By David M. Greenwald

Executive Editor

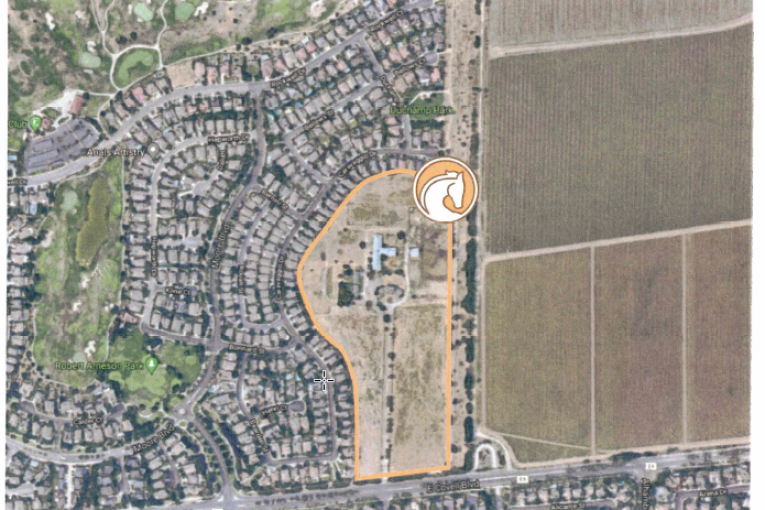

Davis, CA – It has been over a decade since the voters overwhelmingly voted down Wildhorse Ranch directly to the east of Wildhorse and north of Covell on the edge of town. But that was a different time and now Taormino and Associates are back potentially with a new proposal for the location—Palomino Place.

The project description notes, “In Yolo County, the situation is epitomized by what we often refer to as ‘North, North Davis’ (Springlake, Woodland) in which most residents are Davis-employed persons who would likely live there if not for the lack of affordable housing. Where is the civic focus for these families when the Davis community intentionally denies housing opportunities where they work?”

On the other hand, he argues: “The Cannery homes that should have been priced for Davis buyers were overwhelmingly purchased by Bay Area buyers.”

In Davis’ case, “we invite nearly one thousand elementary and high school students to commute daily along with their parent(s) who work here. Which community are these families anchored to emotionally? Where is their ‘hometown?’”

He continues: “Without these children and the state funds accompanying them, the negative financial impacts to the school district, teachers, and Davis residents would be significant and controversial, as closing schools is not a desirable discussion for civic leaders. The City of Davis effectively exiles its employment base while DJUSD simultaneously seeks out their children to return for the District’s financial benefit via advertising on FM 90.9 NPR.

“Furthermore, Davis homeowners pay additional property taxes that benefit these commuting students who, along with their parents, have been exiled to other communities. The long-term impacts of failing to provide housing opportunities for parents and subsequently reducing the need for potential school closures has essentially been ignored by the School District and the City.”

Their proposal would “Provide new homes in Davis designed for and offered at a price that buyers employed in Davis or current Davis residents can afford.

“The shortage of new Davis homes described earlier is unquestioned,” he argues. “The most practical solutions to address housing needs are those locally generated and tailored to achieve a specific outcome.”

The fundamental housing principle is: “Community-Centered Housing opportunities are for those individuals (at least one in the family) who are employed in the broader Davis community or are already a resident/renter.”

The project is situated on an irregularly shaped, 26-acre remnant of a parcel.

Palomino Place proposes four categories of houses:

1) 40% of units: Entry-level townhomes and cottages; 800-1,350 sq. ft.

2) 30% of units: Mid-level move-up cottage homes; typically, a result of an expanding family; 1,600-1,900 sq. ft.

3) 30% of units: Second move-up home; typically occurring because of increased income and/or needs resulting from an expanding family; 1,900-2,200 sq. ft.

4) Four Duplex units

Moreover, “All mid-level and second move-up lots are intended to provide Accessory Dwelling Units (ADU) approximately 650-800 sq. ft. as a standard offering of the builder.

“Within each category of proposed Palomino Place homes are imaginative opportunities to assist purchasers and the City in achieving their housing goals beyond a typical land purchase. The size of the home is consciously formulated to meet the buyer’s financial capabilities with the cost to construct and ultimate sales price,” they explain.

Here is what they propose:

Mimic the Aggie Village model: This is where UCD, as independent investors, purchased the finished home then “land leases” the lot to its faculty and staff who own the home itself—a concept first created in California by the Irvine Company in Southern California.

Limited equity increases limitations: While common with government-subsidized “for sale” units, this practice is used less often in normal market-rate units. UCD applied this approach at Aggie Village to offer more affordable prices to later purchasers.

Equity sharing: Down payment assistance to buyers from either a Private Equity company (common in Silicon Valley), the newly proposed City of Davis Housing Trust Fund, or a local public/private employer participation.

Repurchase rights: To ensure long-term availability for local employees receiving an employer subsidy, the employer requires a “first right to purchase” in the event of its resale for some period before the residence goes on the open market.

Restricting long-term rentals: No retention by the purchaser of the property after vacating for use as a rental home. This restriction helps with maintaining inventory for future Davis employees and residents.

Continued owner-occupancy: Required by the purchaser, except for specific reasons and time frames—for example, a UCD professor goes on sabbatical, a major housing recession, etc. The home must be sold to an owner occupant.

This would be a Measure J vote. Their goal is November 2022.

So… looks like a ‘press release’, but is not under that description… ‘Author’ is credited as DG…

Is this article a “trial balloon”, or a pre-app filed with the City?

I see a number of issues with the proposal… one has been toughed by another thread… huge parking lots of trees, no solar, is just one.

I get a kick out of the ‘name’… Palomino (Pal-omino… which could be parsed as pal o’ mine, oh)… rhymes with Taormino… and part of ‘Wildhorse’… too precious!

But seriously, first glance sees significant issues from a site design perspective (I take few issues as to land use, but the pool(s) thingy looks like a ‘carrot’)… on the land use side, seems to be postured to be “all things to all people”, good strategy for the Measure D vote that will likely come… politically expedient… glad to see that the boundaries weren’t “negotiated” with adjacent properties to get support, squelch opposition… so, in that way it is more “honest” than Wildhorse Ranch, but accomplishes much the same with open space buffers.

Main issues… secondary/tertiary access, for emergencies, utilities, particularly water main loops, is not identified in the graphic in the article.

Am really curious as to “is this a “trial balloon”, or a pre-app filed with the City?”.

Definitely wasn’t a press release. I pulled it off their brochure. Understand that they had some neighborhood outreach sessions as well. Some of them were described to me as contentious.

So, “testing the waters” with voters/neighbors w/o consultations with knowledgeable City staff… build the ‘base’ before vetting with staff… then try to influence the professional staff with their political “base”… Covell Village did the same thing… as staff, I experienced it.

Covell Village didn’t turn out so well for the proponents.

This proposal could have benefitted from professional City staff input… as it stands, they may be making ‘commitments’ to their “base”, that could get their “base” upset/outraged with City staff for trying to make practical, necessary changes… Covell Village, that happened…

See my previous post for some of the ‘practical’ issues…

Oh… and who would have access to the pools? How would they be owned, maintained, repaired, etc? That is another ‘practical’ consideration. The narrative does not discuss that… maintenance/liabilities/repairs to pools is not an insignificant issue…

I think your first paragraph about nailed it.

.

While I think the statement is correct, should we really be making important decisions based on whether the discussion topic is a desirable discussion for civic leaders? I personally believe DJUSD should be considering closing either one or two Elementary Schools, and possibly even one of the Junior High Schools. I believe that would be the fiscally prudent thing to do. However, as the quote points out, closing schools is a discussion that is fraught with political difficulties … and therefore will be avoided like the plague.

JMO

I would have phrased it differently, but I think there is a sizable number of people in the community that agree with the general sentiment.

David, did the brochure provide target prices? How did they deal with the thorny issue of affordability?

Question to Ron Glick … since you are the resident voice here on the Vanguard for affordable starter homes for young families, what do you consider the starter home price range is for young families?

Question to Eileen Samitz … since you are the resident voice here on the Vanguard for affordable workforce housing, what do you consider the starter home price range is for workforce housing?

As far as I can tell – they didn’t deal specifically with affordability or list target prices.

That is not a surprise. However, since housing affordability is arguably the #1 issue in Davis, shouldn’t the message from any new development begin with the affordability built into the proposal?

Shouldn’t our elected officials be sending a clear message to any and all proposed (or pre-proposed developments) that they need to address affordability right from Day One?

Shouldn’t the citizens be letting both the developers and City Council know that they expect all proposals to address affordability right from Day One?

“Question to Ron Glick … since you are the resident voice here on the Vanguard for affordable starter homes for young families, what do you consider the starter home price range is for young families?”

I have no idea. Perhaps the 2020 census data could shed some light upon the topic. In my dream world a family making the median income would be able to afford the median priced home with a 20% down payment and a 30 year loan.

“You might say I’m a dreamer but I’m not the only one.”

20% down payment is very unrealistic for young families unless their parents have much $$$ to gift or loan. Even if 2-income… even if the house was priced @ $250k. Not a happening thing. Unless, perhaps if the ‘young family’ was in their mid-late 30’s, and had no kids yet.

5-10% DP is realistic, with 10% being goal to avoid PMI… wasted $$, just more profit for lender.

30 year loan, at current rates, is realistic. Not ideal, but realistic.

If a young family, had $120k combined income, they’d either be very frugal, very wise, to have $25k in liquid assets. They’ve been paying rent all the time they were amassing that. No retirement savings, little ’emergency savings’.

You are correct… likely the 2020 Census data will shed more light on what is “real” for 2021-2022. I suspect that, even excluding the student population (some of whom have young families), and excluding the “landed gentry”, that looking even @ median income/resources, it will be a “rough row to hoe” for affordability for home purchase… existing or new.

When we bought in Davis, 1980, we had no retirement savings, no ’emergency funds’… we had been frugal… we were stretched to the max, and had parental loans, and still couldn’t make even the 10% level for a down payment (came close, but not there). We were middle class (median) as income was defined then. But we also faced a 12% mortgage interest rate.

This is not simple…

To complicate things, new building/energy standards have increased the $$$/SF cost of housing… theoretically, over time, that should ‘help’… but in the here and now, that doesn’t matter… mortgage lenders don’t factor that in.

This is brilliant. Privately-financed housing built for entry-level buyers, limited equity, ADU’s, and more? What a concept. I look forward to the details and to hearing the concerns of nearby neighbors, but clearly this developer pays attention to Davis concerns and understands this housing market.

Yes… all things to all

voterspeople. Land-use, pools, open space, trees, what’s not to like?Yet, as Matt W points out, no clue, as yet, as to “pricing”… what’s affordable to a mid-career, DINK couple from the Bay Area, is different from a single income, young family (or hoping to start one), early in their career(s)… very different.

It was a huge stretch for us, in 1980 to buy a house in Davis… and that ‘stretch’ was tenuous for several years… we bought a 12 year old, fixer-upper (had been used as a student rental) for $71 k. One income (professional) and a newborn. 3 years out of college…