Last week, Councilmember Heystek pressed city staff on how the last sales measure tax was used, however, eventually his discussion was cut off and his colleagues seemed uninterested in pursuing a line of questioning about how the previous tax measure had been utilized by the city.

Last week, Councilmember Heystek pressed city staff on how the last sales measure tax was used, however, eventually his discussion was cut off and his colleagues seemed uninterested in pursuing a line of questioning about how the previous tax measure had been utilized by the city.

Said Councilmember Greenwald last Tuesday:

“I don’t want to get into criticizing or justifying how we’ve handled our budget. I just want to make the case that we need it now.”

While I certainly respect the opinion of Councilmember Greenwald who has carried the torch on fiscal responsibility issues, I am unclear as to why we should not account for how taxpayer money has been spent. In the end, the conclusion may in fact be that we need the money, but I think the taxpayers deserve to know how their money has been spent. I think we need to at least have that discussion even if we recognize in the end the failure of this tax to pass means drastic cuts to city services.

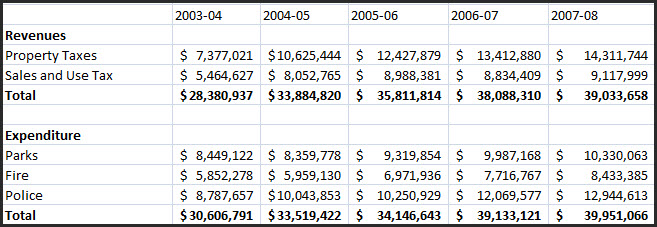

As such I think it is important to understand how this measure was originally sold to the voters. Paul Navazio called this a general purpose tax which meant it could be used for any purpose and it generates $3 million per year revenue, currently represents 8% of general fund budget.

However, when it was placed on the ballot, it was sold the voters in a specific way.

The tax was originally proposed as a means to address historical structural budget shortfalls, as well as provide funding for a variety of expanded service demands. Furthermore there was a concern at that time, which was justified by the concern that the state would continue to raid existing city funds and that the city could no longer count on state money as a funding source. According to Mr. Navazio, the state has increased the amount of funds it has raided during the course of that time.

That said here is how the proponents of the measure claimed it would be spent.

In the argument in favor of Measure P on the ballot the signers that included Lois Wolk Assemblywoman), Helen Thomson (Supervisor) and then Mayor Susie Boyd argued:

“The City faces increasing costs. We will face higher expenditures if we are to provide the additional police protection and meet park and recreation and open space commitments we have made to our citizens.”

It continues:

“Without Measure P revenue, given the uncertain state support to the General Fund, we would be faced with very deep service cuts in police, fire, and parks.”

Since 2003-04, we have had some increases in city staff, but Navazio pointed out that city staffing during that time increased a slower rate than city population, thus there has been a nominal decrease in city staffing on a per capita basis.

In the city’s newsletter sent out in Winter of 2004, they claimed the money would go into the city’s General Fund and be considered “discretionary” revenue. They mentioned public safety and emergency services, street maintenance, parks and recreation, and neighborhood and community services.

“The city faces increased costs to run city programs and services. Needs in the city have grown with the population. Programs, parks and other services have been added. As with other local businesses and organizations, basic program costs, including staff cots, have increased. The city has absorbed many of these increased costs into existing budgets, but this process cannot be sustained indefinitely.”

Councilmember Heystek last week asked city staff about whether city staffing levels have increased since the tax was implemented. According to Mr. Navazio, city staffing levels have gone up at a rate less than that of population growth and thus on a per capita basis, the city has lower staffing levels than it did 2003-04.

In 2004, “City officials are concerned about Davis’ financial situation with forecasts showing the city’s budgeted expenditures are greater than its revenues.”

However, despite this concern, as we showed last week, the city then turned around and greatly increased employee compensation.

They argued that if Measure P did not pass:

- It will be difficult to maintain the current level of services, programs and staffing.

- Building of parks and greenbelts, as outlined in the adopted General Plan (e.g., Mace Ranch), and anticipated by city of Davis residents, may have to be deferred.

- It will be challenging to pay for increased staff costs, such as medical benefits, workers compensation and other insurance premiums.

- The city will have an even tougher time responding to State of California budget uncertainties.

Moreover:

- If local revenues continue to be shifted to the State or the shifted revenues increase, it will be a challenge to maintain a prudent city reserve.

- It will be difficult to continue to maintain the current level of service, programs or staffing.

- City Council will have to determine specific budget reductions to services and programs.

- The likelihood of all departments facing reductions is high.

Given these concerns, it is interesting to note that over the next six years, as we pointed out last week, what saved the city was not the sales tax but rather the dramatic increases in property tax revenues due to the real estate market.

Without the real estate boom, the growth in city salaries went well over and above inflation which would have been unsustainable and would not have kept up with revenue increases even with the sales tax. It is that reality that we now face as the real estate market has plummeted.

However, the vast majority of the sales tax money was eaten by salary increases. As Mr. Navazio pointed out, we really have not seen an increase in city services. In fact, relative to city population growth, we have seen a decrease in staffing levels even before the current retraction in the face of a $3.5 million deficit as the real estate market finally collapsed under its own weight.

Where did the money from the sales tax go? It was largely eaten up with increases to fire department compensation that was negotiated shortly after the tax measure was passed.

In the end, Councilmember Greenwald may be correct that the city needs the sales tax revenue. Certainly given the unwillingness to seriously address employee compensation, it would be almost certain that services would be cut before salaries reduced, even though it was salary increases rather than service increases that generated this problem in the first place.

—David M. Greenwald reporting

If we don’t renew the sales tax measure I am sure we will see cuts in important services–this is how governments punish their citizens for not approving tax increases. But I am appalled by the lack of fiscal discipline this Council has shown and I am inclined to oppose renewal since we need to send a signal to the City that the status quo cannot be maintained. This blof has aLSO MADE IT CLEAR THAT WE HAVE A HUGE PLANNING STAFf. the fact that our population is now longer growing rapidly means we have less need for planning staff. As many City and State employees face furloughs I am also appalled by the impudence of our City Council majority who, like Marie Antoinette, just don’t get it…

“Councilmember Heystek last week asked city staff about whether city staffing levels have increased since the tax was implemented. According to Mr. Navazio, city staffing levels have gone up at a rate less than that of population growth and thus on a per capita basis, the city has lower staffing levels than it did 2003-04.”

But do we need more city staff on a per capita basis as the population grows? This sort of thinking is like saying if we add five more students to a classroom, then we need to add another teacher. We don’t need to add another teacher until there are 30 more students. Am I missing something here?

“But do we need more city staff on a per capita basis as the population grows? This sort of thinking is like saying if we add five more students to a classroom, then we need to add another teacher. We don’t need to add another teacher until there are 30 more students. Am I missing something here?”

The point of that is to indicate that we have increased spending and actually decreased the level of service to the public at the same time, despite the claims of the initial Measure P passed back in 2004.

Sue, I am dissappointed that you didn’t want to discuss went wrong in the past. In order to make sure this money is spent well, and it indeeds go towards its intended use, then we SHOULD indeed discuss the mistakes of the past, and fix them. Otherwise, why authorize more money that’s only going to be spent on salary increases for our public employees?

What about the services???

no this is wrong, we must be more prudent, we must renegotiate these lucrative public union employee contracts. They are unsustainable and it’s simply not fair that they continue to get pay raises from past years negotiations, while everyone else is gettin a pink slip.

Not fair, not right, not sustainable, not feasible.

After seeing how our city managers negotiated the recent labor contracts, I will absolutely be voting NO to renew this sales tax and will be encouraging friends and neighbors to do the same. You can rest assured the city will pick the most painful and unacceptable city service to cut and threaten that this service will be the first to go if the tax is not renewed. There will be no mention of a few more unpaid furlough days for city workers, but there will be promises of severe cuts in basic services.