By David M. Greenwald

Executive Editor

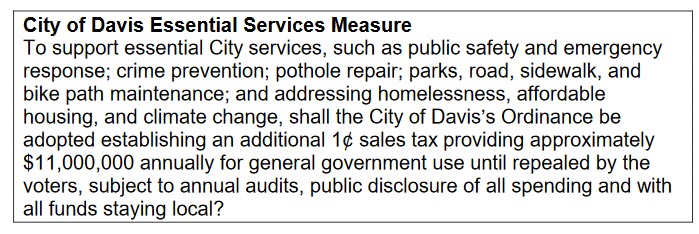

Davis, CA – Two weeks ago, the Davis City Council agreed to put a one percent sales tax increase on the ballot—this week, they will be asked to approve a resolution approving the ordinance and placing a measure on the November ballot to Amend Article 15.19 of the Municipal Code to increase the local transactions and use (sales) tax rate from 1% to 2%.

City staff estimates the tax will generate around $11 million per year.

The tax is proposed to be a general tax, meaning that it can be used for any governmental purpose of the City, and “is not earmarked for specific programs or projects.” A general tax requires a simple majority to pass.

If approved, the sales tax rate for eligible purchases would increase from 8.25% to 9.25%.

City Manager Mike Webb addressed questions from the council and public at the June 4 council meeting.

In response to questions from Councilmember Gloria Partida, he noted that EMC Research which conducted the poll last November “did in fact poll specifically for a 1% sales tax.”

That polling, he said, showed more than 70 percent support for a hypothetical one percent sales tax increase.

“The other question was with respect to the priorities of if a revenue measure were to be presented to the voters and were to pass, the revenues start flowing from that, what  are the council priorities in terms of spending really utilizing those revenues?” he said. “Really that’s council policy directive.”

are the council priorities in terms of spending really utilizing those revenues?” he said. “Really that’s council policy directive.”

He continued, “The suggestion in the staff report is not to go and spend it on new services and programs, but to first use it to shore up general fund reserves and existing services and programs. And then to the extent that there’s excess beyond general fund reserve policies. And that’s what the council can set is what is that general fund reserve policy.”

He added, “And then the council has some room to start talking about whether there’s additional services and programs, housing trust fund, things like that, that homelessness services, affordable housing services. That polled very high in the survey that we did with the community as to needs and demands. But that’s a policy discussion for the council to have if a revenue measure were put forward and passed.”

Councilmember Will Arnold addressed the issue of accountability, noting the quirks of Prop. 13 mean that there is a higher threshold for a “special” tax that would target specific expenditures.

“It’s always been counterintuitive to me that a tax where you identify the use of the funds is the one that has a higher threshold. I always think it should be the reverse that if you’re going to do a general tax should maybe be two thirds because there’s more discretion about how those funds get used. But if you identify ahead of time the use of the funds, that ought to lower your threshold in my opinion,” he said.

He later added, “I’ll also say as we enter a November political season that is going to be the wild West of rhetoric and hyperbole and folks sort of throwing half truths around and them going unchecked. I’m already a little bit disappointed about some of the rhetoric that’s being thrown around about these issues. And so I’m hoping maybe it’s false hope, but I’m hoping that the better angels of our nature will allow for a spirited yet truthful and a debate on these issues that we can all be proud of.”

Councilmember Donna Neville said, “I do hope that we will put forward a general sales tax measure on the ballot. We know that’s not the solution to all of our woes. What we need to do as a city is a much broader, much more concerted effort where we think more broadly about revenue.”

Councilmember Gloria Partida added, “When I first got on council, I was really excited about supporting economic development because I felt that that was a better way to bring in some revenue for our city rather than doing this tax. But we’ve gotten this far and we haven’t really been able to stimulate the economic development that is needed.”

Mayor Josh Chapman said, “I will echo many of my colleagues’ statements here this evening, and I am supportive of moving this forward this evening and having this come back to us in June. I think there is a clear demonstrated need for new revenue.”

He responded to the notion that this is a blank check, stating, “We have our budget cycle that comes up next year, where these funds would, in theory we heard earlier, would be there and be having these discussions around how this money is spent in doing that with our community and in conversation.”

He said, “I think that there’s this opportunity, this line of it’s just this blank check that we’re going to do whatever we want to do with it without having any say or conversation or input from anyone in the community is a red herring in my opinion.”

Sadly, what is missing from that list of “new toys” and “shiny objects” is the reality (reported by the City in its own Budget) that over $225 million of repairs/maintenance to Davis’ streets, bike paths, green belts, parks and buildings over the next 20 years is UNFUNDED, and in all the discussion quoted in this article nothing is mentioned about changing that. $225 million over 20 years is over $11 million per year. Note: streets, bike paths, green belts, parks and buildings are collectively referred to as the city’s “infrastructure”

It appears that while Council thinks about “new toys” and “shiny objects” they plan opn letting the streets of Davis continue to get worse and worse, the buildings to crumble, and the parks and greenbelts get even more weedy than they are now.

Council needs to take a step back and assess what the true financial situation of the City is, and then provide an honest disclosure of that financial state to the voters, with a plan for actually taking care of this city’s services and infrastructure. If they do that, we will find that the $225 million unfunded infrastructure maintenance is only the tip of the iceberg. Many of the City’s current services only have short term funding and once they reach the end of that funding will go away because they too are UNFUNDED.

More taxation which will most likely lead to more programs which will create the need for even more future taxation in order to keep the new services and programs funded. See how that works…

In order to maintain the current level of services and expand the programs the public has indicated they want (homeless services, affordable housing programs) the city needs more revenues.

Revenues can come from economic development, increased sales or property taxes, or user fees/taxes. Economic development has been blocked. The methods of taxation available are limited in a general law city. The council has concluded that the sales tax increase is necessary because revenue options other than taxes are gone and other forms of taxation are less likely to pass.

Economic development has been discussed for about 15 years now. If any of the business parks had been approved, they’d probably be generating revenues now. But all economic development options have been scuttled. The Davis market is anathema to commercial developers.

I’m not thrilled about an increase in the local sales tax because it might increase retail leakage, but that’s probably somewhat mitigated because all the surrounding communities are also discussing the same option. Woodland and West Sacramento are discussing one-cent sales tax increases: West Sac for the November ballot, Woodland council is discussing this June 18, also potentially for the November ballot. Dixon is also considering a sales tax increase.

Council members should probably clarify if the intention is primarily to sustain current services, to expand programs, or both.

There’s not a lot to debate. You can argue for reduced services or for another form of taxation, but that’s about it.

If you cast your mind back to the last sales tax increase, you will recall all of the same arguments being made. Millions in unfunded obligations on the part of the City, the choice of a general tax (50%) despite it being regressive, and the realization that economic development was the only appropriate alternative approach. Then the ‘no on everything’ crowd killed economic development because they feared it might result in a few more cars on the road. The City failed to reign in spending (something no CC or CM actually wants to do) and instead bought a shiny new ladder truck that wasn’t needed by anyone (other than the Fire Fighter’s Union). So where are we? Exactly the same place we were 10 years ago, and the same place we will be 10 years from now. Nothing will change until the CC collectively ‘grows a spine’, the CM is replaced, and the ‘no-on-everything’ crowd channels the ‘Scarecrow’ and actually grows a brain.

Status Quo! Woo Hoo!

Don, you are the parent of children who have grown from birth to the point where they finished. Given that, I am sure you can identify with the following scenario that happens various times (and often multiple times) in that child aging process.

What is a parent to do? What would you do? Do you simply say “Sure Son/Daughter. No problem.” or do you ask for some information about how the current allowance is being used and/or how the money from the allowance increase is going to be used?

Fast forward to a point in time when the child is college/university age.

What is a parent to do? What would you do? Do you simply say “Sure Son/Daughter. No problem.” or do you ask for some information about how the money from the current monthly check is being spent and/or how the money from the check increase is going to be used?

And there is another illustrative example. Imagine a small business owner meeting with a bank loan officer to ask for a loan.

What is the bank to do? Will they grant the loan? Do they simply say “Sure. No financial statement. No problem.”

The voters are the parents in this scenario, and the Council are the asking parties.

The city’s budget is a matter of public record. Just let us know which programs you want to cut.

All of them. When the ignorant masses might start to realize the damage being done in their name by the ‘no on everything’ crowd and the ‘courage-limited’ CC majority something might change. When your advocacy is built on lies, you have not credibility.

Actually Don, as we saw in Item 6 on May 21st the Budget isn’t a matter of public record. What was presented to Council by staff was so lacking in specifics that it rivaled the Pillsbury Doughboy or the Michelin Man for being soft, The question “Why?” was never asked, let alone answered. The question “What cuts?” was ducked so well the Muhammad Ali would have given it the “Float like a butterfly” seal of approval. Duck and weave. Duck and weave.

Now with that said, your question to me is both superficial and foolish. It asks for the kind of knee jerk approach that got us into this mess in the first place. 20 years ago, when Bill Emlen was City Manager, during the 3rd Quarter Budget review, Public Works gave the CM and Council a Budget update outlining their plan for the road repairs/rehabilitation planned with the $1.5 million left in the Road Repairs budget. The CM and Council went apoplectic, because they had already spent (without telling Public Works) that $1.5 million on “new toys” and/or “shiny objects” and as a result the $1.5 million did not exist any more. Their solution was like your question … superficial and foolish. They told Public Works to “defer the repairs until next year.” The problem was that when next year came around the same scenario repeated itself. As a result that initial $1.5 million has grown to be (as reported in the Budget) over $225 million. And in the past 24 months, the reduction of the General Fund Balance by $15 million has effectively raised $225 million to $240 million, as well as once again deferring $1.5 million of road repairs that was budgeted.

We don’t need jerky knees. We need an intervention.

Matt, to further your analogy:

1. I appreciate comments attached to Elaine Mussers column comparing Saylor/Souza council with the current one. I am newbie as only watch council ten years….maybe that is why some call me niave.

2. If folks see a trend/patterns in how council respond to public, maybe that reflect counstant more than personalities on council? constant being community culture who are perennial activists, our “attitudes” toward electeds they instill in others, our being academic community, or maybe city staff culture? Interested to hears others take.

3. I get many “old time council watchers” here are skeptical about 1% tax- but maybe you should advocate instead of opposing it, have measure include set up a over site committee to make should spending goes where promised, not where some future council want to put it. I recalled a recent grand jury investigation of parks tax use of fund supposedly for improving tree care that they thought was just back fill for cut to tree program from General Fund. With council diluting the FBC such a permanent focused commission writ into law would be powerful independent review of budget.

Alan: You are naive, regardless of how you spell it. the only valid approach to the City’s financial situation is economic development. Everything else is simply a ‘band-aid.’ If you want to save the City, band-aids are not sufficient.

I agree with Mark West that the only valid approach is economic development. The problem that Davis has had for well over two decades is that it approaches economic development like the Keystone Cops. With the exception of the all-too-short years where Rob White was the Chief Innovation Officer, ever since 2000 (and probably before) there has been no thoughtful planned approach to accomplishing economic development.

The DiSC development team would have pocketed a minimum of a $100,000 profit per acre simply by seeing the entitlements for DiSC’s 200 acres (100 acres in DiSC 2) granted … and because of Proposition 13, the property taxes paid on those 200 acres would not have increased.

Economic Development is all about actually adding jobs. It will be interesting to see how many new jobs are added to Davis as the the new building on Faraday fills its spaces with tenants. That will be useful data on how effective delegating the City’s economic development to developers actually is.