This is a core question that Rich Rifkin poses today in his biweekly Davis Enterprise column and while Mr. Rifkin deserves a lot of credit for helping to educate the public on city budgetary problems, at times being the only voice on the Enterprise to sound the alarm, we do not entirely see eye to eye here.

This is a core question that Rich Rifkin poses today in his biweekly Davis Enterprise column and while Mr. Rifkin deserves a lot of credit for helping to educate the public on city budgetary problems, at times being the only voice on the Enterprise to sound the alarm, we do not entirely see eye to eye here.

He writes, “Before you vote, yes or no, on the City Council’s proposal to increase the sales tax in Davis another half-cent — from 8 percent to 8.5 percent — you should know where your money is going.

“The city figures the larger levy will generate $3.61 million per year. Most of that will go to higher compensation for its current employees and to cover unfunded expenses for retirees.”

This is a much more complex point than Mr. Rifkin has the space to write about. While it is true that, of the $3.61 million, around $2.3 million will go to employee-related costs, most of those employee-related costs are outside of the control of the city.

Of the costs that are within the control of the city at this time, $1.06 million will go to personnel-related increases. However, only $360,000 will go to higher compensation to employees, which is a 2% COLA (Cost-of-Living Adjustment) that the city gave to offset some employees for taking hits on pensions and medical insurance.

$447,000 of that comes from the losses the city received due to the fact that DCEA (Davis City Employees Association) and Fire Fighters held out for contracts, and $250,000 came from the removal of budget savings that came when the city filled two vacant police positions.

The other $1.24 million is outside of the city’s control for the most part. Over half a million came from increased costs to retiree medical and medical insurance. Another $437,000 came from increased PERS (Public Employees’ Retirement System) costs, which were actually mitigated somewhat by the city having employee groups take up more of their own share. And $305,000 came from leave benefit funding.

None of that was in the city’s immediate control, so while Mr. Rifkin writes that the hole the city is in is due to higher compensation for its current employees, really only $360,000 of that is the case and that was again used to offset other cuts.

Mr. Rifkin writes, “The tax increase is first needed to pay for fatter salaries given away by the current City Council.” That is a small amount of the costs (about a tenth of the tax revenue), but Mr. Rifkin does not attempt to estimate exactly how much the city saved in the exchange. The city calculated it saved about $5.8 million during the course of the new contracts over what they would have spent; if that is true, $360,000 is largely chump change.

Mr. Rifkin continues, “The increase will help the city afford Cadillac medical plans given to employees and their families.”

As our analysis of school health insurance shows, I do not know if we can call the city’s health plan a Cadillac medical plan. A full-time city employee’s medical insurance is around $1920 per month versus about $1600 for a teacher’s. The main difference is that, while the city picks up much of that tab for its employees, teachers are only covered up at $952 per month by the school district.

The city might have been able to have negotiated more of that pay to come from the employee, but the problem is that the 2009 MOUs were so modest in scope, the city had to push on employee groups to take up more of the cafeteria cash outs, pensions, and retiree health.

As it was, the city had two groups hold out and had to impose last, best, and final offer. Had the city tried to exact much more from employee groups this time around, we might have had them all hold out, which would have been politically untenable.

From our perspective, the city did what it could in this round of negotiations, and the fault lies not with the 2013 MOUs, but with the 2009 round that did not go nearly far enough.

“The increase also will cover the growing costs of pensions, including the underfunded amounts going to those who’ve already retired.”

This is true. And while factually correct, it ignores the fact that most of these are out of the hands of the five individuals currently on council who are not responsible for past mistakes.

Mr. Rifkin continues, “The salary hikes built into the current labor deals are small compared with the big increases Davis gave its employees from 2000 to 2010. The firefighters, for example, got a 36 percent pay hike from 2005 to 2009. That was only four years after a massive salary jump and the giveaway of a new, unaffordable pension plan worth millions of dollars more for every public safety employee.”

He continues, “Yet small as they were, the recent raises were irresponsible and unnecessary. Davis did not have the money for them, no other cities were bidding away our workforce and the salary spikes have made the fiscal crisis of the city even worse.”

But Mr. Rifkin makes a tremendous calculation error here. The city paid about $360,000 back to employees in salary increases in exchange for concessions on other issues. Perhaps he is right, the city could have gotten more, but let us say that the $360,000 was the difference between two groups going to impasse and seven groups going to impasse.

We know that just two groups going to impasse cost the city about $11,000 a month in costs, and perhaps that is a low number. Over the year it took for the first five groups to agree to terms, and terms being imposed on DCEA and Fire, that’s well over $1 million in costs. Let us conservatively suggest that five additional groups going to impasse would cost the city about $1.5 to $2 million in total costs.

Even $1.5 million in total costs is more than $360,000 a year over three years. So by getting the groups to agree a contract rather than going to impasse, the city actually came out ahead.

It is these types of tradeoffs that the city has to factor in, that Mr. Rifkin did not in his otherwise sound analysis of the situation.

Mr. Rifkin then writes, “A bigger hit to the city than increased salaries is the growing expense for retiree medical benefits (known as OPEB). Before the 2009-10 fiscal year, the city never funded this expense.”

He continues, “Now, once a person retires from the city of Davis, the city will write a check each month to CalPERS to cover whatever it costs for medical insurance for the retiree, his spouse and his child. If he lives deep into old age, taxpayers in Davis will be on the hook for decades.”

He adds, “For the past five years, Davis has been pre-funding its OPEB expense for future retirees. This fiscal year, the funded amount will be $3.74 million. The city owes $2. 22 million for the OPEB of its current retirees. Our full bill for 2013-14 is $5.97 million.”

So for some time, the city has been working to deal with its $60 million unfunded liability on retiree health care benefits, after new accounting practices under GASB 45 (Governmental Accounting Standards Board Statement 45) showed that the city’s liability, by simply paying for the benefits as the bills come due, would push the city heavily toward bankruptcy by 2030.

Instead, the city has been trying to pay its way into fully funding the liability in advance, which for some time we have known will save the city literally tens of millions of dollars by the time we hit 2030.

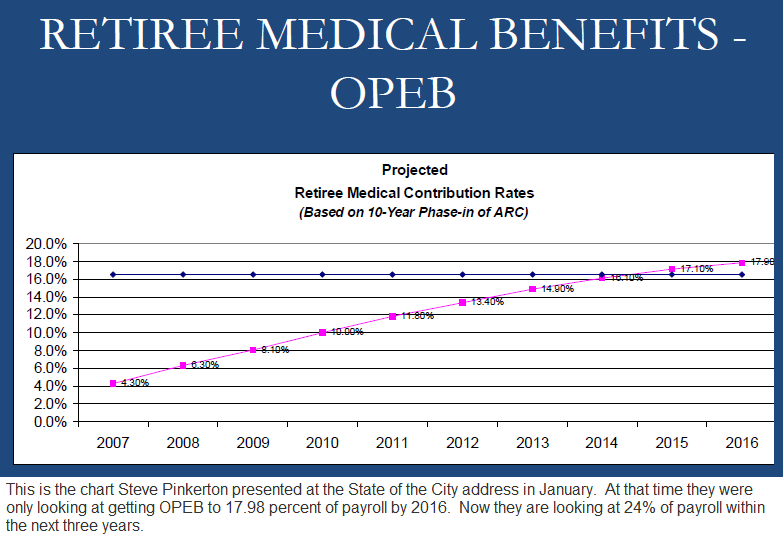

In 2012, the city was concerned that OPEB costs would soar to perhaps as high as 24 percent of the current payroll.

“Unfortunately, 20% of payroll is probably not going to cut it in the future,” City Manager Steve Pinkerton said in January 2012. “We’ve been ramping this up, the council has been responsible and doing the right thing for the last three or four years by beginning to take on retiree medical, ramping it up each year from 6% to 8% to 10%, last year it was 12% of payroll, the original plan was to go 14%…”

“We’re recommending based on some input we got earlier this year to go all the way up to 20%,” he continued. “The reality is that you’re probably going to see a discussion soon where we’re going to have to ramp it up eventually to closer to 23-24 percent.”

However, the agreements signed and imposed by the city have allowed the city to reduce costs on retiree health to 17% of payroll – perfect solution? No. But the council over the last two rounds of MOUs has increasingly shifted burdens from the taxpayers to employees.

Mr. Rifkin then argues, “The great crisis in pension costs is ahead of us. Employer rates in 2020 will be double what they are today. If nothing changes, the residents of Davis will pay $13.2 million per year to let city employees retire young and flush with cash.”

Davis has actually done a good job of thinking ahead.

In January Mayor Joe Krovoza noted that the city budgets are already taking into account expected hits from the state on increased costs for PERS, finally directing employee shares to be picked up by the employees rather than covered by the city, as it has done for the last decade or so.

Last spring, City Manager Steve Pinkerton noted, “I think there have to be some changes in PERS, I don’t think it’s sustainable. There has to be some point in time where they’re going to have to start looking at changing the system, even for existing employees.”

At the same time, the city is limited in what it can do.

Mr. Rifkin takes on a more moderate tone in his conclusion.

He writes, “I am not ready yet to endorse a yes or a no vote on the sales tax increase. I am aware that, if it is voted down, services in Davis (including police, fire and parks) will be severely cut back. Our town will be a less pleasant place to live.”

He adds, “What I would like, if they want a yes vote, is for the people on the Davis City Council to explain two things: Tell us what mistakes they and past councils made that got us in this predicament, and what exactly they will do to fix the problem they have identified.

“If they don’t understand what they did to put us in this crisis and they don’t know how to prevent it from recurring or getting worse, why should we trust them with even more tax money?”

Here we fully agree – there needs to be a time of reckoning for past mistakes and assurances into the future. However, we believe that the current council has done much to earn voter’s trust back with regard to finances and that we should trust them with our money right now. Whether that holds into the future is a bigger question.

—David M. Greenwald reporting

“However, we believe that the current council has done much to earn voter’s trust back with regards to finances and that we should trust them with our money right now.”

On 2/14 you wrote:

“It is not the best option, but voting for the sales tax at this time puts far too much trust into the hands of the unknown – we do not know what the council or city management will look like going forward and I for one have seen too much progress to simply roll the dice right now.

So I will be opposing the sales tax in June, and hope that things can come together in time for a parcel tax in November that solves the revenue problems for the city – while at the same time providing us with the assurances and accountability we need going forward.”

So which is it? Lately you seem to be all over the place.

I was talking about two different things. One was the trust in the current council and their record. The other is my support or opposition to the sales tax.

So David, are you still against the sales tax?

Yes, for the reasons stated last week.

Thanks for clarification of this, I don’t think this is generally understood.

Why were people insisting so vigorously just a couple weeks ago that the council put an advisory measure on the ballot that would attempt to earmark these funds for infrastructure improvements and other non-employee purposes?

Where did those folks expect we would get the money to pay for the employee-related costs that are “outside the control of the city”? Did I misunderstand the proposed purpose of the non-binding vote?

Yes, you misunderstood. The purpose of the non-binding vote was to carry out the usual bait and switch where voters are fooled into thinking that their tax money goes to parks, social services, police etc but then it mainly goes to higher salaries and benefits for city employees.

the numbers here don’t support that.

If they had gone for the higher tax increase, which they came very close to doing, then potential revenues would have been closer to 5 Million, so there would have been some money beyond what was needed to pay employee related costs in the general fund. If this is the scenario that had played out then I can see some value in adding an advisory measure, although I’m not convinced that those are very meaningful.

As is stands now, in essence all funds generated from the lower tax rate will be earmarked for employee compensation, so an advisory measure seems completely unnecessary.

So of the 3.6 million only $360,000 will go towards higher compensation?

Yes and higher compensation is relative, they are taking cuts in other areas and offsetting some of those cuts with a very small 2% pay increase

So their take home pay is not going up?

No.

MM: So of the 3.6 million only $360,000 will go towards higher compensation?

This is false. Almost every cent will go to employee compensation. (The only amount which won’t is going to pay for higher water costs.)

David Greenwald’s piece is wildly stupid. Even dumber than what he told me it was this morning when I saw him at Cloud Forest Cafe.

Compensation for employees is not just salaries. Yes, we have bumped up salary costs, as I explained in my column. That in turn makes pension funding more expensive. And pension funding is employee compensation.

Yes, OPEB and medical rates are beyond the control of the City Council. But how much the City pays for these forms of employee compensation is (almost) entirely within the control of the Davis City Council.

The most important thing to understand is that our City Council has put us in this bad position by failing to control compensation costs. And the growth of total compensation is why we are running a huge operational deficit. That is it.

David told me today that, if the Council had followed my advice–which I have given them consistently for the past 10 years–we would have had to impose contracts on the employee groups which signed these (unaffordable) contracts, and since the imposition process would have taken longer, we would be in a worse position today.

David is right on that. But it’s another bone-headed point.

We signed deals with the workers we cannot pay for. If we imposed affordable deals, where total comp growth was tied to revenue growth, we would have a balanced operational budget. (We would still have a crisis with regard to long-term maintenance of roads and other infrastructure.)

Imposing good deals, even if there was a short-term price to pay for it, is eminently smarter than accepting deals we cannot afford.

But because we followed David’s stupid advice, we are in a crisis and we (or a bankruptcy court) will eventually have to change the labor contracts in the manner I have suggested, even if this tax increase passes.

No one should be under the illusion that the sales tax increase will solve our labor compensation problems. In fact, with the new CalPERS numbers now out for pension funding, the problem by 2020 is going to be bad enough that we will need an additional $4.4 million in tax revenues per year simply to keep our workforce employed, assuming that medical costs don’t also increase.

So it is more accurate to say that only $360,000 will go to salary increases.

Even that is wrong. I don’t know the exact number. However, my best estimate for the sworn police officers is the pay increases over 3 years from 1-1-2013 to 12-31-2015 will increase SALARIES for those employees by about $600,000. That number includes all sworn officers, including the police chief, the assistant chief, the captains and lieutenants, all of whom are sworn officers and all of whom are on 3% at 50 and all of whom are paying 12% of salary now to cover a portion (less than 1/3rd) of their pension funding.

But keep in mind, all non-sworn police employees, all management employees, all department heads, all finance employees and on and on got a BIGGER pay raise than the sworn police officer got over the same period. The only ones who did not are fire and DCEA, because they would not sign their contracts.

Most important to understand is that a higher salary means a worse pension funding crisis for the city, because the amount we owe is based on salaries.

If we had a Rifkinesque council, all salaries would have been reduced by at least 5%; and we would have cut back on the great amount of time we are paying city workers to not work. They get waaaaaaaay more paid vacation time than we can afford. They get triple the number of paid holidays than their equivalents in the private sector are paid not to work. Management employees and department heads, many of whom are paid far too much in salary now, get an additional two weeks of salary every year for “management leave” time.

It is time the taxpayers of Davis own up to the fact that these goodies are too expensive. They are part of the reason our streets are in disrepair and our debts have ballooned into the hundreds of millions of dollars. The time of irresponsible City Councils needs to come to an end. Passing a new tax increase will simply push that fact back by a few years.

I would still advocate a vote for it, however, if the Council will own up to its mistakes and explain how they plan to correct them. Up to now, our Council has never taken responsibility, and they have foolish bloggers claiming that the only ones who made bad decisions with contracts were the previous Councils. Even if those mistake were even worse, this Council is the one which has pushed us to the brink of the cliff; and we will fall over short of new revenues this year.

David wrote:

> Of the costs that are within the control of the city at this time,

> $1.06 million will go to personnel-related increases. However,

> only $360,000 will go to higher compensation to employees,

> which is a 2% COLA

Sure they only get $360K “NOW” but most of the rest of the money is reducing the hit of increased health care costs that the rest of us are paying “NOW” and funding their big pensions that they will get “LATER”. So Rich is right in that the city workers will get almost all the tax increase.

We need signs that say “Vote for the tax increase so more city workers can retire in their 50’s with a pension of over $10K a MONTH like the former police chief” or “Get a part time job so you can afford to pay higher taxes and higher health care so we don’t need to pass any costs on to city workers”…

Well said SOD. We’ll keep getting taxed more and more so public workers are allowed to maintain their pay and sweet benefits.

As I explained, we cut as much as we could have at this time.

That is your oft stated opinion, but like all opinions, simply repeating it does not turn it into a statements of fact.

The City could have chosen to cap total compensation, or link it to increases in revenues as Rich has long argued, but chose not to. These increases have never been outside the control of the City, we just have not demonstrated the will to control them.

How do you know that they could have done that?

‘Last, best offer.’

Understood that this is a possibility, but at what cost? I estimate the cost of taking all bargaining units to impasse and beyond to be about $1.5 to $2 million. That’s a huge added cost.

Not if it saves $3.6 Million (and growing) in recurring annual costs.

David, you are not thinking. The fact is that sooner or later these changes will have to be imposed for Davis to be solvent. You act as if in 2015 we can get affordable contracts through negotiations. The truth is–and you ought to know this–is that the $2 million or so you are worried about will have to be paid at that point, if we put off imposing a sensible contract.

I am thinking – I simply believe we got as much as we could this round of bargaining, the next round is two years away and we will at that point need to go further than we have now.

We also could make more cuts in the number of employees and in programs. (We were told that the city employees have been developing their recommendations of cuts of up to 25% need to be made. Where are these lists? I trust city workers to know where cuts would be most effective and least damaging.)

Whether the city council can be blamed for stupid and pandering pay and benefit increases, they’re here. Citizens need to decide whether want to maintain our present level of services and/or spent more on streets and other things. If so, we need to be raising LOTS more in revenues from existing Davis taxpayers.

We also need to quit anticipating that we can depend on our economic development initiative to bail us out of this ever-worsening dilemma.

I have not seen a list as of yet. I was told that the number of layoffs with no tax would be 30. There didn’t seem much appetite for that and when I floated it as part of the plan to put a full parcel tax in November, I got push back even from the deficit hawks in City Hall.

This is exactly right. The contracts are in place. At this point if we want to significantly cut costs then we need to lay off employees, which translates into a decrease is services.

People can complain all they want about employee benefit packages and salary increases, but it won’t change the current situation.

If we don’t want to see services cut then we need to pass a sales tax this spring. If we want our roads and infrastructure maintained then we need to pass a parcel tax this fall. If we don’t pass these tax measures then we will need to live with the consequences.

“At this point if we want to significantly cut costs then we need to lay off employees, which translates into a decrease is services.”

Not necessarily. Through outsourcing we can reduce costs and maintain or even improve services while boosting local businesses. Many tasks do not need to be carried out by City employees.

but that means laying off existing employees and the council and city staff doesn’t have the appetite for that. also i think a lot of people believe that while the employees have already taken their lumps, the voters have not yet. it’s their turn.

“but that means laying off existing employees”

Exactly.

‘council and city staff doesn’t have the appetite for that’

Yes, as I have said elsewhere, we lack the will.

“the employees have already taken their lumps, the voters have not yet. it’s their turn.”

Funny, our taxes have risen almost continuously over the past 20 years or so in order to fund the City employees unsustainable compensation increases. We have a long way to go in cutting total compensation before it is the tax payers turn again.

Our taxes going to things other than the city. The only tax increase we have had is the half cent sales tax ten years ago and a $49 parks tax.

Uh huh…property taxes have remained flat for the past 20 years, as have City fees for building permits, business licenses, recreation classes, pools, etc. How about water rates, waste water rates, trash pickup rates, and fees for other City services. They have also not increased in 20 years, right? What about all the unfunded obligations that we have ignored, those are tax increases that have accrued but we haven’t paid yet.

Uh huh, our taxes haven’t gone up a whit.

The City Council does not have an appetite for that. But it ought to be, at the very least, looking at ways to outsource. For example, we should start outsourcing vehicle maintenance, to know how much we can save.

The City Manager’s report for the December 17 meeting included a list of cuts that totaled over $5 million to the General Fund. In that scenario every department, including fire and police took cuts. I viewed it as “hypothetic” (illustrative of what would be required) l and it was not discussed.

Thank you. It must make interesting reading. Have you a link, perchance?

They are going to get less now than they would have before the new contracts.

So their pay and benefits total is going down?

David wrote:

> They are going to get less now than they would

> have before the new contracts.

To say this they have to be getting:

Less per month in take home pay

and

Less per month paid for health care

and

Less per month in vision dental and other benifits

and

Less per month paid for their pensions

I don’t think a single person employed by the city is going to have the city pay LESS for ALL of the above…

I think you are looking at this the wrong way, the question is: are they getting less under the new contract than the old contract, and I believe the answer to that is yes.

That cannot be true if the total cost of compensation is rising without a concomitant increase in FTEs. Their net cash in the bank at the end of the month is going down, but their total compensation continues to rise at an unsustainable rate.

Mark, it’s going down while it’s going up. Not that hard to understand. LOL

City costs are increasing while compensation is going down.

Give you an example since it’s counter-intuitive. The employees get a defined benefit in their pensions. We have not funded that payment enough. Some of that is our fault, some of that is CalPERS fault. The result is that both the city and the employee are actually both paying more for the same benefit level. Hence in real terms, the employee has taken a paycut despite the fact that the city is paying more for the benefit.

Unbelievable to me, Greenwald does not understand what total compensation means. As a result, when he makes claims about employee comp, he cannot be believed. His numbers simply are based on ignorance of what compensation is.

For those who don’t know, compensation is the full cost to an employer to employ a worker. Some of that might be deferred, but it is still compensation. So when OPEB or pensions are underfunded, and the rates rise in order to cover those expenses to retirees, that is in fact (deferred) employee compensation.

One of the many areas where Davis has erred is its give away of OPEB for lifetime to employees who worked here a short time. (Once again, due to the fault of the present Council, we no longer have any vesting period.) So if a person who is eligible to retire from PERS via some other city or county he worked for, he can work for Davis for one day, retire, and Davis will owe about $500,000 in NPV (if he lives another 35 years). And all of that is compensation for the one day he worked for Davis.

How difficult would it be to undo this oddity? Do I understand you, that the current city council did this to us? Why would any city council approve such a potential disaster on the city? Does this decision mean that we’re stuck with Pinkerton’s NVP?

“One of the many areas where Davis has erred is its give away of OPEB for lifetime to employees who worked here a short time.”

Can you quote the language that states this.

“Can you quote the language that states this.”

Yes. It’s in the new MOUs. You need to examine the language in the last ones, which had a vesting period for time served in Davis, and the present ones, which do not.

If you send me an email, I can explain this in full. I was unaware of the change until I looked into the question of whether Steve Pinkerton, who has been here only 2.5 years, qualifies for OPEB from Davis. I thought the answer was no, because I was basing that on the vesting language in earlier contracts. But I discovered that the current City Council removed the vesting language, putting us back where we were prior to the 2011 contracts.

Did you ask Pinkerton or Yvonne why that language was removed?

If you didn’t know the council did this, is it possible that the council did it inadvertently.

If so, is it too late for them to undo it before we get stuck with the costs for some more retires with normally inadequate vesting.

Given our fiscal condition, what rationale could have gone into this other than an simple error?

I don’t see why employee organizations even would care much about assuring that Davis gets stuck with the bill for employees who spend only a short time here.

“Did you ask Pinkerton or Yvonne why that language was removed?”

I never spoke with either of them about it. I was asked by someone in Davis if we were going to have to pay for Pinkerton’s OPEB for life, once he retires from Davis. I immediately said, No, Davis has a vesting period and he has not been here long enough. But just to check to see what the vesting numbers were, I looked in all the contracts. And I found that what had been in the prior contracts was removed.

The change does not benefit long-time Davis employees. It really only affects people like Pinkerton, who come here vested in PERS and then retire shortly thereafter. Davis gets left holding the bag for the next 40 years paying their OPEB. That is exactly what is going on with Jim Antonen’s OPEB. We also pay for Jim’s wife. And he never really worked long enough to retire from CalPERS, but we paid him for 6 months after he was fired, just so he would qualify for a PERS pension and lifetime OPEB from us.

So I did speak to Pinkerton about it and it’s an interesting answer.

No David. Total compensation is the cost of compensation to the City, not the amount going into the employees pocket. If the City’s costs for compensation per employee is going up, then Total Comp is going up.

Employees are getting less money, city is paying more money. That’s the point I’m making.

My original statement was: “They are going to get less now than they would have before the new contracts.” The corollary is that the city is paying somewhat more than they were under the previous contract. My statement was intended to reflect the fact that employees took a hit.

I also agree with Rich that we need to go further, and I agree with Mark that a more comprehensive approach would be better.

David wrote:

> I believe the answer to that is yes

You are wrong, and as Mark points out if the city is paying more for the same number of employees.

I bet most of us would take a cut in “current pay” so we could retire at 50 with 90% of our salary.

In order for a City employee to retire at 50, with a 90% pension, they would have had to be a public safety employee, AND working as such since they were 20. If they worked until they were 85, they would get the same 90%.

“If they worked until they were 85, they would get the same 90%.”

That is true. And what that fact does is it gives a person after 30 years a strong incentive to retire. Take a police officer who is 53 and is an experienced investigator, making $120,000 in salary. He can retire, collect $108,000 (plus 2% inflation) per year for life, have his lifetime medical bills and those of his wife and even a minor kid for some years paid for by the taxpayers of Davis, and he can go to work for, say, Sacramento County as a DA investigator, making an additional $120,000 in salary plus whatever medical cash-out they pay. Or even better, he can take an investigator job in Reno, make a smaller salary, but pay no state income taxes on his new salary or on his $108k pension.

Knowing that, why would anyone not simply retire after 30 years?

Shouldn’t people HAVE to work until they’re 85 years old to get this level of benefits, assuming they’re able-bodied?

Are you still working?

Were it up to me, we would encourage all people (save those who are truly disabled) to work until age 65. If they choose to retire earlier than that, I would have the City pay only the minimum ($115/month) for their OPEB. And then after they are 65, the employee’s share would fall to zero.

Barring accidents (or unavoidable health problems), cops and firefighters should be able to work until at least age 55 in those positions. After that, they should be eligible to be retrained to do other jobs for the City, if they want, and they can stay another 10 years, if they don’t want to retire so young.

Former Fire Chief Rose Conroy’s husband Jess Hernandez retired from the City of Davis Fire Department at exactly 50 years old on December 17, 2004 after 29 years, 10 months and 14 days. Has anyone heard if either of them got new jobs are just trying to scrape by on the ~$200K a year they get from Davis (and rental income from the investment real estate portfolio that they amassed while “scraping by” as Davis firefighters)?

Note that, under PERS rules, an employee on 3% at 50 does not have to be age 50 to get his full 90% pension. If he accumulates a lot of unused sick leave and vacation time, he can buy what is known as “air time,” by cashing in his accumulated unused sick and vacation leave. Many across our state have done this sort of thing to retire at age 48 with a full pension.

The only thing which makes firefighter retirement somewhat different from police retirement is that cops have a lot more opportunities to double dip on pensions or to simply do some sort of private investigative work. The uncle of a friend of mine who was a cop in San Jose until he retired worked for that last 25 years, after going on his pension (which predated 3% at 50), as a private investigator for criminal defense attorneys. His second career came with no pension.

That’s a tricky metric because if the city’s fees to PERS have gone up, does that mean that employees are receiving more compensation – I would argue no. The other issue is the rising costs of insurance. So what’s really happening is the costs are going up, not the compensation. You have to take into account things like inflation when you compare compensation, in real money, employees are getting less than they got previously but the city is paying more.

This doesn’t seem so tricky to me, but maybe I still don’t understand your argument.

When the costs go up to provide employees health benefits, life insurance, retirement program payments and other such benefits, there are two sources to cover these increased costs. One is the employees themselves. If this route isn’t taken, that leaves the employer to cover them.

Increased in such costs must be seen as “compensation increases” on the receiving end. Each of these categories shows up on my pay stubs.

The total compensation goes up when these employer costs go up. If they were taxable, you can be sure employees would have to pay for the added costs.

Now the new issue (consider inflation) is a whole ‘nother deal. It doesn’t really wipe away the fact that the added costs are going to the employees.

And, too bad the city doesn’t get increased property taxes based on the inflation level. Lots of things would be sustainable if that were true.

“When the costs go up to provide employees health benefits, life insurance, retirement program payments and other such benefits, there are two sources to cover these increased costs. One is the employees themselves. If this route isn’t taken, that leaves the employer to cover them.”

And so the employee is paying more and the city is paying more for the same benefit that they received previously.

But, whatever “more” that the city contributes is an increase in compensation (simply by definition) to the receiving employee.

The fact that a benefit does not get enhanced at the same time really is irrelevant to whether the associated compensation is going up.

“Same benefit” is not synonymous with “same compensation.” What if the employer payments for health insurance tripled, say, from $6,000 to $18,000. Wouldn’t you agree that the employee’s total compensation increased by $12,000 with that change?

Something unfathomable is keeping you from accepting this basic proposition, and I think it’s getting in the way of making your case for other, more important points you’re presenting.

Or, I could be wrong.

“That’s a tricky metric because if the city’s fees to PERS have gone up, does that mean that employees are receiving more compensation – I would argue no. “

Then you simply have no understanding of the concept of compensation. It is not “arguable.” It is plain English, a topic which confounds you. Compensation is defined as what it costs to employ a worker. There is no argument to be had.

As I stated, the benefit is defined, the amount contributed is not defined.

You seem to not understand the definition of compensation. It is the amount it costs to employ a person, in terms of benefits, salary, pension, other perks, etc.

Think of it by example. Say a certain job comes with a $100,000 salary and a medical benefit. If that benefit costs the employer $10,000, the employee’s compensation is $110,000 plus whatever other benefit costs the employer has for this employee (maybe a car or clothing or life insurance, etc.).

If two years later the employee’s salary is reduced to $95,000 while the cost of his medical benefit has gone up to $20,000, his compensation has

increased by $5,000, ceteris paribus, to $115,000. The employee may not feel $5,000 “richer.” However, if he simply received a salary and suddenly had to buy the medical himself, and it went up by $10,000 to $20,000, he would clearly understand that the cost of that benefit is how much he was getting in compensation for it. It’s harder to understand that if you are not paying for it yourself.

You need to know there is no “debate” here. You have simply confused employee salary with compensation. But, again, compensation has always been defined as the cost of all the benefits, including salary.

David, you are completely wrong. The reason we need the tax increase is to pay the increase in compensation. How can you possibly not get that?

The pay increase is only $360,000 of the $3.6 million. Even absent the pay increase, we would need the tax increase.

Minor clarification… the City pays 0 for vision. They have made a plan available, at group rates, but at the employees’ sole expense.

Ok, so would someone please explain to me what is unclear here? We have financial obligations that we have created largely through the actions of past councils. This is done. I do not see how more rehashing is useful.

We need to raise money to cover expenses that we must pay whether they are in terms of employee ( or surrogate in the case of outsourcing) compensation and costs associated with maintaing our infrastructure. We have two ways of doing this in the near future, the sales tax and the parcel taxes. We seem to be in agreement that economic development is desirable, but not applicable in time to save us from our more immediate debts. Now one can wring one’s hands about where the money is going and how much is going where ( much as I wring my hands every time I pay my federal taxes realizing that part is going to our war related expenditures and to subsidize large companies whose products and efforts I do not approve). But it is important to realize that this hand wringing is pointless.

We, as a community have to make the decision that we will incur these additional taxes or that we will agree and push vigorously to reduce services. I know that I have simplified deliberately. But does anyone truly feel that this is not the decision we are facing ?

The obvious problem is that we continue to take a piecemeal approach, arguing about each component, without developing a comprehensive plan. We need to raise taxes AND we need to decrease expenses AND we need to invest in economic development. This would have all been a bit easier if the current CC had held the line on total compensation but they failed to do that so we have even more work to do.

Increasing taxes alone will not solve our problems, though higher taxes is an important part of a comprehensive solution. The best way in my mind to justify raising taxes now is to also immediately start reducing payroll through outsourcing, and increasing economic development through changes in zoning, improved marketing, and creating space for new and expanding businesses. We need to start doing all of these things right now, not rolling them out one step at a time, or worse, promising to do them sometime in the future.

What is missing now is the leadership needed to create the comprehensive plan to deal with our deficit. Without effective leadership, there really is no reason to believe that we will have the will to follow through with all the steps needed. That is why I believe that the necessary tax increases are in trouble, not because they are too expensive, but because there is a general lack of trust that the CC and Staff will use the money appropriately. This is especially true if we make the wrong choice during the next election.

If we do not have the will to follow through with the comprehensive solution, then we will be better off in the long run defeating the tax increases and forcing the necessary changes through bankruptcy proceedings.

MEDIC: “We have financial obligations that we have created largely through the actions of past councils.”

This is correct. However, it is very important to understand that the current city council has made the problem worse, and the marginal damage they caused is why we have gone into such a terrible operational deficit. This council increased employee compensation (including salaries) and the amount they increased compensation is the amount the tax increase will cover.

It is false to think that this Council could not have imposed deals which controlled the growth of compensation. In fact, this Council put itself at the mercy of CalPERS in the way it wrote its contracts, and nothing PERS has done since they signed these deals has been a surprise.

Part of this lack of trust that you speak of may come from the actions of past or current council, we would probably disagree on at least the role our currents council has played.

But I would argue some of this distrust stems from people who willfully spread misleading information regarding our current fiscal situation and how we got here. I believe Rifkin’s piece did just that.

This type of action does not help our community solve it problems. I would challenge Mr. Rifkin or any other person sharing information to do so in a way that accurately represents the situation so our community can base it’s decisions on facts instead of half truths and misleading commentaries.

Michelle, can you point to one single thing which I wrote in my piece which is incorrect, untrue or misleading? If you cannot, you owe me an apology.

Unlike David Greenwald, I have a good grasp on the English language. I don’t use the wrong words. Every word I said in my column means exactly what I said, and there is nothing in it which is in the least misleading.

Rich are you suggesting that facts cannot be presented in a way that misrepresents the truth?

Tell us Michelle, since you called Rifkin out please point out what untruths or inaccurate statements he made.

I have not presented the facts in a way which misrepresents the truth. But now, in a few different posts, you have accused me of so doing, without pointing to any instance where I did do.

I would accuse you of slander*. However, I get the feeling that you lack the fundamental understanding of language to know what it is you are saying. Your questions to David suggest you have not been paying attention. And his answers to you suggest he lacks the ability to understand his own answers.

*In written form it is libel, not slander. However, since you are not the publisher of this blog, it is more apt to say you have slandered me. Either way, don’t worry about a lawsuit. I would simply prefer you explain what it is you think I misrepresented, and I will gladly straighten you out, and then you can apologize for your badly chosen words.

“Every word I said in my column means exactly what I said, and there is nothing in it which is in the least misleading.”

You should Steve Pinkerton or Yvonne Quering what they think of your analysis. They’ll have a very different take than you.

I communicate with them often. In fact, the OPEB and pension numbers I used in my column came directly from Yvonne.

Which explains why they believe you have misused the information they gave you.

I should add this: As good as Pinkerton has been for Davis, he is partly responsible for this mess, too. His staff (led by Ms. Quiring) claimed that the 2013-14 budget was in balance. They knew this was not going to be the case soon thereafter. (I know that from a conversation I had with Yvonne in her office. Kelly Fletcher was there, too.) However, Pinkerton, Quiring, Fletcher and so on SHOULD have known on July 1, 2013 that the 2013-14 budget was bad.

Not one thing (of any importance to the bottom line) that was unpredictable on 7-1-13 happened between then and 12-17-13 to make the so-called “balanced” budget go so far out of whack. They knew about the pay increases. They knew about the OPEB increases. They knew about the pension funding increases. Et cetera.

Yet, in their mid-year report–which may have been prompted by my inquiries (where I discovered that revenues were far short of expenses*)–they suddenly tell the Council that the Davis GF will be out of cash soon and they desperately need to raise taxes to cover the loss and this situation throughout 2020 is going to spiral out of control. Pinkerton and his team ought to have done forward projections far sooner.

——————

*Yvonne told me that the reason I found that revenues were so far short of expenses, when I asked in November, was because of timing alone. That is, property tax revenues had not yet come in, and that was primarily the problem. And because of what she told me, I killed the column I was going to write. I believed her. I still do. However, I was surprised in December to find, with no real unpredictable events changing matters, Davis was suddenly in a crisis they had not foreseen.

Since you are on the staff, please tell me why they never saw this coming and why, if they did, they never said so when the so-called balanced budget was passed on 6-30-13?

Michelle:

I am afraid it is you who is being misleading by denying the extent of our problems. Community wide denial is why we are in the current mess, denial about the real costs of over compensating our employees, denial about the cost of failing to invest in economic development and denial about the failure of our City Councils, past and present, to transparently and honestly deal with our financial situation.

Rich’s column is accurate and anything but misleading. Sticking your head in the sand won’t change that.

Mark:

Thanks for this post (and thanks to Rich for all the research).

We don’t have a “political” problem, we have a “math” problem.

It would be “nice” if everyone that works for Davis could retire at 50 and have the city take care of them for life, but the numbers just don’t add up (the math problem).

We can try and deny that there is a problem but it will just make fixing it harder…

Then how do you propose Bob Dunning earns a living from now on?

David you need to rethink this. You are too smart to be missing the point people are making here.

I’m not missing the point, I’m just not agreeing with it.

1. When I say there is no appetite to lay people off, I mean, it might as well be a non-starter, that’s how hard the push back was from even the most fiscally supportive parties.

2. Pushing seven employee groups to impasse would have been a disaster for the city, I don’t think they would have survived it and Weist would have exploited it.

So that’s where I come down.

This confirms that whatever point you get, you’re still completely missing the point that’s been repeatedly brought up by a half dozen of us over several hours. Neither of the two items you’ve listed is the thing being contested.

Simply put, we are talking about what the word “compensation” means. It’s important in your case because not acknowledging the meaning of the word is what allows you to minimize the increased benefit compensation costs we’re facing in future years and the impact of the council’s recent decisions.

But, since you brought up some other issues:

1. It’s no surprise that city employees and city council members never would have an “appetite” for laying off staff, but that doesn’t mean that they (and we) shouldn’t be considering the possibility–whether to replace the services by contracting or to simply stop providing lower priority services. What will face them (and us) if the sales tax and parcel tax votes fail? Will staff cuts still “might as well be a non-starter” at that point and in the next few years?

2. Ending up at an impasse with one or more groups is another thing for which nobody really has an appetite. But, it would indicate that the city is serious about getting the financial house in order. (When you say, “I don’t think they would have survived it ,” I don’t know whose survival your concerned about.)

Clearly. The only other point I tried to make is that employees and the city are each contributing more for the same level of benefits under the new MOU.

“…But I would argue some of this distrust stems from people who willfully spread misleading information regarding our current fiscal situation and how we got here. I believe Rifkin’s piece did just that. This type of action does not help our community solve it problems. I would challenge Mr. Rifkin or any other person sharing information to do so in a way that accurately represents the situation so our community can base it’s decisions on facts instead of half truths and misleading commentaries.”

I agree with the general proposition that “willfully spreading misleading information (and half truths)” doesn’t help our community solve its problems. But, I can’t imagine that we’d be facing anything close to that in a Rifkin write up.

Tonight’s Enterprise has made it inside, and I’m ready to take on Rich’s apparently controversial column. It would be really helpful, Michelle, if you’d indicate the half truths and otherwise misleading information for which I should be looking.

“It would be really helpful, Michelle, if you’d indicate the half truths and otherwise misleading information for which I should be looking.”

Crickets…………..

I cannot help but notice that after Michelle defamed me, and I challenged her defamation, she stopped posting. I guess that is her way of apologizing for her mistake.

Thanks, Michelle, for admitting you had no evidence of my writing something in my column which was misleading or a half-truth.

I cannot help but notice that after Michelle defamed me, and I challenged her defamation, she stopped posting. I guess that is her way of apologizing for her mistake.

Thanks, Michelle, for admitting you had no evidence of my writing something in my column which was misleading or a half-truth.

Lets see does your assertion that I am admitting to have no evidence, which you base on the fact that I haven’t posted for a couple hours (I do have a life you know, okay I don’t normally, but today I actually did) count as slander or liable? The different definition are so confusing I can never keep them straight? Either way maybe we can share a lawyer and count down on costs!

Take II: (couldn’t get the full effect with out the quotes:)

Lets see does your assertion that I am admitting to have no evidence, which you base on the fact that I haven’t posted for a couple hours (I do have a life you know, okay I don’t normally, but today I actually did) count as slander or liable? The different definition are so confusing I can never keep them straight? Either way maybe we can share a lawyer and cut down on costs!

Michelle wrote (~ 8 hours ago):

> I would challenge Mr. Rifkin or any other person sharing information to do

> so in a way that accurately represents the situation so our community can

> base it’s decisions on facts instead of half truths and misleading commentaries.

We are still waiting to hear what you think Rich wrote that is a “half truth” or “misleading commentary” ….

Geez, do you guys think I have nothing better to do then sit around and blog on the Vanguard all day? Never mind don’t answer that.

Here is a link to a piece that does a pretty thorough job pointing out the “half truths” and “misleading information”.

https://davisvanguard.org/vanguard-analysis-should-voters-trust-the-council-with-more-money/#comment-219381

Michelle, this seems to be a link that comes right back to your 11:35 p.m. post that contains the link itself. I guess you meant to do that to make some point.

I’m surprised that you would charge that Rich “willfully spread misleading information” and “half truths” in his column. As I’ve read your past comments and article, I’ve found your words respectful and moderate even in disagreement. So, today seems out of character.

Referring us to David’s article doesn’t really help. He doesn’t even use “misleading” or “half truths” in his critique of Rich’s column. Adding that the Enterprise column is a disservice to community decision-making probably is farther than you intended to go. But, that’s why you shouldn’t now be surprised to have gotten feedback from others here.

David did an excellent job pointing out the misleading aspects of the piece.

Actually, David does not understand what the word compensation means. As a result, he likely misled you in that regard. However, it is me you have defamed.

I wasn’t responding to the issue of compensation, look at the genesis of the discussion. I was responding to a comment about whether the employees were receiving less – and they are. They are paying more to receive the previous level of benefits. My point had nothing to do with compensation.

I’m going to bed. If I do not reply to any comments in the next 8 hours it is because I am sleeping. Please refrain from attributing false motives to my absence.

I wonder if Michelle is still in bed?

Enough of this. Don, please remove further posts that are personal rather than substantive in nature.

So that I understand the rules…it is OK for a member of the Editorial Board to defame another poster but it is not OK for others to call her on it. Got it, thanks!

If it were not ok for others to call her on it, I would have removed those posts when they occurred. Now it’s just piling on. I hope Michelle will reply at some point, and that she and Rich can have a productive dialogue on here.

I was simply trying to stop this and focus people on the issues at hand.

I’ll speak to the lady’s defense. Mr Rifkin brought up “air time”. By legislation previously passed, that ended effective Jan 1, 2013. So, his reference was not a lie, but it was not the complete truth either.,

And that posting was not meant as a personal attack, but trying to speak facts/truth.

Michelle, don’t you know that Rifkin is always right and righteous and if we disagree, we’re just too biased, ignorant and/or stupid to understand? Just ask him.

Our city is facing some very serious fiscal challenges. Most people, including myself, do not have the same depth of knowledge regarding these issues as Rich does. My concern with Rich’s article is that a majority of people in this town probably do not possess enough knowledge regarding our fiscal problems to put his assertions into a meaningful context.

As a relatively uniformed reader what I heard when I read the piece was that city council wants to increase taxes to pay for “fat” salary increases for employees and “cadillac health care plans”.

From the little I do know, I realized that this was not a completely accurate assessment of the situation.

I’m concerned that his piece will not lead to meaningful dialogue or solutions. Instead it marginalizes people, pitting tax payer against city employees. I don’t see how this can be beneficially in any way for our community.

Rich clearly has vast amounts of use knowledge on this subject and is clearly a good resource. Plus I think he has very legitimate and valid concerns.

What I urge him and others with this type of knowledge to do is express their concerns not in a way that creates divisiveness and distrust but instead in a way that moves our community forward towards solutions.

I will acknowledge that my statement yesterday did not do this, and I apologize for that. I’m making a concerted effort to keep my dialog on this site productive, and I thank those who help me in this effort by pointing it out to when I don’t.

BTW, city employees are taxpayers, too… those in the private sector are also often living in part on the taxpayers’ largess. SS, Medicare, farm subsidies, special tax credits, SBA support, etc.

hpierce wrote:

> those in the private sector are also often living in part on the taxpayers’ largess.

You should say “some” in the private sector are also often living in part on the taxpayers’ largess (I’m not getting SS, Medicare, farm subsidies, special tax credits, SBA support or anything else from the government)…

I said, “are often”… = “some” @ a 50% confidence level. Guess I should seek the same apology as another poster did, but not worth my effort.

Michelle wrote:

> As a relatively uniformed reader what I heard when I read the piece was

> that city council wants to increase taxes to pay for “fat” salary increases

> for employees and “cadillac health care plans”.

Thanks for the for the follow up (and the apology). I apologize if either David or Michelle thought I was getting “personal”. I enjoy reading posts from both Michelle and Rich and was interested to see what Michelle read in Rich’s Enterprise piece that was a “half truth” or “misleading”.

We can debate if paying MILLIONS more in compensation is “fat” but it looks like most of the Davis health care plans fits the definition of “Cadillac” (as a guy that pays more than $20K out of pocket for health “insurance” and finds out every year that quite a bit does not “count” toward hitting my $6K deductible when the insurance starts to pay 80% I can only dream of having health insurance as good as the Davis city employees) as defined by the ACA (see the link below from Kaiser and NPR):

http://www.kaiserhealthnews.org/stories/2009/september/22/cadillac-health-explainer-npr.aspx

According to your own citation, health premiums @ ~ 20 k is not “cadillac”… don’t understand your point.

Not many private sector jobs promise healthcare for life.

Your stated issue was “cadillac” plans… that is what I responded to. If you are paying over $20 k per year AND have a $6k deductible, you need to look elsewhere.

Actually, they do… it’s called medicare.

Or, the taxpayer-funded program in CA called Medixal… should we end that? Some City employees do not qualify for Medicare when they retire…. at “best”, many qualify for Medicare when then they turn 65… until then, most only have a 50% contribution from the City, and once they turn 65 (60, for some), the City picks up the supplement to Medicare costs.

Please stick to facts.

I don’t have a copy of the most recent MOUs, but here is what is reported in the City’s 2013 Annual Report, (pg 68) about OPEB coverages:

“Miscellaneous Employees Hired after July 1, 1996

• 60 or Over

› City pays full medical premium

› Capped at 100% Bay Area/Sac Kaiser family rate”

That is above and beyond Medicare, or what you call the supplement. The City supplies this for the employee and spouse for their lifetimes, and as Rich Rifkin pointed out yesterday, do so without any vesting period required.

Perhaps you might consider sticking to the facts as well.

Correct information. Rifkin’s mistake was failing to check with Pinkerton or Yvonne as to why the vesting option was removed from the last round of MOUs.

Good point. Hopefully they will elaborate on this particular decision at the March meeting.

I assumed I was being reprimanded too;-).

This have been a very good and very important debate. Too bad it degraded a bit to a personal level, but I think topics that are important like this tend to raise the passions and hackles of posters and that will tend to start feeling personal at some point.

I have a few points/thoughts.

First, have any of you in VG Land ever had your pay cut?

I have not. And I have never had to cut any employee’s pay for business reasons.

However, I have had to constantly cut for all but a couple of the 30 years I have been managing department, division, project and company budgets.

There are some valid reasons why cutting employee pay is relatively rare. It has to do with human nature and human motivation. The simple explanation is that it is almost impossible to maintain a level of labor effectiveness per unit after cutting individual pay. People don’t respond well to feeling like they are sliding back down rungs of the ladder of prosperity when they got used to the higher rungs. Nobody responds well to being forced to regress in their perceived progress.

Instead, here is what we do in the private-sector…

– Layoff the higher cost AND the lower performer employees that are non-essential and move the responsibilities to the remaining workforce.

– Invest in process improvement and automation to lower the labor cost per unit of production.

– Implement performance incentives in response to the added responsibilities to help motivate the remaining workforce.

– To deal with any discrimination claims, offer some severance for a release of liability. Also, change the job descriptions with the added responsibility and those that demand to stay then have to prove themselves. And if they do then great… it will be someone else that does not measure up that will be let go.

If done right what you end up with is success implementing faster-better-cheaper. Some people will complain about the social injustice of this approach… those CEOs and their corporations are just greedy constantly only caring about the bottom line and making workers work more for less. That argument is 90% bullshit. Because having worked in these companies I can absolutely refute it. The fact is that companies do not exist unless they can… one – hire and retain motivated talent… and two – make a profit. So, just like the Hostess corporation, everyone loses their job if these two things don’t happen.

What I have had happen is to have any pay increases frozen for a period of time. I have also had my benefits cut and cut and cut and cut.

Also, I do know of some cases where a company owner has asked the workforce to accept a temporary pay-cut until the company could get back to making enough to restore pay levels. There are several pretty compelling stories of this type of thing. Of course it takes a lot of trust between labor and management to pull off something like that without destroying the morale and productivity of labor.

But getting back to our city employees and their compensation… I think we are screwing up thinking we can cut the pay of existing employees without impacting the levels of city service.

And unfortunately I think this also includes some minimal cost of living increases.

Because I don’t see a way to beat the headwinds of human nature and human motivation.

So, what we need to do instead of cutting pay just to retain all those butts in seats, is to change job descriptions, lay people off, consolidate responsibility, eliminate non essential tasks and services, etc.

So what we should end up with is city employees that actually produce commensurate with their pay.

But the pension benefits have to change. And since these changes would not impact the here and now on the ladder of prosperity, the changes should not have too big an impact on employee morale and motivation. And all the city employees KNOW that their pension benefits are absurd and are at risk for being reduced.

Your benefits were ‘cut and cut and cut’, or “frozen” where you or your employees had to make up the difference when premiums were raised, or actually had to absorb the ‘existing’ contributions? Just trying to understand…

Well my DB pension benefits disappeared in the 1980s. And the company contribution to my 401k continued to decrease over time… from 10% matching down to 3% matching. Then in the 90s we started seeing the cafeteria style health insurance benefits… and as the premiums continued to rise, my employer’s contribution would rise at a much slower rate, and eventually stopped and then dropped.

The difference with this and the public sector was that none of us in the private sector had any set retirement age. So, there was no “make up the different” with respect to that benefit… we either had to save more, or we just planned to work more years.

Now with health care, absolutely. And this is one of the biggest hidden benefit enhancements in the public sector that gets very little press. Until recently, tax payers were footing ALL the health care inflation costs and the public sector employees didn’t have to contribute one dime more. Now that is changing and the din of the whining coming from those government employees is really hard to take given that the rest of us have had to adjust our lifestyles downward so that we can cover almost all of the increase in healthcare costs.

“all those butts in seats” is more than a bit gratuitous, given my experience with many city and other public employees (not counting DMV employees. LOL). Know as many ‘seat warmers’ in the private sector (by %-age) as I do in the public sector.

Show me where you think there are excess butts in seats in the private sector. I think you are generally quite wrong about this except for industries where there is some natural monopoly like for AT&T and PG&E. However, those companies operate more like a public-sector business than a private-sector business. I agree that there were more examples of this in the past, but in the last 30 years there has been a big shake up in the private-sector due to global competition. Every medium-large company, and many small businesses, in any competitive industry have implemented lean operations principles… or else they are struggling and heading toward insolvency… or at the very least they are barely treading water ready to topple at the first significant business bump in the road.

hpierce – If you check out all the industries where we are constantly discussing hyper inflation… primarily healthcare, education and government… in all three cases we have not seen a very big attempt at using automation and other business techniques to drive down the cost of labor per unit of service.

Labor is very sticky in healthcare. Until we advance robots, we will need doctors and nurses to provide care. And doctors and nurses are paid handsomely. Their labor costs, plus the cost of medication, are what is driving up the cost of healthcare far beyond the inflation index.

Education should not be as sticky in this day and age. Today, kids get more information from their phone in a week than most people got in a year going back just 30 years ago. There is no reason we continue to put so many teacher butts in seats given that 24×7 365-day per year access to almost all information known in the world. We just need to teach the kids how to use the technology, and then focus on teaching them life skills so they can be economically self-sufficient and happy in their careers.

Now government is a mess of butts in seats. There is so much opportunity for implementing lean operations and to exploit technology to drive down the cost per unit of service… that it is breathtaking that we continue to argue about the need for more money to fund all the butts in the seats.

And when you consider all of the organizations and industries where we are dealing with hyper cost inflation and competitive difficulty, those organizations and industries have the common thread of union labor.