By David M. Greenwald

Executive Editor

Davis, CA – Measure N supporters can pop the corks. By my calculations, there is no realistic path to victory by No.

Right now, Yes has 67.78 percent of the vote. That lead has held remarkably steady throughout the vote counts.

Here is the county’s estimated number of votes remaining. That total is 1785. Is it possible that there are more? Yes, but realistically it’s close enough.

How much of that is DJUSD? We don’t know.

But I took a very conservative estimate to illustrate how improbable a change would be at this point.

Let’s say there are 1000 uncounted ballots in DJUSD. It would take about 705 of them to be NO in order to change the result. That would be almost a complete reversal of the trends and frankly it is simply not happening.

More likely there are less than 1000 remaining ballots to be counted and Measure N will get around the percentage it has now—give or take.

The No campaign—such as it was—attempted to criticize the fact that the district was seeking to make the parcel tax permanent with an inflator for inflation. But the  district frankly did exactly what it should have done—attempt to lock in a revenue stream that clearly will be needed in perpetuity.

district frankly did exactly what it should have done—attempt to lock in a revenue stream that clearly will be needed in perpetuity.

Had the voters said no, the district would have had to have come back an ask for a shorter term ask. But Measure N was clearly within the historical rang—albeit at the low end.

There were some bad arguments made about the adjustments for inflation but clearly you cannot have a permanent parcel tax that depreciates in value in real terms over time. That would not make sense.

There also seemed to be a lack of understanding of how inflation works—just because a number goes up, doesn’t mean you are paying more in real terms.

Analysis of Campaign Effects and Trends

This was probably the most robust No campaign we’ve seen. And there were really two separate groups/arguments in opposition.

One group argued basically that this measures lacks accountability and the district needed to come back and offer a parcel tax with a sunset date.

The other group tried to inject the transgender debate into the schools issues.

It really doesn’t appear that either had a lot of traction.

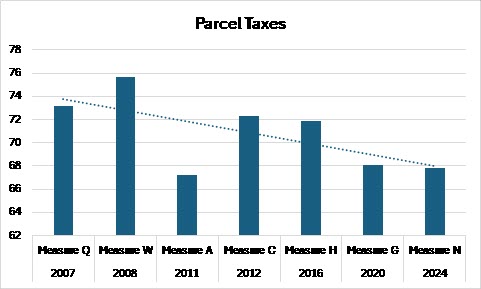

We don’t have a lot of data, but over the last 17 years, we have had seven parcel tax elections for DJUSD and the range of results goes from 67.2 to 75.7. That’s not a huge amount of variance.

The chart actually distorts the amount of variance because it starts at 60 rather than zero.

But there is a bit of a trendline and it does goes down.

I would, however, argue that the results are driven more by the ask than by some sort of trend.

For example, 2007 and 2008 were both the largest margins—they were also only asking for $100 at the time. 2008 was in the heart of the great recession, the district was facing mass layoffs and there was huge community response.

On the other hand, in 2011, the district made several mistakes that kind of drove down the results.

Even so, none of those results are true outliers, they are still within a relatively narrow range.

We do see a drop off from Measure H in 2016 to Measure N in 2024. That’s four percentage points. But is that due to the opposition? Or is due to changing demographics? Or is it due to the fact that Measure H was an eight year tax while Measure N is now permanent with an inflator? In other words, the district asked more and the results ticked down.

The results for Measure G and Measure N are also remarkably similar. Measure G boosted the parcel tax for teacher compensation while Measure N locks in the bulk of the parcel tax permanently. Both were new asks, rather than simple renewals (yes, I agree with the opposition that Measure N was not a simple renewal).

The Future

It is kind of easy to look at the trendline and wonder the extent to which there will be district support for additional parcel taxes into the future.

Again, part of the hope with Measure N is to limit the number of times the district has to go back to the voters.

We can see why they would want to do it.

First, parcel tax campaigns are expensive to run, especially for a district living on the margins. Even with this parcel tax, the district is facing layoffs with the current budget situation.

Second, the system is bad. If the district is pulling 67 to 75 percent for every parcel tax, that’s pretty strong and, yet, they have to live on the edge each time they go to the voters.

Third and maybe most consequentially, it is hard to know how long into the future the community will support parcel taxes at the two-thirds level.

If we look at polling, it is often the case that people over the age of 60, while still supportive of parcel taxes, are not supportive at the two-thirds level and so there is no guarantee that into the future the community would pass these taxes.

From the standpoint of the opposition, that was a reason not to make the tax permanent. From the standpoint of the district, that is precisely why they should have tried.

Declining Enrollment

The opposition tried to mix in the fact that there is declining enrollment—that was a mistake on their part and it conflated unrelated issues.

The parcel tax, however, isn’t meant to fill the gap for declining enrollment. It is meant to fill the gap between what the state provides and what the district has provided to the community in terms of services.

Declining enrollment is a multilayer threat to the school district because each student brings in money in its ADA calculation. And as those numbers go down, the district has to adjust its budget and find places to cut.

The district has stabilized its enrollment numbers largely through out-of-district transfers. The opposition falsely construed this as a negative, suggesting that we are supporting students from outside of Davis—but the truth is their enrollment helps DJUSD.

More complicated is the fact that most of those students’ parents either work at DJUSD or UC Davis and therefore there is not really much DJUSD can do about their enrollment—nor is there any reason that they should.

Furthermore, the out-of-district transfer is the flipside of declining enrollment—they are basically two sides of the same coin. That’s due in large part to the housing crisis. People who work at DJUSD and UC Davis that cannot afford to or are unable to live in Davis are still sending their kids to our schools for a variety of reasons.

The bottom line: this won’t be the last time the voters are asked to approve a parcel tax, Davis has a track record for passing them, but it’s hard to know in the future if current demographic trends continue.

Here’s my analysis:

In reference to your parcel tax charts: 2011 was an outlier year because it was not a presidential election year and everyone was focused on recovering from the great recession. Take out 2011 and it’s pretty darn clear that there is a strong trend against tax overrides. What is the trend in how many of our local citizenry are paying Mello-Roos taxes and higher base property taxes as people sell, trade up or purchase the first time? The no-tax group has always been the heart of No votes and their message resonates with multiple property owners and new property owners. A one percent increase every year in the number of those kinds voters adds up every four years.

The culture war opponents are only a factor in energizing traditionally unengaged voters or giving anti-tax voters an additional reason to vote No. It can also be argued that the culture war opponents energize as many marginal Yes voters. So I am not sure their role is significant.

I don’t think many older, over 65, voters are switching from Yes to No just because they are older. If anything, older voters have grandchildren in their lives and continue to vote the way they have always voted on education related taxes. People don’t just abandon life views because of age.

The No campaign’s use of charts and data, cherry picked or slanted as it was is valuable only to the extent it helps people who were leaning No to vote No with the feeling they are being rational and not just cheap and mean. Politics is not that complicated. It’s about each voter’s emotional core.

The DJUSD and the city of Davis as well as the county and state grossly underestimate the need to educate the voters, the taxpayers, the community. When there are two sets of what look like believable statistics, the voters are left with only their gut instincts and the advice of friends, neighbors and others they trust to decide on how to vote.

Government has to work at communicating the truth, good, bad and ugly if it wants to earn trust. It has not really done that lately.

“ The DJUSD and the city of Davis as well as the county and state grossly underestimate the need to educate the voters, the taxpayers, the community.”

Certainly a point I agree with.

Measure C in 2012 was similar to Measure A (2011) in that it was a special mail only election. Although the primary election was scheduled in June of that year, Measure C was scheduled for March. I’m remembering that the March election was needed because it had to pass early enough to avoid deadlines for cutting staff jobs; a June election would have been too late. A difference is that Measure A was a new assessment, whereas Measure C was a consolidation and extension of Measures Q, W, & A.

You left out Measure E which passed in November 2012 (Presidential general election) with 69.0% of the vote.