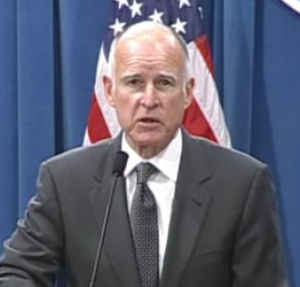

In July, candidate Jerry Brown laid out a series of common sense proposals to deal with pension reform on the state level. While we have generally focused on pension reform at the local level, clearly, state-level changes could be made to help communities trapped into past promises of unsustainable wages.

In July, candidate Jerry Brown laid out a series of common sense proposals to deal with pension reform on the state level. While we have generally focused on pension reform at the local level, clearly, state-level changes could be made to help communities trapped into past promises of unsustainable wages.

However, as critics are quick to charge, Governor Brown’s budget proposal has promised cuts to about every sector except one, pension reform. Orange County Columnist Steven Greenhut, a leading proponent of pension reform, accused Jerry Brown of dodging the issue.

Mr. Greenhut writes, “By his own words, Brown appears concerned mainly about assuring that pension-fund performance is in line with economic returns on investment. I’ve yet to hear him talk about the fairness of the current system, in which public employees retire at early ages, often with millionaires’ pensions, while those in the private sector must work 15 years or more longer and retire with far less, or who must depend on a Social Security system that resembles an unsustainable Ponzi scheme.”

The GOP, for their part, has limited leverage in the state, but they also know that Governor Brown wants the tax extension put to the voters.

Senator Mimi Walters, who was a candidate for State Treasurer but was routed in the polls by Bill Lockyer, is preparing a package of pension reform plans that she is saying must be addressed.

“We want reforms in place before there’s any discussion about tax increases,” said Senator Walters. “I do know there’s not support at all to even put it on the ballot without significant pension reforms.”

The Governor has responded that he intends to unveil his own pension proposal in the next few weeks, but does not want it tied to any negotiations with the Republicans over taxes.

“I don’t want to put too much on the table and have the whole thing collapse,” Governor Brown said earlier this week. “But people are concerned about that and I said I’d have various proposals. I intend to follow through on that.”

The problem is that Senator Walters’ reform package includes a 401K plan, and that is dead on arrival. The Republicans have limited leverage in this system and know that their only card may be Governor Brown’s tax reform. However, I suspect that Governor Brown is not going to give into such tactics.

Republicans also have to recognize that Governor Brown is in the position to be able to deliver pension reform, whereas they would have to put the measure on the ballot and that is problematic at best, because the unions have the manpower and resources to defeat such efforts at the polls.

If Governor Brown says he is going to put up his own proposal for pension reform, we ought to wait to see what that pension reform is before moving ahead.

If it is what he pointed out last summer, I think that is a good start and even Mr. Greenhut acknowledges that Governor Brown’s plan is not bad. He writes, “It calls for an end to pension-spiking abuses, a two-tiered system with lower benefits for new employees, an end to retroactive increases, an increase in employee contributions and some good-government reforms to increase oversight of pension institutions such as the scandal-plagued California Public Employees’ Retirement System.”

However, he points out there is a huge difference between campaign promises and including it in the budget.

Marcia Fritz is the president of the California Foundation for Fiscal Responsibility, the group best-known for publishing a database revealing how many state employees receive pensions of at least $100,000. She claims to be a Democrat who voted for Governor Brown. She does not agree with a straight 401(k)-style pension.

Steven Greenhut reports that Ms. Fritz told an audience that “she had advised both Brown and GOP candidate Meg Whitman on pension-reform issues, and she gave Brown a list of several minor things he could do to save money on pensions – the low-hanging fruit that wouldn’t elicit much blowback from the unions.”

“For instance, she suggested that the administration change the way Cal Fire [the Office of the State Fire Marshall] wants to include planned overtime as part of its pensionable benefit package. CalPERS is about to retroactively increase these pension benefits – which Brown could easily stop. Prison guards, who sometimes can retire at age 50 with guaranteed six-figure pensions, also receive an additional 401(k) program, which could easily be stopped,” he added.

“Fritz also pointed to a loophole that allows public school teachers who work part time through job sharing to earn full retirement credit for their time,” Mr. Greenhut reports. “She also suggested changes to the state’s absurd airtime purchases, whereby public employees can pay upfront for larger long-term pension benefits at about 50 cents on the dollar.”

“Not a single one made it into his budget,” Ms. Fritz said. “He didn’t try very hard.”

“This is low-hanging fruit,” Ms. Fritz said. “When I see Brown isn’t even picking the low-hanging fruit, I wonder how in the world is he going to get behind pension reform of any significance?”

Bottom line is that pension reform activists have to recognize that Governor Brown is the one positioned to actually make some changes. Both Democrats and Republicans probably need to follow his lead here.

From the Republicans’ standpoint, this is “only Nixon can go to China.” Jerry Brown has enough cachet with unions to be able to make the kind of reforms needed – and most acknowledge are needed – without facing the wrath of the powerful interest group.

From the unions’ perspective and the perspective of Republicans, at some point the voters are going to revolt no matter how much money and organization unions can muster and when they do, you will get a Proposition 13 of pension reform, which means the end of defined benefits and the beginning of defined contributions.

That is not where I or any pension reformer on the left side of the aisle wants to go. At the same time, the legislature and governor have to recognize that no matter what numbers you can generate at the state level, pensions and pension obligations are going to be the death of local government. Local government does not have the resources for the state not to make serious structural changes in terms of what is a vested benefit and what is a gift of public funds.

As I said, Jerry Brown’s plan deals with a lot of these issues. Perhaps we ought to look into some of Ms. Fritz’ low-hanging fruit, but the bottom line is that cities need a way to be able to rollback contributions and increase the age of retirement in order to survive. Unless we do that, it is not state government but local government that is going to land belly up.

—David M. Greenwald reporting

I heard yesterday that New York has garbage men making $144,000/year when you include benefits. How much will they get a year in pension funds? Don’t send your kids to college, get them on the public union gravy train.

That’s comparable to what firefighters make in Davis. Granted NY York is a lot more expensive to live in.

[quote]Jerry Brown has enough cache with unions[/quote]Think you meant “cachet”, but “cache” may work, too…

hpierce, doing proofreading, just caught it

Jerry has his plate full right now cutting our budget–this will take all of the political capital that he can muster.

The unfunded pension liability issue will resolve itself due to a basic economic principle–what cannot go on for ever, won’t. Many cities will go bankrupt and have to reform or abrogate their pensions. Illinois will almost certainly renege on some of their debt whether its called a bankruptcy or not. (States cannot go bankrupt officially though some in congress want to change that).

Cities and states that do not reform now will face more draconian measures down the line–just as companies who have gone through chapter 11 have cut pensions.

So I’d give Jerry a pass for now. Get the structural deficit done than wait for more cities who completely mismanaged their finances to lead the way (by going bankrupt).

This is not a very elegant solution, but I think its is what is likely and probably the only politically feasible way to pension reform (yes we can change the rules for new hire but that will not solve the problem, nor will increasing employee contributions, though both are good ideas I support).

There is also a lesson for Davis–if we don’t deal with our own unfunded liabilities we will join Vallejo (and soon) Stockton, Fresno, Los Angeles and many other cities who will be forced to restructure (i.e., default) on their debt.

“From the unions’ perspective and the perspective of Republicans, at some point the voters are going to revolt no matter how much money and organization unions can muster and when they do, you will get a Proposition 13 of pension reform, which means the end of defined benefits and the beginning of defined contributions.”

Good point, and the reason I am not too worried right now. There is a seemingly unstoppable tide of resentment building over the PEU gravy train. I would expect the few forward-looking union bosses and their Democrat politician benefactors to see this and be working on selling a defense strategy. However, if they fail, the stories of union employee have versus private employee have-nots will increase. The result, I think, will be this “Prop-13” for PEU defined benefit plans… something I think we absolutely need. Frankly I think PEUs need to be outlawed given the conflict of interest they pose to our fiscal health.

Unions are interesting animals that seem to be lacking the long-term survival instinct. They eventually consume their host… unless we taxpayer continue to bail them out.

dmg: “Bottom line is that pension reform activists have to recognize that Governor Brown is the one positioned to actually make some changes. Both Democrats and Republicans probably need to follow his lead here.”

I understand that it is very early on in Brown’s governership and so he must be given some leeway to some extent. However, as Ms. Fritz points out, Brown has not even incorporated the simplest of pension reform solutions (low hanging fruit) that Fritz suggested, which is very troubling. The only leverage the voters have to make sure serious pension reform occurs is to link it to the tax reform that Brown wants. If the linkage does not happen, the powerful union interests may deter Brown from enacting true pension reform.

It is easy to talk a big game as Brown has done (how many campaign promises have been reneged on by most politicians once they actually get into office?), but actually doing something substantive is a whole other matter. But I agree if Brown fails to enact real pension reform, the voters very well may enact a “Proposition 13 of pension reform” as dmg suggests, which may not be a bad thing…altho it could have unintended consequences, much as Prop 13 has had. Brown really needs to seriously think about pension reform now rather than later…

[i]”Many cities will go bankrupt and have to reform or abrogate their pensions. Illinois will almost certainly renege on some of their debt whether its called a bankruptcy or not. (States cannot go bankrupt officially though some in congress want to change that).”[/i]

I doubt this will ever become law (and pass constitutional muster), but you are right that there is a movement afoot to make state bankruptcy, like municipal bankruptcy, the new norm ([url]http://www.nytimes.com/2011/01/21/business/economy/21bankruptcy.html?pagewanted=1&_r=2&ref=homepage&src=me&adxnnlx=1295724574-o/3Jm72tjV/2aDceRm2rhQ[/url]). [quote]Policymakers are working behind the scenes to come up with a way to let states declare bankruptcy and get out from under crushing debts, including the pensions they have promised to retired public workers.

Unlike cities, the states are barred from seeking protection in federal bankruptcy court. Any effort to change that status would have to clear high constitutional hurdles because the states are considered sovereign.

But proponents say some states are so burdened that the only feasible way out may be bankruptcy, giving Illinois, for example, the opportunity to do what General Motors did with the federal government’s aid. [/quote] Since this story bubbled up, there has been some outspoken opposition to the idea ([url]http://www.washingtonpost.com/wp-dyn/content/article/2011/01/24/AR2011012406317.html[/url]): [quote]House Majority Leader Eric Cantor said Monday that he opposes changing the law to allow fiscally pressed states to seek bankruptcy protection, an idea that has been raised by some conservatives.

Speaking to reporters, Cantor (R-Va.) also said state governments should not expect Washington to solve their fiscal problems. States have the ability to balance their books by cutting spending, raising taxes or renegotiating agreements with labor unions, he said. “There will not be a federal bailout of the states,” Cantor said. [/quote]

I suspect the state bankruptcy idea is a nonstarter, for many reasons…

” you will get a Proposition 13 of pension reform, which means the end of defined benefits and the beginning of defined contributions.

That is not where I or any pension reformer on the left side of the aisle wants to go. “

Other then the instinctive leftism that you admit to, is there a rational reason?

401K’s or their equivalents have many advantages that real progressives should like.

1. They put the risk of low market returns on the recipient rather than the government. This means that in recessionary times they do not create pressure to cut social services and education.

2. Unlike defined benefit plans, they are not stacked against the poor. Defined benefit plans stop paying when the recipient dies. Since higher paid employees have higher life expectancies, this favors them. (It is one of the secrets of social security that it is a much better deal for the middle class than for the poor.) And 401K’s give the low paid a way to build up wealth to pass on to their children, unlike defined benefits plans.

Possibly some combination of the two might be possible, with minimal distributions in defined benefits

and supplementary distributions in defined contributions.

[i]”It is one of the secrets of social security that it is a much better deal for the middle class than for the poor.”[/i]

Not true. You are ignoring the fact that Social Security is biased in favor of the poor, so that the amount returned to a low-income Social Security recipient is a higher percentage than it is for a middle-income recipient.

The only category of people in the U.S. for whom Social Security is not better for the poor than the middle class–it is the same–is for blacks. That’s because poor blacks have such short life expectancies. For all others, the poor get a better deal out of Social Security than all other income strata. (The rich get the worst deal as a return on investment.)

If you care to read about this, here is an article on this very subject ([url]http://www.hks.harvard.edu/jeffreyliebman/mypostoped.htm[/url]).

By the way, my view is that in place of Social Security, I think we should move to what President Bush proposed, essentially forced private savings/investment accounts. However, I would tax up front the accounts of higher income people and use that money to subsidize the accounts of the poor.

By doing that, we could achieve the same “progressive” outcome which is now achieved by Social Security. We would also increase our national savings rate, which is very low compared to most other countries.

The great risk in moving to such a system is that the forced savings would be exposed to too much risk. However, that problem can be solved. Financial advisors have fairly accurate ways to measure the long-term projected Beta (volatility/risk) of a given portfolio. I would have a national regulatory body set caps on the risk. That is, to sell a portfolio management service to anyone who is a “forced saver,” you would agree to the terms and conditions (and fee restrictions) established by the regulatory body. (This is how it works in Chile, where they have privatized Social Security.)

The result is –depending on the age of the forced saver–portfolios which have a broad representation of equities, private and public bonds and cash and perhaps small amounts from other categories of savings and investment.

Most people who don’t have pensions and are not poor save their money exactly this way. They go to a company like Merrill Lynch or Edward Jones or one of their competitors and they establish a broad market portfolio with a good mix of stocks and bonds (and maybe some REITs and CDs and so on). A lot of leftist ideologues are convinced that ordinary people are just too stupid to have accounts of that type. I think the widespread success of that kind of savings among the middle class and above is proof that it works out just fine, as long as the saver does not have a terribly unbalanced portfolio.

I feel sorry for Moonbeam. Why did we elect him as governor then turn around and hang a dead chicken around the guys neck?

If the federal government does not allow California to file for bankruptcy the only way good old Moonbeam could even remotely solve this problem is to give back as much control to the cities and counties as possible and then keep all the funding the cities and counties would have received and use that money to help balance California’s budget.

This way the Banana Republic of California will not have to file for receivership. It simply puts the burden of filing bankruptcy on the cities, counties and school districts to reset the labor and pension contracts. This saves the state credit rating and keeps California from defaulting on their bonds.

Jerry Brown had to wait 30 years to have the last word on the passing of prop 13 which he opposed then in his first stint as Governor . CA voters, you didn’t want to pay property taxes to support your local communities and school districts. It’s back in YOUR LAP now.

[i]”CA voters, you didn’t want to pay property taxes to support your local communities and school districts. It’s back in YOUR LAP now.”[/i]

California voters and non-voters have paid high amounts in taxes for the last 50 years, including today. Prop 13 had no long term impact on revenues flowing into the state, the schools, the counties, the cities or special districts. The idea that it did is based on ignorance and ideology. Look at the trend and tell me where Prop 13 caused a revenue shock. See this graph ([url]http://blogs.reuters.com/felix-salmon/files/2010/12/cal.png[/url]).

The problem we have today is mostly the result of a huge increase in spending during the bubble years, 2002-2007. If we would have simply capped the increase in state spending at 3.5% per year during that 6-year stretch, we would have no state budget problems now, even though tax revenues are lower than they were at the peak of the bubble. See this graph ([url]http://www.google.com/imgres?imgurl=http://gregor.us/wp-content/uploads/2011/01/California-Budget-2000-2010-plus-2011-Proposed.jpg&imgrefurl=http://gregor.us/california/peak-california-budget-or-brown-ian-motion/&usg=__PQBjwseLMaCkkmScy_DmBhB87zU=&h=579&w=579&sz=55&hl=en&start=0&zoom=1&tbnid=KUl7CJNe60UrWM:&tbnh=168&tbnw=201&ei=aN5ATfSNFYa8lQfvj-GoBQ&prev=/images?q=state+of+california+spending+graph&um=1&hl=en&safe=off&sa=N&rls=com.microsoft:en-us&biw=1003&bih=621&tbs=isch:1&um=1&itbs=1&iact=rc&dur=329&oei=aN5ATfSNFYa8lQfvj-GoBQ&esq=1&page=1&ndsp=12&ved=1t:429,r:2,s:0&tx=111&ty=111[/url]).

davisite2: “CA voters, you didn’t want to pay property taxes to support your local communities and school districts. It’s back in YOUR LAP now.”

See here: [url]http://taxfoundation.org/files/bp60.pdf[/url]

California has the 49th worst tax climate for business, and the 16th lowest property tax rate.

However, see here: [url]http://www.taxfoundation.org/publications/show/1913.html[/url].

California has the 10th highest median property taxes paid on homes, and the 15th highest property tax as a percent of income.

Prop-13 is not the problem.

I would be perfectly happy to pay more taxes for the schools and various other programs, but I’d prefer they not be regressive sales taxes or property taxes. My preference would be for personal income taxes in California to increase, and for the increase to be across the board for all state taxpayers.

[quote]By the way, my view is that in place of Social Security, I think we should move to what President Bush proposed, essentially forced private savings/investment accounts. However, I would tax up front the accounts of higher income people and use that money to subsidize the accounts of the poor. [/quote]

The problem with this is that there would be tremendous pressure from special interests for legislation to allow for “emergency access” to your private retirement account to make a down payment on a house, pay for your children’s education, and numerous other needs. Given that we are a nation of people who live from hand to mouth, it would be very likely that huge numbers of people would find themselves in the position of being to old to work and having nothing to live on. They would then be on relying on the govt. anyway so why not just leave the social security safety net in place so that it can do what it was intended to do.

[quote]Most people who don’t have pensions and are not poor save their money exactly this way. They go to a company like Merrill Lynch or Edward Jones or one of their competitors and they establish a broad market portfolio with a good mix of stocks and bonds (and maybe some REITs and CDs and so on). A lot of leftist ideologues are convinced that ordinary people are just too stupid to have accounts of that type. I think the widespread success of that kind of savings among the middle class and above is proof that it works out just fine, as long as the saver does not have a terribly unbalanced portfolio.[/quote]

I am sure Goldman Sachs, Merril Lynch, and every other investment firm is salivating at thought of the hundreds of billions in management fees that could be made if everyone was required to contribute to a private investment account. The thought that most people have the ability to manage their own investment account is not true. My own mother for example had her entire life savings churned down to nothing by a Paine Webber broker who advised a never ending series of buying and selling risky securities just so they could collect the commission on each trade. She was so ashamed of being taken to the cleaners that she never mentioned it to anyone in the family until there was nothing left.

[i]”My preference would be for personal income taxes in California to increase, and for the increase to be across the board for all state taxpayers.”[/i]

California already has one of the five highest personal income tax rates at all income levels. It’s self-defeating to raise the rates even more. All that accomplishes is to encourage more high-income earners to move their income out of state.

Here are the highest 5 states for marginal income tax rates:

1 Oregon 11.00%

1 Hawaii 11.00%

3 New Jersey 10.75%

[b]4 California 10.55%[/b]

5 Rhode Island 9.90%

The most important reform we need in California is on the spending side. We need to cap the increase in year over year annual spending at 3.5% (adjusted for population growth). That needs to be a hard cap, regardless of how much state revenues increase in any one given year. If, in a very good year, revenues grow by 5% or 8% or whatever amount more than 3.5%, the legislature should have two choices: A) place the excess in a reserve account which can only be drawn on in years when revenues grow by less than 3.5%; or B) pay down the principal on bond debt (assuming there is no prepayment penalty).

In my opinion, state sales tax rates are too high (and too regressive) and our marginal income tax rates on the rich are counter-productive. I think personal/residential property tax rates are just about right.

The one tax area I think which would be reasonable to increase going forward is commercial property tax rates (which really ought not have Prop 13 protections).

If we as a state have a value to preserve undeveloped land (and discourage “sprawl”), another area where we might raise taxes is with land conversions–that is, the tax rates on income earned (or capital gains made) from short-term sales of undeveloped land or from gains made on an investment in raw land in which the gain was made converting it from a farm or pasture or forest or some such thing into houses or apartments or commericial buildings, etc.

It’s my understanding that our capital gains in California are taxed at the same marginal rate as ordinary or earned income is taxed at.

So if an investor buys up ag land or pastoral land or otherwise undeveloped land–say 100 acres for $1 million–and gets the local government to change the zoning on that land and then sells his property for $2.5 million, he would have made a capital gain of $1.5 million.

We tax that gain at the same rate as marginal income. I don’t think it would be a terrible idea to tax it at say the marginal rate plus 1% or even plus 2%, if the public intention is to discourage sprawl. It would be the same situation for the party who bought the land from the original investor and built houses or commercial buildings on the formerly raw land and then sold the now developed property within say 5 years. Tax that at a higher rate than we tax ordinary income or gains from developments inside urban areas.

[i]”The problem with this is that there would be tremendous pressure from special interests* for legislation to allow for “emergency access” to your private retirement account to make a down payment on a house, pay for your children’s education, and numerous other needs.”[/i]

If you are saying people would be borrowing against their asset, then that should be outlawed. That said, I have never heard of anyone borrowing against his future stream of Social Security payments.

*If we had publicly financed elections for Congress, these special interests would have far less power than they do, now.

The one tax area I think which would be reasonable to increase going forward is commercial property tax rates (which really ought not have Prop 13 protections).

Do you own any commercial property?

[i]”I am sure Goldman Sachs, Merril Lynch, and every other investment firm is salivating at thought of the hundreds of billions in management fees that could be made if everyone was required to contribute to a private investment account.”[/i]

You say that as if you think that is a bad thing. It’s not bad at all. However, I would (as noted in my post above) have a federal regulatory body regulate how much in fees the firms could charge. I am not talking about highly managed accounts with daily, weekly or even monthly trades. I am talking about broad market portfolios which go largely unmanaged.

It does seem likely that unsophisticated people who would be forced to save and invest would be easy prey for shady characters if we did not have regulatory oversight on their behalf. So as your mother’s story suggests, someone needs to look out for the unsophisticated.

[i]”The thought that most people have the ability to manage their own investment account is not true. My own mother for example had her entire life savings churned down to nothing by a Paine Webber broker who advised a never ending series of buying and selling risky securities just so they could collect the commission on each trade. She was so ashamed of being taken to the cleaners that she never mentioned it to anyone in the family until there was nothing left.”[/i]

As I sadi above, the management of these accounts must be regulated so that the accounts have the protections of risk and diversity and that they are made age appropriate.

If your mother’s portfolio was made up of “risky securities,” it was not diversified and would not be allowed under the plan I suggest. Also, the fees charged would be regulated in order to avoid the problem of shysters ripping off the unsophisticated.

With government oversight of the fund managers, this plan works very well in Chile. Argentina also has this kind of system, and it has worked less well there. I read one of the main problems in Argentina is that they have a high domestic content requirement in their accounts, and that (due to the backward nature of the Argentine economy) has taken away the protections investors get by diversifying their portfolios. We don’t have that problem in the U.S.

If you take your average guy–say me–and I put my forced savings into a portfolio which is made up of 40% broad market equities*, 15% AAA corporate bonds, 15% US T-notes, 15% munis, 10% global equities and 5% money-market funds, I would have the protection of long-term diversity and my fees would be next to nothing.

This idea just is not that complicated. It’s the old random walk notion ([url]http://en.wikipedia.org/wiki/Random_walk_hypothesis[/url]) that we have known for at least 100 years.

*Say the S&P 500, which returns roughly 7.25% per year for the long term.

[i]”Do you own any commercial property?”[/i]

No. Not currently, but I have in the past.

Here is where I am coming from on this issue. Take a large office building in San Francisco. Say it has 100,000 s.f. of leasable space and say its fair market value is $300 million, which is based on its net income. But say the last time it was sold was 30 years ago and it was sold then for $50 million.

So for purposes of property tax, it is currently valued at $90,568,079 and it pays $905,680.79 in tax. In other words, the propery tax value has no relation to its fair market value, and the property taxes it pays are small relative to the income the building generates.

If commercial property taxes were instead based on assessed market value, which is determined by the property’s income stream, then the amount paid in tax would only go up when the revenues generated by the property go up.

Obviously, that is not beneficial to the owners of commercial properties. However, there is a market value created by marrying the tax rates to the real values of commercial properties–it no longer discourages the sale of such buildings to new investors.

Currently, if you take that 100,000 s.f. office building which has not sold since 1980, the owners of it have a very strong incentive not to sell, because they are winning by paying a sub-market property tax rate, which the new buyers would be unable to do. In the long run, it is inefficient (and hence negative for the larger economy) to create such constipation blocks in the sales of real estate. You discourage owners from taking the money they could make on a sale, for example, and reinvesting that in new buildings or other ventures.

Don: “Do you own any commercial property?”

Rich: No. Not currently, but I have in the past.

I do. On Fifth Street. So you want to raise my taxes, but not yours. Got it.

With government oversight of the fund managers, this plan works very well in Chile.

I have family connections to Chile through marriage. My limited sampling of opinion from Chileans includes much dissatisfaction with their pension system. A 75-year old middle class gentleman in-law continues to supplement a modest pension with side work, such as someone his age can get.

Here’s an article on the Chilean pension system that I remember originally reading a couple of years after GW Bush was seeking to privatize social security. It touches on some of the shortcomings then. It was reformed in 2008. I don’t know if the reform has made a significant difference on a macro level. I just know that it hasn’t changed anything for my 75-year old in-law.

[url]http://www.nytimes.com/2006/01/10/world/americas/10iht-chile.html?_r=3[/url]

[i]”So you want to raise my taxes, but not yours.”[/i]

I would grandfather in all current owners of commercial properties, so it would not affect you.

As things now stand, if you were to sell your property, it would be reassessed at current market value, and the new owner would have to pay a base property tax of 1% of assessed market value. But under Prop 13, his property could not be reassessed in the future at market value, if his property grew in value more than 2% per year (and chances are strong, over time, it would).

Under the tax regime that I think makes more sense, the tax assessment of a new owner of a commercial property should be based on its true value from the point of sale forward, just as commercial properties were taxed prior to Prop 13.

That said, I think there is good reason to create a partial exception for an owner/occupied property like yours, because your property’s market value–unlike say a large apartment complex–rises or falls independent of the actual profits of your business. For example, if your revenues are falling due to increased competition, it’s not the case that the value of your property is falling. Likewise, even if your revenues are steady, nearby developments could make the market value of your property go up or down, because those developments might make your property much more or much less attractive to potential buyers of your property.

So perhaps an equitable solution would be to maintain a Prop 13-type cap for owner-occupied commercial properties which have gross revenues under some reasonable number–say $5 million per year. But I would still increase the assessed value inflator to the lesser of 3.5% or market value*. That way, after a property is sold, you don’t get the huge distortion between assessed value and market value which is created by capping the inflator at 2%.

*3.5% is not a magic number. I don’t know if it is necessarily right. I use it because it is roughly the normal CPI inflation rate.

P.S. In thinking about this some more, I would adjust Prop 13 that same way for owner-occupied residences. That is, once a place is sold to a new owner, the new inflator should be the lesser of actual market value or 3.5% per year. The 2% cap is what creates such a wild distortion.

Rifkin: “You say that as if you think that is a bad thing. It’s not bad at all. However, I would (as noted in my post above) have a federal regulatory body regulate how much in fees the firms could charge. I am not talking about highly managed accounts with daily, weekly or even monthly trades. I am talking about broad market portfolios which go largely unmanaged. It does seem likely that unsophisticated people who would be forced to save and invest would be easy prey for shady characters if we did not have regulatory oversight on their behalf. So as your mother’s story suggests, someone needs to look out for the unsophisticated.”

And you want to trust the feds to regulate the investment industry? LOL

“And you want to trust the feds to regulate the investment industry?”

And your alternative is what, they regulate themselves? Talk about LOL.

dmg: “And your alternative is what, they regulate themselves? Talk about LOL.”

I think you missed my point. Rich Rifkin was advocating that we trust the feds to regulate the investment industry if the country switches over to private investment accounts rather than our current Social Security system. The danger in such a switch is that the gov’t will not truly regulate the investment industry to any meaningful extent, just as they have not done thus far – which will endanger the PIAs. I have personally seen too many cases in which investment advisors get clients into very unsuitable risky investments, only to have their life savings wiped out. I think the country needs to hang onto its Social Security system, but stop allowing the gov’t to raid it whenever it needs money; and make the gov’t pay back the money it has already borrowed from Social Security. The idea of private investment accounts sounds good in theory, but I suspect will be a disaster in practice for many reason, not the least of which is that you will be relying on the feds to regulate Wall Street, which has not worked thus far…

Rich: “The 2% cap is what creates such a wild distortion.

Only when real estate values appreciate more than 2%.

Whether owner-occupied or investment, the total monthly costs of the property (e.g., mortgage, insurance, tax, maintenance, etc.) are business expenses. I would be fine connecting this cap to the CPI since this “distortion” should be the business’s standard macro cost volatility (with the exception of industry-specific market price volatility… which the business already has to deal with). It would also more equitably address the tax revenue fairness challenge (i.e., CPI causing government spending inflation). The problem with using market rates as in pre-Prop-13 days is that it causes existing businesses (whether owned or leased property) to fail because of uncontrollable expenses. When the tax bill goes up, their P&L goes red. When the tax bill goes down (in theory), they get used to the lower tax bill and then the next increase creates more red until the business owners can fire someone or increase rents. CPI is fair in that it represents a broader economic index and should be the standard economic “pain” that most are already feeling.

Note that in 2009 the CPI was -0.4% and in 2010 it was 1.6%.

But under Prop 13, his property could not be reassessed in the future at market value, if his property grew in value more than 2% per year (and chances are strong, over time, it would).

Under the tax regime that I think makes more sense, the tax assessment of a new owner of a commercial property should be based on its true value from the point of sale forward, just as commercial properties were taxed prior to Prop 13.

This would create an even more unbalanced two-tiered structure whereby old property owners reap the benefit of Prop 13, but new property buyers don’t.

What I don’t understand is why you prefer to tax property, which has historically been subject to volatile price changes, instead of income. We already have a progressive tax structure in place for income. Commercial property yields income. Just tax that.

Jeb Bush and Newt Gingrich just published an OpEd in the Los Angeles Times arguing that states would be wise to consider filing bankruptcy to relieve their financial troubles. They cite three states, California, Illinois and New York, while failing to mention the angry elephant in the living room with similar problems, Texas.

In The Economic Populist by Michael Collins.

Texas faces a $25 billion shortfall for a $95 billion two-year budget. That equals California’s 18-month deficit inherited by the recently inaugurated Governor Jerry Brown.

“So why haven’t we heard more about Texas, one of the most important economy’s in America? Well, it’s because it doesn’t fit the script. It’s a pro-business, lean-spending, no-union state. You can’t fit it into a nice storyline, so it’s ignored,” said Business Insider

Texas is a major inconvenience to Bush and Gingrich. They lay the financial problems at the door of unions and state employee pensions:

“The lucrative pay and benefits packages [read pensions] that government employee unions have received from obliging politicians over the years are perhaps the most significant hurdles for many states trying to restore fiscal health.” Jeb Bush, Newt Gingrich, January 27

This is blatant intellectual dishonesty. By giving examples of states with strong civil servant unions, they stack the deck for their explanation of state debt. Yet the dire budget problems in Texas negate their argument entirely. That is sufficient reason to dismiss the rest of their arguments and their stated motives, as well.

The Larger Picture – Tear Down that Government at Every Level

In the past few weeks, we have seen a multilevel assault on federal, state and local governments and the programs offered, e.g., public education, roads, public safety, etc.

This year’s public fretting over the federal deficit was bipartisan. Peter Peterson’s budget commission produced a plan to reduce the federal deficit at the same time that President Obama’s hand picked commission reported similar findings. Entitlements, Social Security in particular, require substantial cuts. They failed to note the real causes of the deficit – wars and bailouts.

Even though Social Security has a surplus, there’s a repetitive mantra that You’ll never get your money out of it. The budget hawks have repeated that so often, they probably believe it. And they should. They’re doing everything they can to make sure that we don’t see a fair return on our significant investment. The message is clear. Cut Social Security, take less than your were promised, and we’ll all live happily ever after (unless you relied on the promise made by the government based on your full participation).

The second assault on government targeted local municipalities – Day of Reckoning 12/19/10. Meredith Whitney of CBS claimed her study showed that the municipal bond market was headed for collapse and chaos. Whitney failed to show her work and asked us to trust her. This created unrest in the bond market. Whitney clings to her evidence just the late Senator Joseph McCarthy held tight his fictitious list of 400 Communists in the Truman and Eisenhower administrations who were subverting the government.

Now, Bush and Gingrich are attacking state governments and the programs that they provide to citizens. They focus on unfunded pension liabilities that ballooned during the recession we’re told is over. They fail to note the cause of those problems: the fact that pension funds relied on the Wall Street casino and fell victim to the vicissitudes of Goldman Sachs, etc., and the failure of Congress and the last two chief executives to regulate risky behavior.

The Neo Malthusian Catastrophe

Economist Thomas Malthus argued that there would be, “forced return to subsistence-level conditions once population growth had outpaced agricultural production.” The new Neo Malhusians argue that we must return to inferior economic conditions, absent the right to organize and bargain for wages and without the promise of Social Security, because expenditures have outpaced the ability to produce offsetting revenue.

Bush and Gingrich fail to ask the questions of real importance. Why has the economy faltered so badly? The answers wouldn’t please them or their patrons.

To begin with, there has been no regulation of risk filled financial schemes, from subprime derivatives to credit default swaps, since the big banks and Well Street were set free in the late 1990’s.

We’re fighting two very expensive and unnecessary wars.

Bailouts!

Then we have the money addiction of the top 1% of the population, which took 65% of the net new income in the United States from 2002 through 2007.

What are they Afraid of?

There is an island of fiscal stability among the states, North Dakota. The traditionally conservative state also has a state bank, the Bank of North Dakota (BND). State funds go into the bank, BND creates credit, and funds are available for the public benefit. Here is the BND statement of purpose for lending.

Lending Services: On behalf of the State of North Dakota, the Bank administers several lending programs that promote agriculture, commerce and industry. Financing economic development is the thrust of Bank of North Dakota’s efforts. The Bank is specifically authorized to assist numerous other financial institutions in providing financing to stimulate economic development in the state.

Ellen Brown has been advocating state banks for the past two years. She points out that, .”With over $17 billion available to deposit in its own bank, California could create $170 billion or more in credit — enough not only to meet its budget shortfall but to fund many other much-needed projects; and rather than feeding an ungrateful Wall Street, the bank’s profits would return to the state and its people.” Ellen Brown, July 22, 2009

Legislation was introduced in Washington that would create a state bank of Washington. This has attracted attention since it would be only the second state bank if the legislation passes.

“Rep. Bob Hasegawa, D-Seattle, the House bill’s sponsor, said the proposal was modeled after a similar institution in North Dakota and based on the idea that the state’s money should not be at the disposal of Bank of America, where Washington has its accounts.

“Why don’t we create our own institution, keep that money in our state and we make money off our money that we can then reinvest back into our community?” asked Hasegawa.’ The News Tribune, January 26

Aside from their general paranoia and guilt, the potential of a state bank movement may have Jeb Bush, Gingrich, and their patrons frightened out of their wits. They may be particularly fearful of the unpredictable and innovative Governor Brown who needs financial relief now and has the will and spirit to engage in a political showdown. BND is a highly credible state project. A Washington State bank would be significant due to the size of the state and the major business located there..

But a Bank of the State of California would represent a major threat to just about everyone on of the Neo Malthusians. The state was and can be once again a trend-setter. What a trend that would be.

Reprinted from The Economic Populist by Michael Collins

wesley506: “Texas is a major inconvenience to Bush and Gingrich”

Not really. It is more a convenient story to prevent those with a tax-more-and-spend-more worldview to accept once and for all the overwhelming evidence that it does not work.

Texas is suffering from a recession extended by a national government controlled by Democrats that spent the last two years chasing ideological rainbows instead of doing the things necessary to pull us out of the economic doldrums.

Here is the difference… Texas is a low tax state. They can temporarily raise taxes to help bridge the funding gap and still be a low tax state. CA is a high tax state… the fourth highest behind Hawaii, New York and New Jersey. CA cannot raise taxes enough to make any dent in our budget deficit without jumping to #1. California is fully leveraged. Texas is not. Texas is less insulated from extended economic downturns that impact sales tax revenue. But California was running asinine budget deficits even before the recession. The CA writing has been on the wall for a decade or more, yet the Democrat-controlled state legislature ignored it… more recently pinned the blame on the faux-GOP governor, and now is left holding the complete bag o’ problems.

There is another metric being ignored: how about the correlation between states’ overall rate of taxation and unemployment? The tax foundation has CA as having the second worst business tax climate behind New York. Look here: [url]http://www.bls.gov/web/laus/laumstrk.htm[/url] to see that we also have the second highest state unemployment ranking.