I have heard and seen some opposition to a new tax. While I certainly understand that people feel that the city is taking too much of their money – particularly with the new water rate hikes – I think we have to be realistic.

I have heard and seen some opposition to a new tax. While I certainly understand that people feel that the city is taking too much of their money – particularly with the new water rate hikes – I think we have to be realistic.

There is the position that was expressed that passing a tax would take pressure off the city to push forward with plans for economic development. I get that as well; however, what I have not seen to this point in time is an alternative to short-term revenue enhancement.

I am going to show the Vanguard readership some key slides from City Manager Steve Pinkerton’s budget presentation, and then I will allow our readership to crowdsource an alternative to taxation.

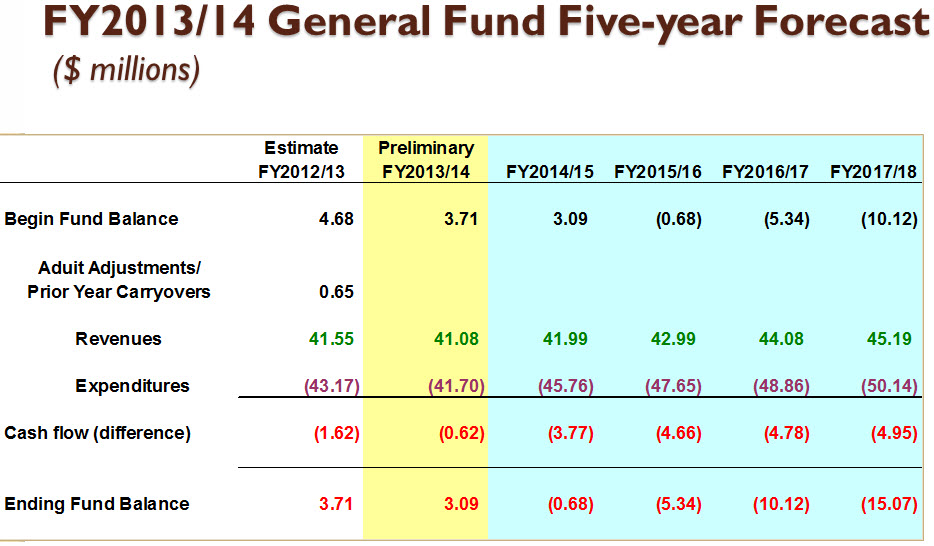

Mr. Pinkerton argued that we “can no longer defer unfunded liabilities without severe consequences in the future.” He notes, “Current five year projection doesn’t assume full funding of future infrastructure costs,” and adds, “At current rate, will likely deplete fund balance by end of FY 14-15.”

Here is what the city is looking at:

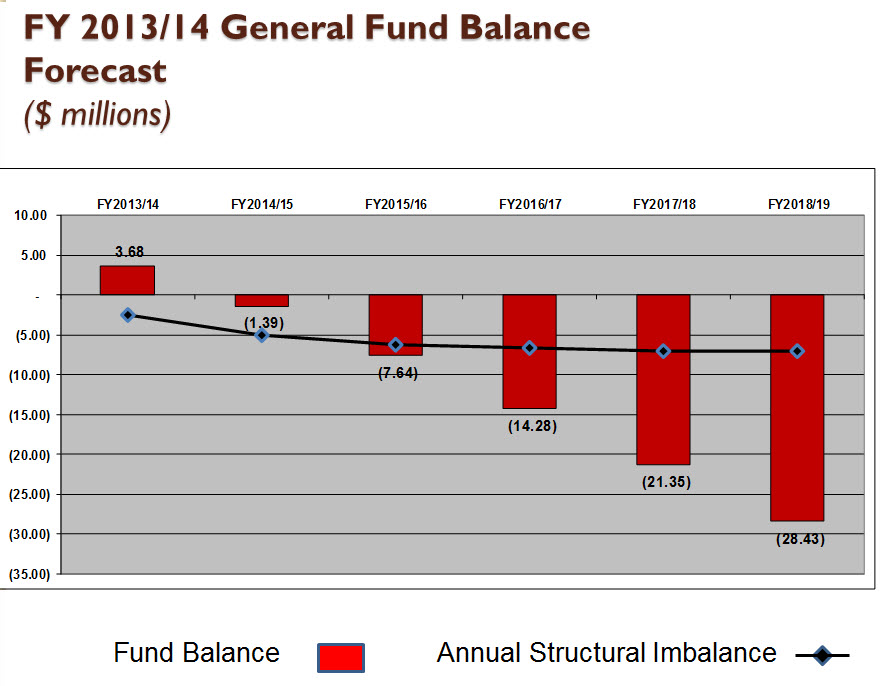

So the annual fund balance will produce a $28.43 million hole.

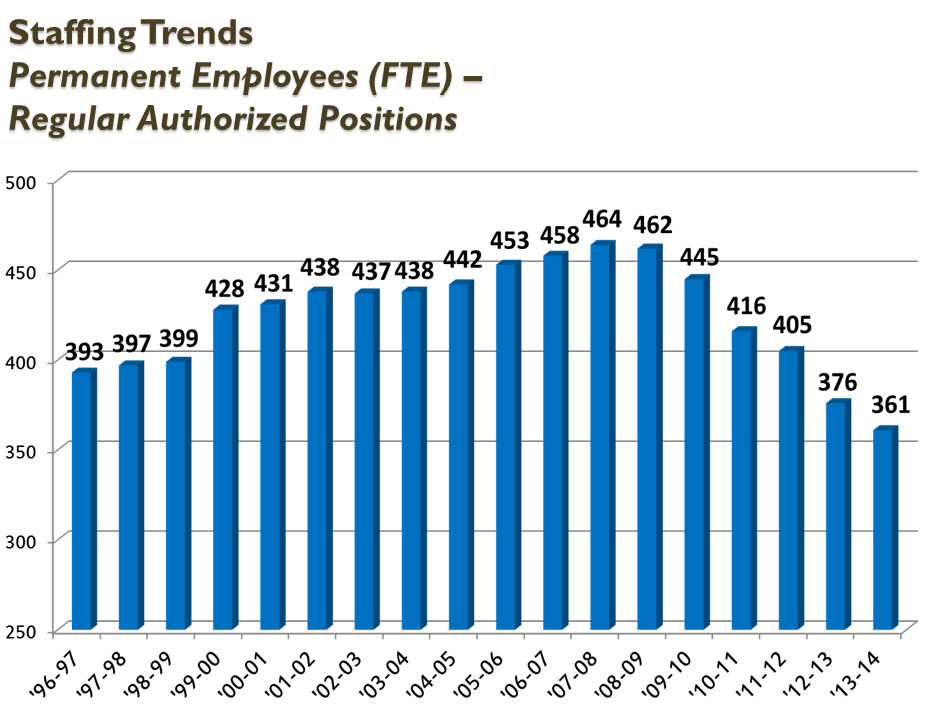

The city has done a lot of work to cut costs. For instance, city staffing is at a nearly 20-year low.

Cutting enough staffing or services to trim into the $5 million deficit, therefore, doesn’t seem feasible.

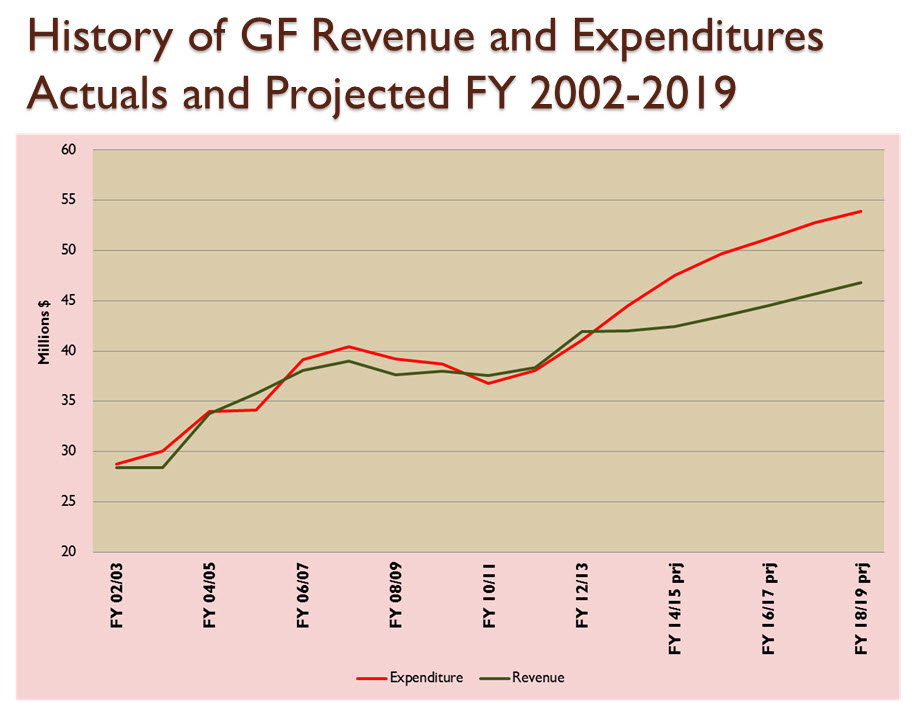

City Manager Pinkerton has argued this is predominantly a revenue problem. That is not completely illustrated in the slide above, which shows revenue increases of more than $15 million over about a 15-year period, but those increases are trumped by about $25 million in increased expenses.

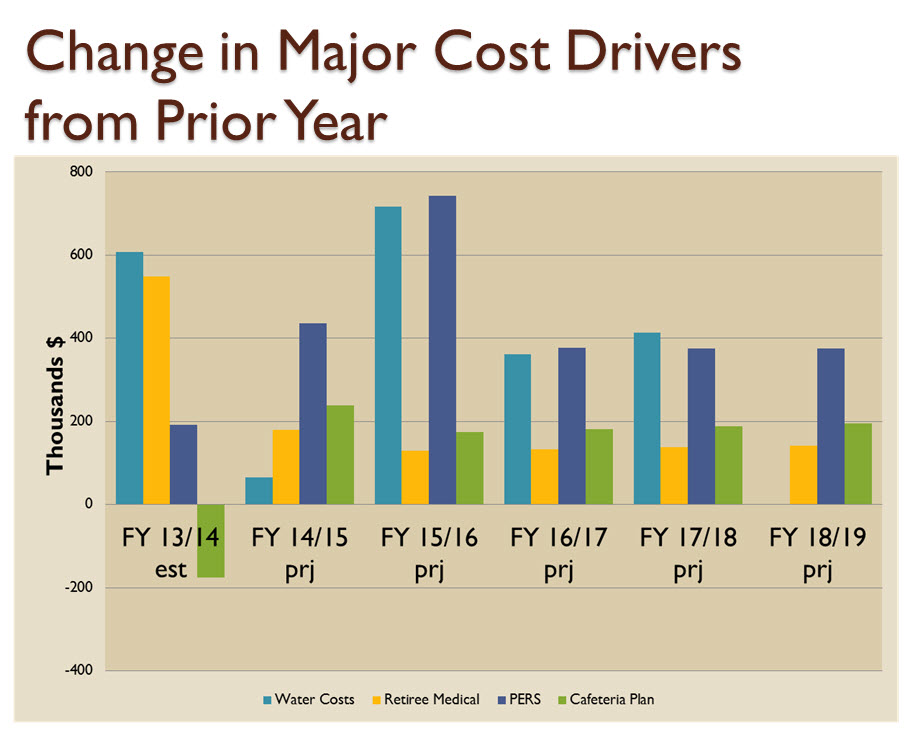

The next slide illustrates the bind that the city is in, in terms of future costs that will re-open the deficit.

The only costs that are remotely within the city’s grasp are the new water costs, but even those are a fairly small percentage of the overall hit. Notice that the increased costs for road repairs are not even in these equations.

The bottom line is that the city would like to use short-term strategy of increased taxes because they do not feel they can sufficiently cut from the budget and still preserve current levels of services. That is, of course, a city goal – to maintain services. If the public wishes to cut services, then it should itemize those cuts and show how you can get to $5 million in cuts without increased taxation.

—David M. Greenwald reporting

Let John Meyer run the city through a JPA saving $200,000. Let the fire union run the fire department saving $100,000. Raid measure O funds $500,000, Add value of restricted public parking to residential assessments 200,000.Cut city council renumeration $100,000. Put a toll booth in the Richards tunnel $1,000,000. Use maximum enforcement on biking without a light at night $2,000,000. End pass through agreement with county 2,000,000. Its a good start. If that isn’t enough cut the water treatment staff because everyone knows our poop don’t stink.

LOL!. Thanks for the Saturday chuckle Toad!

Use maximum enforcement on biking without a light at night $2,000,000.

That is one I can get behind 100%

“The city has done a lot of work to cut costs. For instance, city staffing is at a nearly 20 year low. Cutting enough staffing or services to trim into the $5 million deficit, therefore doesn’t seem feasible.”

It doesn’t necessarily follow that it’s not feasible to trim into the deficit because staffing is at a low level and some other costs have already been reduced.

Assign a 10% cut to each city operation. Current employees are those best capable of identifying where additional cuts can be made with the least negative impacts on operations. Don’t assume that all city staff will behave the way the fire department has in recent years.

City is considering a 12% cut as you suggest

To put such a cut into perspective, here is a chart from the December 19th City Manager’s report to Council.

–

To put those FTE numbers into context:

FY 2013/14 = a 4.0% annual decrease

FY 2012/13 = a 7.2% annual decrease

FY 2011/12 = a 2.6% annual decrease

FY 2010/11 = a 6.5% annual decrease

FY 2009/10 = a 3.7% annual decrease

FY 2009/09 = a 0.4% annual decrease

The cumulative decrease since FY 2008/09 is 22.2%

I’m curious, have most of the city employee cuts been lower level? Have they cut management positions at the same percentage?

Most of the cuts were by attrition and there have been upper level positions eliminated along with lower level ones

GI — The City Manager’s Report of 17 December shows all “Historical Budget Reductions” from FY08-09 to 13-14. This includes all FTE cuts.

The City website appears to be down but Matt has posted the Reductions chart above. The whole report is worth a careful reading.

Saving $2,000,000 a year by getting rid of the pass through is actually a good idea. A majority of supervisors are opposed to forcing growth the city doesn’t want.

Not general fund money

What’s the difference? Couldn’t this $2-million be used to benefit Davis programs and citizens? Is it out of the question that pass-through cash could be used, instead, for some items that otherwise would be financed from general find accounts?

It’s always seemed like expensive blackmail payments to the county to decide what they otherwise would or should decide for free.

It’s complicated, but the answer as explained to me by Pinkerton a few weeks ago is no.

For $2-million a year, I’d hope this payoff to the county could be both uncomplicated and justified better than it has been in the past. Are we still using State RDA funding to pay this scandalous “pass through”?

Yes from the successor organization.

With what funding David?

“Under AB 26, all redevelopment agencies in the state will be dissolved as of October 1, 2011 unless a city adopts an ordinance to make certain payments to the schools and special districts (referred to as the Continuation Payments). A successor agency would be appointed (and could be the City) that would be under the control of a seven member oversight board. The City would only have one vote on the board, with the balance of the members representing the other taxing entities, the public, and the former employees of the agency.”

So the city is continuing to make payments of $3.27 million to the county – if they decide to stop, that money simply goes away, it’s not money that can be reallocated.

David, that appears to explain the distribution methodology, but does it answer the question, “Where does the money come from?”

It comes from the same place as before, but most of that money now goes directly to the state

David, I don’t follow. Correct me if I am wrong, but wasn’t the State the source of RDA funding? Then they took that funding away. Is that correct?

Regarding the source of RDA funds, my understanding is that the tax increment resulting from redevelopment went to the RDA instead of being passed upstream. Thus the RDA monies were generated locally via the property tax system.

” wasn’t the State the source of RDA funding? Then they took that funding away. Is that correct?” That is incorrect. Jim Frame has it right. The money came from the increased value of the properties in the RDA district. That money was administered by the state, so some might have thought that was the source of the funds. But is was local monies going to the district instead of to local government, local districts, and local schools. Since the money wasn’t going to local schools, the state ‘backfilled’ that money to the school districts. Now it is reapportioned to the various governments, and it is true that the city gets less than it used to. But the city isn’t the only level of government involved in the funding structure.

The net effect of killing RDA was a loss for cities like Davis and a gain for the state. Our RDA did not affect other local districts. However, in a round-about sense, since so much state money goes to K-12 schools, the school districts win by killing RDA, as that money no longer is used to backfill. And it is for that reason that the CTA was the leading force out to kill RDA.

The LAO has a very good review of the changes brought by liquidating RDA’s. I recommend that council members and candidates read this carefully, especially the recommendations and conclusions at the end. http://www.lao.ca.gov/analysis/2012/general_govt/unwinding-redevelopment-021712.aspx

Conclusion, clearly not borne out yet based on Rich’s comments and his detailed analysis of this issue some months ago: “Over time, schools and other local governments will receive significantly more property tax revenues—and fewer funds will be reserved for redevelopment purposes.”

Supervisors change.

The last slide purports to show changes in major cost drivers, yet it omits the biggest cost of all: staff compensation. The Staffing Trends slide is impressive at first glance, but without knowing the average cost per FTE cut makes it almost meaningless. Important numbers are missing from the presentation.

Also, how can the shown City water costs, which it is just now beginning to pay, go down? Rates are going up at least a factor of three by 2018! Yes, the City can shift some irrigation to intermediate wells, some of which are to be shut down, but will this water really be out of the system that ratepayers are paying to maintain? And, it has not been settled how much the City owes ratepayers for water used in the past decade and paid for by ratepayers. Payment should have come from the General or other Fund.

Paul, the official analysis has not been released yet by the City (although I don’t know why), but based on my communications with the Staff person that was completing the audit, the Water Enterprise Fund is going to owe the City General Fund money for each of the years in the past decade, rather than the other way around.

The reason that is the case is twofold. 1) the Water Enterprise Fund has no fiscal/accounting employees, and it “purchases” those services (as do the Wastewater Enterprise Fund and Stormwater Enterprise Fund and Solid Waste Enterprise Fund) from the General Fund’s Finance Department. The costs of those purchased services, which were included in the Cost of Service Analysis that I helped Bartle Wells complete, is a bit more than $500,000 per year. 2) the Water Enterprise Fund does not own any of its 26 well sites, and it rents the those sites from various General Fund departments (Parks, Public Works, etc.). When I last checked on the progress of the audit the City staffer in charge was in the process of validating the fair market rent for those well sites.

So I suspect your last sentence will end up reading, “Payment should have been made to the General or other Fund.”

Matt –

To Paul’s opening question, isn’t that addressed in Robb’s earlier observation that these are cumulative increases shown?

Yes, that is correct. Paul often reads only the Introduction and stops before reading Chapter One.

The net water costs go to zero, it appears! How can the well-space rentals go up faster than the water rates? Paul

Again Paul you need to read the instructions. The bars reperesent the year to year change. So the zero value you are seeing in any individual year means no change from the prior year.

So . . .

— FY 2013/14 water costs for the City will be $600,000 higher than FY 2012/13.

— FY 2014/15 water costs for the City will be $70,000 higher than FY 2013/14.

— FY 2015/16 water costs for the City will be $700,000 higher than FY 2014/15.

— FY 2016/17 water costs for the City will be $350,000 higher than FY 2015/16.

— FY 2017/18 water costs for the City will be $400,000 higher than FY 2016/17.

— FY 2018/19 water costs for the City will be the same as FY 2017/18.

In aggregate FY 2018/19 water costs for the City will be $2,120,000 higher than FY 2012/13.

Matt – thanks for setting me straight! I read the bottom, but not the top – very careless! Paul

No problem Paul. By 2018 it will be a big enough number that the General Fund will indeed owe the Water Enterprise Fund money each year, but for now I believe the shoe is on the other foot.

Of course economic development is a two-fer, it increases tax revenue and puts money into the pockets of people who have more to spend and spin off more taxes. Remember Yolo County has a 17% poverty rate. Turning our backs on economic development is pretending poverty doesn’t exist here. By the way preserving our agricultural heritage also preserves the stratification of income that economic system perpetuates where, like Walmart and McDonalds, low wages add to the need for public assistance, farm labor does the same.

I agree. I find it quite ironic that many of the same people blocking ED and demanding that we preserve every acre of farmland for the benevolent business of farming also lament the percentage of the population in poverty. It seems to me that they people that bemoan poverty and demand that we fix it would be the strongest advocates for using land in ways that provide the most opportunity for people to escape poverty. But this is not the case.

And the discontinuity leads me to that opinion that there are Davis voters afflicted with a savers addiction and by building a farmland moat around the city they secure a permanent supply of enough needy people to satiate that addiction.

I think it is a hoot when I hear these same people decry the growing income gap… because the business of farming is one with one of the largest income gaps. However, the business of farming is apparently politically correct. And the business of banking that the business of farming need to supply land acquisition and operating capital, is not.

A few points:

1. I would invite people to look at the City Manager’s report from the December 17th meeting. Unfortunately the City website appears to be down but hopefully Don or David can post it. Attachment D: CITYWIDE GENERAL FUND REDUCTION SCENARIO BY DEPARTMENT is of particular interest because it lists, department by department what could be done to achieve a reduction in 2014-15 of $5.1 million dollars. Read it and ask yourself how much of it would actually be achievable. Some of the “big ticket” items include:

Eliminate Assistant Police Chief–$266,308

Reduced criminal investigations and no response to low level crimes–$192,238

Eliminate Three Fire Fighters–$518,121

Eliminate One Division Chief (Fire)–$215,510

Streamline recreation programming and reduction of fee subsidy–$422,234

2. Please note that the chart above “Change in Major Cost Drivers from Prior Year” needs to be read cumulatively. These are additions on top of the prior year. Sobering…

3. Finally, as Matt Williams has been trying to point out, the current direction for street maintenance is not encouraging. From the December 10 staff report we see staff recommending the following: “Therefore, staff recommends performing the $25 million in repairs the first two years and maximizing annual funding for Years 3 through 20 as much as possible, thereby maximizing the condition of the streets and paths.”

This scenario–Scenario 5, assumes a minimum of $2 million per year in years 3-20 (increased at 2% per year). At the end of 20 years we are left with an overall PCI (pavement condition index) of 37 (compared to a previously recommended PCI of 63, which is essentially identical to the current PCI). In other words, in this scenario we still end up with failing streets 20 years out. Clearly, after the initial $25 million we are going to have find more than $2 million per year. This is what staff means by “maximizing annual funding Years 3-20”.

–

The bottom line is that the situation is even more dire than what an initial examination of the City Manager’s report would indicate–even though the City Manager is being, I believe, very up front about the challenges. I am open to discussing further cuts but first would like us to work out some criteria for where those cuts might come from. The City Manager’s report lays out lots of cuts but does not describe how departments were guided in determining what cuts to make.

None of this is new information. None of this information comes as a surprise. Council after Council has deferred, deferred, deferred. Now it has all come home to roost under the watch of the current Council and future Councils.

Placing credit where due, the current Council, under Mayor Krovoza’s leadership and Manager Pinkerton’s able and disciplined administrative approach, have succeeded in cutting and consolidating operating budgets in every department.

Throughout this process, and in context of being intimately aware of the inevitable revenue problem has there been no concerted, nor sustained effort to articulate and aggressively advocate for the imperative of an cogent plan to pursue economic development in the near term? The best the city has been able to muster is the conclusion that we new locations for larger scale business/research parks if we hope to prevent further exodus of local Davis-based technology successes.

But even that effort has been half-hearted with no funding set aside for development or funding of an economic model capable of quantifying or demonstrating why additional employment opportunities make economic and fiscal sense for the city.

To date, even the City’s Finance & Budget Commission is not convinced that the Business & Economic Development Commission’s “Comprehensive Economic Development Plan”, issued some two years ago and which argues for such necessity, and is inadequately supported by empirical evidence.

When and how does the City Council truly intend to “get moving” on this issue? Who should know better than the City Council of the need to have their ducks in a row, and evidence in tow, if they are sincere about trying to engage the community and move this important conversation forward?

In the meantime, what is the logic that suggests the community should support an additional tax revenue measure, when the leadership itself can’t recognize the urgent need to engage the community and present the alternative of Economic Development as both a necessary and vital component of economic sustainability for the City’s future?

Here is the document with the budget reductions mentioned by Robb Davis above: http://davismerchants.org/vanguard/BudgetReductionsDec2013.pdf

To Robb’s point that “the above chart must be read cumulatively”, it becomes painfully clear the impact of full funding of the OPEB liability. While it is indeed admirable for this council to take on the task of “making up” for the failure of the past decades – in terms of the City’s and Council’s past failures insist on funding of its post retirement healthcare promises – we need to ask if this is the only alternative to achieving meaning adjustments in the long term unfunded liability for this program?

In addition to merely accepting that it should our kids responsibility to liquidate this liability (over the next 30 years) this number represents a huge driver of our future projected current period budget deficits.

As other cities and counties around the country have shown, there are other tools and other alternatives to achieve meaningful reductions in this huge unfunded liability.

The question, however, particularly in this election year, is will any of the current or prospective candidates for council have the political appetite to take on this much needed reform? Hopefully, I am wrong on this point. However, without a willingness to openly explore and consider potential cost-saving strategies and meaningful reforms to address this massive liability, we will again be asking the community to endorse the status quo without the open and transparent discussion it deserves.

Here is what I would recommend to the city council.

1. Flog myself in private every night for allowing the Mace 391 asset to be unnecessarily given away for $.05 on the dollar of opportunity value.

2. Pray every night that neither the voting population of Davis, nor the media, wake up and hold me accountable for giving away the Mace 391 asset.

3. Implement all the cuts recommended in the City Manager’s report.

4. Light a fire under staff, the Innovation Task Force and other committees to quickly identify and build 1000 acres of business park. Get help from UCD, SARTA, SACTO and ??? to help put together a marketing plan to attract business to the community. Make this priority #1.

5. Update the General Plan to incorporate the new business development. Also include peripheral retail development and a plan to revitalize the downtown.

6. Ask the community to get involved shouting down opposition. Rightfully pin the blame on our fiscal problems on the old guard and those greedy in their own desires to prevent any and all change even when it clearly would result in the fiscal insolvency of the town.

When are we going to turn this conversation to a discussion of the City’s true “burn rate” (a term employed in the venture capital community and refers to ongoing costs of operations of a startup or development stage company before it achieves a state of self sufficiency)?

This is basically a cash-on-cash approach to assessing our true, current period funding demands – including full provision for properly maintaining our roads and schools, our necessary water, energy and transportation (including parking) infrastructures, and most significantly our requisite contributions to promised employee retirement programs?

What kind of approach to fiscal and financial stewardship is it when we refuse to set aside the full current costs of these programs in the expectation that some future generation of taxpayers will step in to pick up the slack that our generation couldn’t muster during the decades in which those services were actually being provided? Retirement costs of today’s employees are a necessary financial burden of our current budgets – such program benefits are a true cost of today’s employees just as is their salary. If we can’t “afford” to fund these benefits then something has got to give – but don’t pass it on to the kids – they will have their own burdens to shoulder.

A similar logic is at play with deferred maintenance for essential physical infrastructure – with the significant caveat that if choose long term bond funding today to pay for assets with a future service life, then the funding model still matches the service period. This is fundamentally different that the issue of deferred employee benefits, in which case there is no “continuing or future service life” in connection with the ongoing payment stream for this unfunded liability – the term of service has already been delivered and enjoyed by the then current residents.

Bottom line, this current budget needs to include the current portion of new debt service required to establish and maintain a responsible level of infrastructure maintenance for our transportation and other essential public utility needs.

Without taking this approach, frankly we have no realistic idea of our true “burn rate”, and, accordingly, we have no clear or realistic idea as to our true revenue needs either today or in the future.

So, please, let’s add a current period budget line items equal to a reasonable provision for amortization of roadway maintenance expense until such time as we issue the necessary long term bonds.

As for the unfunded and underfunded employee benefits, that bill should go to those residents who have lived here and enjoyed our outstanding municipal services for the past 20 years. Anybody willing to step up and make things right – or should that be the responsibility of your kids and grandkids?

Let’s get real in this conversation. The vast majority of the huge general fund operating deficits will not be attributable to basic ongoing costs of continuing such services, but rather they will virtually all be associated with what we should more appropriately term “legacy costs of past administrations” – the two should not be conflated.

Fire all the current overpaid firefighters and hire some of the 200 who lined up for interviews at City Hall for half the price.

This of course is why seniority needs to be kept.

City employees have managed to control the process to where they are grossly overpaid relative to private sector equivalents. Maintaining these costs will deprive the city of services and could lead to a downward cycle of increasing taxes and fleeing residents, a la Detroit. The poor and vulnerable will suffer the most.

One simple solution, once we get over our bias and inertia, is to lay off city employees and to outsource the work. Certainly many city positions in parks, maintenance, secretarial services, etc can be outsourced. Maybe even firefighting. If I were a city employee I’d be very worried about this. No buying of politicians will be able to stop this in the long run, especially as there will be multiple precedents from other, more poorly run, cities, which will hit the deficit wall earlier.

Please, let’s try to keep one point very clear – it is not the city employees who are the ones responsible for this mess.

It is their leadership, together their union advisors, the third party compensation negotiators and a failure of elected leadership to serve as necessary checkpoints and financial watchdogs in the process.

Only the Federal Government is the only entity with the power of the treasury printing press. The idea that local governments can long operate solely on the basis of “pay as you go accounting” is indefensible. If you want something to be there for you when you retire, somebody needs to be salting away the funds to make that happen. When nobody takes up that fundamental responsibility – we see the results.

The employees, together with the unsuspecting taxpayer, are every bit the victims in this drama which is unfolding in city after city across the country.

One thing is for sure – not talking about the problem isn’t going to solve anything.

Yeah right realchanagz, everytime I pass the protesting firefighters out front of City Hall with their $150,000/yr compensation packages I’ll be sure to remember that they are the victims.

“the third party compensation negotiators”

I don’t think there have been any of those prior to the latest round of negotiations. I haven’t paid close attention to city labor matters over the years, but every time I’ve run across the process in the past, the Council has directed staff to handle the negotiations. (Fox/henhouse.)

Jim,

Fair or not, it’s my assumption that such negotiators operate with about 3 degrees of freedom and adhere strictly to other, peer reviewed compensation models and with no regard to norms for comparable private sector wages and benefits.

My assumption — and I acknowledge it may not be valid — is that the negotiator operates as directed by the City Manager, who in turn operates as directed by the City Council. If the Council says cut, and the manager says cut, then I would expect the negotiator to produce cuts.

Point taken – but generally its the leadership that sets the tone, if not the marching order.

We can keep this conversation focused totally on a small contingent of very highly compensated firefighters or we can broaden the conversation, focus on the larger much larger problems associated with the legacy costs of past administrations (specifically the unsustainable benefits packages) which are dragging down the current budget and try to work towards meaningful solutions that will benefit the overall community and help put us back on a path to fiscal sustainability. Maybe, then, they too will begin to get the message.

.R. wrote:

> City employees have managed to control the process to where they are

> grossly overpaid relative to private sector equivalents.

Not many are “grossly” overpaid, but just about everyone that works for the city is making more than most that do similar work in the private sector…

> Maintaining these costs will deprive the city of services and could lead to a

> downward cycle of increasing taxes and fleeing residents, a la Detroit.

I don’t see this happening any time soon especially since most of CA is in worse shape than Davis (and it is not like many people are going to move from Davis to Woodland or Dixon to save a few dollars on taxes)…

> The poor and vulnerable will suffer the most.

True, (as a former poor person and student of history this is unfortunately always the case)…

> One simple solution, once we get over our bias and inertia,

> is to lay off city employees and to outsource the work.

I’m a small business owner and like this idea in theory, but it never seems to save any money. In reality more often than not a city just goes from paying politically connected unions a ton of money (so they kick back some of it in the form of campaign contributions) to paying politically connected big companies a ton of money (so they kick back some of it in the form of campaign contributions)…