by Peter Bell

On Monday, May 16 2016, the Securities and Exchange Commission rolls out the last piece of the Jumpstart Our Business Startups Act or the JOBS Act that was originally passed in 2012. Equity crowdfunding becomes legal nationwide for anyone and is no longer the exclusive purview of the accredited investor.

On Monday, May 16, 2106, these new crowdfunding regulations will allow individuals to invest in start-ups, regardless of their income or net worth. Title III or CF regulations as they are sometime known allow small companies to raise capital from friends, family and interested investors via registered intermediaries which are normally on-line crowdfunding platforms like WeFunder.com.

Start-Up investing used to be for accredited investors only, this is an individual with a net worth of greater than $1 million or who earns at least $200,000 per year. One of the 2012 JOBs Act’s key provisions allows new businesses to raise capital directly from the general public, so for as little as $100, anyone can buy equity stock in the latest hot start-up.

Crowdfunding is best known for web sites like Kickstarter, but when you invest in a Kickstarter project, you don’t buy equity in the company. Participating in these product crowdfunding efforts you are just helping the organization launch its product or service in return for example get a preferential product delivery with the first shipment or a price discount on the product when it ships, plus a T-Shirt. With equity crowdfunding, you have an ownership stake in the company, with a share of the profits or the exit should the company IPO or get purchased by another entity.

The SEC has wrapped the new capital raising option with a bunch of protections for investors built into the process. The issuer company must present their security offers to the investing public through a SEC registered investment portal. These portals can be run by a registered broker-dealer or an organization that registers with the SEC as a funding portal. The portal has the responsibility check that the issuer is presenting factual information and that the security offering is in compliance with relevant laws and regulations. There is also a limit on the amount of money that can be raised on these Title III rounds which is limited to $1 million over a 12-month period. The issuing company needs to file a Form C, which is an initial disclosure form, plus provide regular updates on the status of the fundraising efforts.

Has equity crowd funding worked anywhere else in the world?

In “socialist” leaning Europe, the regulatory bodies have been way ahead of the US in opening crowdfunding to everyone. One such example saw Mondo Bank Raise UK £1 Million ($US 1.4 million) to set the Equity Crowdfunding speed record. Mondo saw 1,861 individuals invest on average UK £542 (approximately $750 US Dollars) at 1pm GMT on March 3rd 2016…all in 96 seconds.

Why open equity crowdfunding to the public now?

The SEC was created in 1934 and along with that came the creation of this special class of investors known as “accredited” investors who could invest in “unregistered private investments.” These companies are not publically listed and not subject to regulatory scrutiny, but the SEC assumed that if you have a certain amount of net worth then you ought to be sophisticated enough investor to look after yourself.

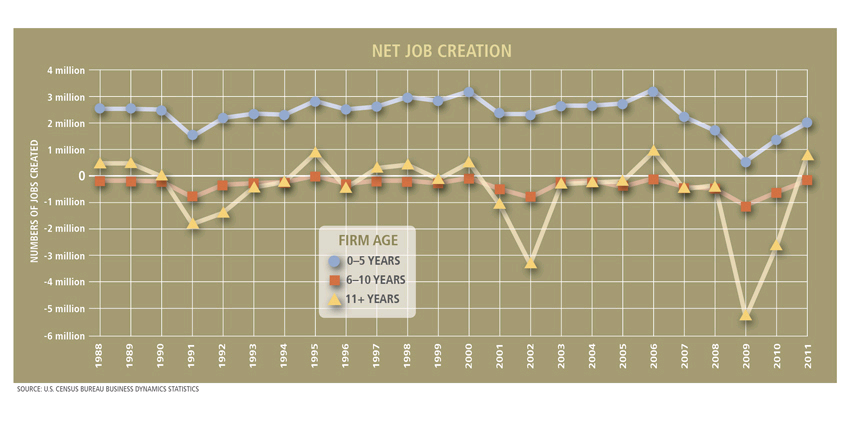

In the year 2014, a total of 316,000 angels invested $24 billion into 73,400 ventures, with the average deal size being $325,000 and average equity granted 12%. An average of 4 jobs were created from each of these angel investments, resulting in 290,000 * new jobs in 2014 out of total of just under 3 million new jobs generated by the US economy in the same period.

This means that angel investing involved less than 1% of the population in 2014, yet is incredibly important to the American economy as it created 10% of new jobs in 2014.

Why is financing for Start-Up’s important to all citizens?

New businesses account for nearly all net new job creation. So if you want to have a job in the US today, you really need to make sure that the country’s economy is generating new start-ups.

How big is this potential pool of investors?

This remains to be determined, but the potential is large. Of the 12 million households that qualify under existing regulations as accredited investors, approximately 370,000 participated as active angel investors. With the passage of the JOBS Act, anyone over the age of 18 can invest, which opens up the potential pool of investors by another 240 million people, which is a massive group of potential investors and a potential game changer for the US economy.

The Davis Funding Club was founded to bring crowd funding to our town. The Club’s mission is to crowdfund Start-Ups commercializing technology developed at U.C. Davis and from ideas coming out of the local Davis economy. The majority of our investment deals will be Start-Ups commercializing Intellectual Property developed at U.C. Davis from the university’s $780 million annual R&D expenditure. The Davis Funding Club membership is limited to U.C. Davis faculty, staff, students and alumni, Davis residents, business owners and workers, staff and customers of the Start-Ups being funded and members of the Davis Angel Network.

This is a crowd of 300,000 people who could potentially allocate $1,000 of their IRA or 401K retirement accounts to fund start-ups and represent a potential investment capital pool of $300 million dollars. At an average fund raising size of $325,000, a fund of this magnitude could launch almost 1,000 start-ups and create 4,000 jobs right here in Davis.

May 16th represents an interesting milestone in the history of the American entrepreneurial ecosystem and Davis will be participating in the potential revolution on Monday, with two offerings from Davis start-ups, FoodFully and Blimp BioPharma, becoming available via the WeFunder portal at this URL: https://wefunder.com/davis-funding-club.

Want to meet these start-up founders or the Curator of the Davis Funding Club?

Come to JumpStart Davis Wednesday the 18th of May at Sophia’s kitchen at 6.30pm or come to Davis Roots on June 1st at 6pm.

Peter Bell is the Curator of Start-Ups for the Davis Funding Club – http://www.davisfundingclub.com

* Jeffrey Sohl, “The Angel Investor Market in 2014: A Market Correction in Deal Size”, Center for Venture Research, May 14, 2015

What a surprise. The government allows yet another natural right to be legal throughout our great land. Oink!