following table shows summary statistics of City of Davis employee compensation as reported by Transparent California (www.transparentcalifornia.org).

Inspection of this data shows a strong, generally increasing trend in median employee Pay and total Pay and Benefits from 2011 through 2021. It also shows a fairly sizable 41.6% increase in annual employee costs per Davis City resident from $627 in 2015 to $888 in 2021. Note that the population of Davis in 2021 was underestimated and the employee costs per resident thus overestimated due to the number of students that has left town because of pandemic concerns during the 2020 and 2021 census.

APPENDIX B – CALCULATIONS OF ACTUAL ANNUAL EMPLOYEE COMPENSATION INCREASES COMPARED WITH INCREASES BASED ON RATES OF INFLATION

Average compensation changes of full-time, year-round city employees was determined by  first segregating and removing all part-time and non-year round employees from the listings of the individual annual payroll details for all employees of the City. Then the compensation of all the full-time employees was arithmetically averaged to calculate the average Pay and average total Pay and Benefits for all full-time, year-round City employees.

first segregating and removing all part-time and non-year round employees from the listings of the individual annual payroll details for all employees of the City. Then the compensation of all the full-time employees was arithmetically averaged to calculate the average Pay and average total Pay and Benefits for all full-time, year-round City employees.

This in turn allows the average annual percent increases or decreases in average Pay and Pay and Benefits to be determined and compared to annual increases in the CPI as reported for Bay Area Urban Wage Earners & Clerical Workers by the US Bureau of Labor Statistics (https://data.bls.gov/timeseries/CWURS49BSA0).

In this manner, the differences in average annual compensation between what was actually paid to City employees were then compared to the compensation that would have been paid if Pay and Pay and Benefits were instead increased only by the annual Bay Area CPI as shown in the following table.

APPENDIX C – DIFFERENCES IN METHODOLOGY IN REPORTING TOTAL COMPENSATION FOR CITY OF DAVIS EMPLOYEES IN 2018

One contributing factor to the unusually large increase in total Pay and Benefits from 2018 – 2021 is that Transparent California now rightfully reports unrecognized pension liability as compensation in a separate category called “Pension Debt” for the first time in 2018 (see https://transparentcalifornia.com/salaries/2018/davis/).

Transparent California explained the addition of this new reporting category as follows;

“What are pension debt payments?

The cost associated with employer-provided retirement benefits is comprised of two components: the normal cost and the unfunded liability (debt) payment.

The normal cost is the amount the pension fund determines is necessary to pre-fund that employee’s future benefit. But because this cost is calculated based on a series of projections about future events, they oftentimes end up being insufficient to fully fund the employee’s promised benefit.

When this happens, an unfunded liability (debt) is created. In order to pay this debt down, the annual retirement costs are increased accordingly.

Beginning in 2017, agencies belonging to the state pension fund (CalPERS) are only required to report the normal cost portion which gives the erroneous impression that their annual costs have significantly declined.

To ensure the full annual cost of employee compensation is reported, and to maintain parity with the reporting methods used by non-CalPERS agencies as well as all CalPERS agencies prior to 2017, Transparent California prorated these agencies’ pension debt payments across all employees. This prorated value is reported under the “pension debt” column.

The pension debt column does not appear for any agency prior to 2017, as that cost was already included by the reporting employer as part of their retirement costs.

Similarly, it does not appear for the agencies that continue to report their full retirement costs to Transparent California.”

Regionally, both Woodland and Winters also saw such new categorical disclosures in their total compensation reflecting accrued “Pension Debt” as reported by Transparent California. West Sacramento and Yolo County did not have these categories in their payroll disclosures for 2108 by Transparent California because they have been adequately accounting for their full pension obligations beyond 2018.

I wonder how these numbers would look if you started in 2008. As I recall the city held back on compensation during the housing bust and started trying to make up for it after that deep recession.

Funny thing, I think the $114,000 average in salary won’t even qualify you for a conventional mortgage in Davis. No wonder so many City of Davis employees can’t afford to live in Davis.

I guess the point here is that if you hold down salaries you don’t need economic growth thus Dan Carson is a bad person and you shouldn’t vote for him. I got news for the community, Carson is probably going to win re-election. Call it anecdotal if you want but I’ve spoken with several people who live in that district and they are all going to vote for Carson. If you ride a bike around there Carson is also winning the lawn sign campaign with his signs on many more lawns than Bapu’s and the only Fortune sign I have seen is on B St. far outside of the district.

Also these fiscal challenges have been around much longer than Carson. Back around 2000 when the City Council gave unfunded 3% at 50 pensions to the cops and firefighters like most of California is when the city budget went upside down. The big loss for the city on the economic development side was when people opposed developing the 391 parcel. Ramosland was a second bite at the economic growth apple and it too failed.

Four years ago Carson ran on trying to fix the budget and he has worked to fix it. You can do this by holding down wages, increasing city revenue or growing your economy. From this article it appears that the author, who has been a steadfast opponent of growth, would prefer holding down compensation. Carson, it seems to this observer, has been trying to get there through a combination of all three methods of budgeting.

True, but not as simple as one might think… ignoring “deferred maintenance” (roadways, structures, water lines, etc., etc.) goes back to the late 1970’s… we’re talking close to 50 years… what was the $$$ spent for? “Feel good” purposes… toy closet, ‘life enrichment’, ‘recreation’ programs, etc., etc.

It got exacerbated in the mid-90’s/early ’00’s when PERS was “super-funded”, and, in lieu of salary, other ‘total comp’ costs, the City took over paying for not just the employer’s share, but employees’ share of PERS payments (the City share was 0.00).

And Mr Pryor did not point out the 2.5%/yr, PLUS (usually) CPI adjustments by DJUSD… and the # of days worked, etc. Guess he was afraid of touching ‘the third rail’…

That’s where the 3% @ 50, 2.5% @ 55 kicked in… it is more complicated since then.

Mr Pryor “cherry-picked” his time frames… a whole different picture would emerge if the time frame was 1975 to present… and his comments neglect another set of facts for retirees… unlike SS recipients, PERS annual adjustments are THE LESSER of 2% or CPI (generally)… and, in addition, retirees, if they or their spouse (either one) are eligible for Medicare, the retiree goes on Medicare when they turn 65, pays the Part B premiums, and the City only pays for the Part C, up to the Kaiser rates… facts Mr Pryor chose not to point out…

Would add more, but need to run out and get some green firewood to burn in the fireplace tonight, preferably in one use plastic wrapping…

This is disgraceful. (As a side note, pension costs also generally go up, as salaries rise.)

On the other hand, how does one apply for one of these jobs? Might as well get your own piece of the sinking ship, at least.

First you get a four year degree in planning and go to work in city government in an entry level position while you work towards a masters in Public Administration or some related field. Then after 5-10 years you move up to a more senior position and then in another 5-10 years you move up to an even more senior position.

So start working towards it now and maybe you will get there when you are around 100 years old.

Inane question… at best… more likely, trolling… with a 1/3 hp motor…

Typ.

The article states average salary for full-time city employees, which would presumably include those across a wide spectrum of jobs and experience levels.

Doesn’t surprise me a bit.

Not really – those are impressive compensation levels.

Of course, some say that those who go into civil service only need a 1/3 hp motor to “succeed”.

I’m all for reigning in costs. But it seems like the basis of the article is a comparison of wage increases to the Consumer Price Index (CPI). But there doesn’t seem to be any analysis of a comparison of other comparable city employee compensation to Davis city employee compensation. Or to put it another way when Davis hirers a new Director of Economic Development or any company looks to hire an employee; you don’t look at the cost of living in the area to determine what to pay someone. You look at what others are paying employees for a similar job. So if I’m looking to hire a widget maker and other widget makers in the area are paying $100K per year. It doesn’t matter if I’ve been paying $80K and the CPI says the cost of living in the area says that a $5K increase is all that is warranted. If I want to hire someone I’m going to have to pay them at least $100K.

Once again, Davis is not an island. The Sacramento region is growing at a monstrous rate. That’s going to cause the cost of goods and the cost of employee compensation to rise. So I’d be interested to know how recent Davis city employee compensation compares to other regional cities? Also, what does the city have to say in it’s compensation calculations? What is their justification for their numbers?

Looks like a comparison to other cities may be included in Part 2:

Depends upon whether or not a given city is actually having trouble filling a position. It’s not like desired positions are necessarily vacant in other cities. In other words, the “unemployment rate” matters. Could be that there’s 100 or more people applying for top-level jobs.

Ultimately, people may also be applying from out of the area, where they’re paying a LOT less in salary.

Paying someone more than other cities does not guarantee that you’re getting the best candidate, either. But it is a good way to ensure cost escalation.

I understand that Yolo County health services has close to 100 vacant positions now. Local governments are trying to fill positions–there’s not much competition among the appliants–it’s the other way around

Would have to know more about the type of positions that are open, to make a judgement. The health field that you referenced, for example – is often/generally in need of more workers. Some of those positions (such as a CNA) are low-pay, but high effort type of jobs. Essentially similar to the fast-food industry type of job.

But if you offered a job with the city of Davis (with the average salary and benefits listed in this article), I suspect there’d be literally thousands of potential takers. Ready to start tomorrow – even if they had to move from anywhere in the entire country.

And that would hold true even if you doubled the price of housing, in Davis. (It’s actually moving in the opposite direction, however – everywhere.)

On top of that, we’re entering a recession.

It’s almost never “easy” to get a job. It’s the other way around – employers usually have lots of qualified applicants. Now, if you’re a computer genius (and we weren’t entering a recession), you might actually be “pursued” by an employer.

We’ve heard the same type of claim regarding “teacher shortages”, despite a declining student population throughout California. (Actually, workers sometimes do leave a declining field even faster than the opportunities themselves decline. But that doesn’t mean that there’s a shortage in the long term. It simply means that those workers are getting out while the “getting out is still good”.)

The link below shows the 17 vacant position for the city of Davis.

I’m not even seeing any which reach of the “average” salary listed in the article above. And yet, I suspect they’ll get plenty of applicants.

https://www.governmentjobs.com/careers/davis?page=1

It’s pretty difficult to “dislodge” any long-termer receiving the type of salary and benefits described in this article. That is, until their retirement benefits are deemed sufficient enough for themselves. At which point, they’ll fall into the “partially unfunded” category – from the city’s point of view. (Davis is not alone, regarding this type of “accounting”.)