Sacramento, CA — Facing a looming fiscal crisis that could cripple public transportation across the Bay Area, State Senators Scott Wiener (D-San Francisco) and Jesse Arreguín (D-Berkeley) introduced legislation that would allow voters to approve a new funding measure in 2026 to stabilize and strengthen the region’s transit systems.

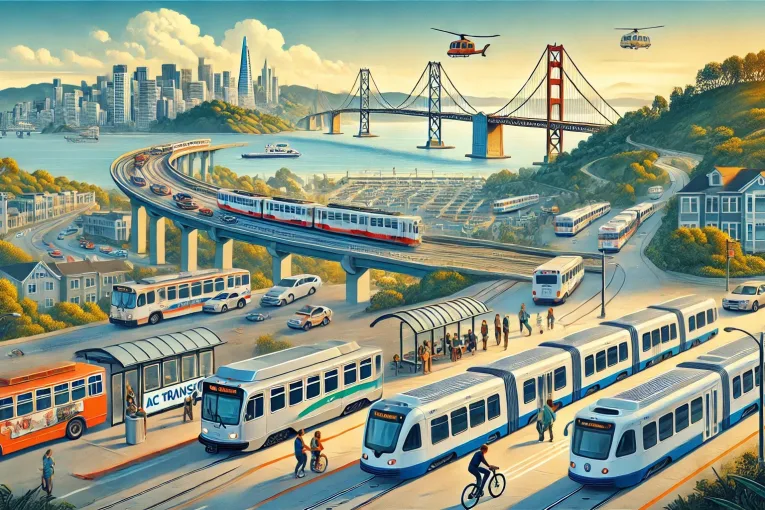

SB 63, known as the Connect Bay Area Act, would authorize a regional ballot measure to secure sustainable funding for BART, MUNI, Caltrain, AC Transit, and other transit agencies. Without additional support, officials warn that drastic service cuts—including BART running trains only once an hour and eliminating weekend service—could begin as soon as 2026.

“Strong, reliable public transportation is essential for our economy, our climate goals, and our quality of life,” Senator Wiener said. “SB 63 gives the Bay Area a pathway to avoid devastating cuts that would cripple our region and worsen inequality and congestion.”

The bill comes as transit agencies confront a financial cliff worsened by the pandemic’s lingering impacts on ridership and fare revenue. A temporary $1.1 billion infusion from the state in 2023 postponed service reductions, but that funding runs out in mid-2026. Senator Arreguín is also pushing for $2 billion in this year’s state budget to help agencies bridge the gap until a voter-approved measure could take effect.

The lawmakers warned that without new funding:

• BART could lose up to 85% of service;

• MUNI could slash service by half and end most routes after 9 p.m.;

• Caltrain and AC Transit would face major cuts;

• Congestion on the Bay Bridge could spike by 72%;

• Air quality could worsen with millions of extra car trips;

• Students, workers, seniors, and low-income riders could lose vital access to transportation.

The authors believe that the damage would ripple through the economy, making it harder for businesses to attract workers and customers, students to reach school, and families to access healthcare.

“As someone legally blind and transit-dependent, I know firsthand that public transit is not a luxury—it’s a necessity,” said Congresswoman Lateefah Simon. “Service cuts will hurt the most vulnerable people in our communities and make inequality worse.”

Despite financial challenges, transit agencies have made significant progress in recent years. BART has reduced crime by 17% year-over-year and kept cost increases below inflation. MUNI earned its highest rider satisfaction in 20 years after cutting subway delays by 76%.

San Francisco Mayor Daniel Lurie said the region must pair funding with reforms. “A thriving San Francisco needs affordable, reliable transit to connect people to jobs, school, and healthcare. We need to fix this before it’s too late,” Lurie said.

If passed, SB 63 would put a sales tax measure on the November 2026 ballot in San Francisco, Alameda, and Contra Costa counties, with an option for San Mateo and Santa Clara counties to join. The default tax rate is set at half a cent, though San Francisco could increase it to one cent for MUNI support. Final rates and a detailed spending plan must be approved by July 2025.

In addition to raising revenue, SB 63 demands better financial oversight and efficiency from agencies. BART, MUNI, Caltrain, and AC Transit would undergo independent financial reviews and be required to implement cost-saving reforms. They must also comply with regional coordination plans led by the Metropolitan Transportation Commission (MTC).

Laura Tolkoff of SPUR, a Bay Area urban policy group, praised the bill’s mix of funding and reform. “This is the kind of smart, forward-looking investment we need. These transit systems carry 80% of Bay Area riders — their survival is essential to our economy, equity, and sustainability.”

SB 63 is co-authored by Assemblymember Catherine Stefani (D-San Francisco) and is expected to be heard in committee later this spring.

There is a point where the populace can be considered overtaxed, and it typically happens when taxation leads to significant economic hardship, reduced incentives for productivity, or widespread dissatisfaction. Here are some key indicators that taxes may be too high:

Diminished Disposable Income – When people have little money left after taxes to cover necessities and discretionary spending, economic growth can slow.

Reduced Work Incentives – Excessive taxation on income or profits may discourage people from working more hours or starting businesses.

Capital Flight and Tax Evasion – High taxes can push businesses and individuals to move their money or operations to lower-tax jurisdictions.

Growth of Informal Economy – If tax rates are too burdensome, people may turn to off-the-books work to avoid them.

Public Backlash and Political Instability – Historically, excessive taxation has led to protests, tax revolts, and even revolutions (e.g., the Boston Tea Party or the French Revolution).

Laffer Curve Effect – At a certain point, higher tax rates can lead to lower overall tax revenue because people change their behavior to avoid taxation.

Finding the right balance is key. Governments need enough revenue to fund public services, but excessive taxation can backfire by stifling economic activity and eroding public trust.

This is absurd that we have spent billions on transit systems only to have them be cut back to the point that they will have frequency cut to the point that the systems are not usable. But the systems have done this to themselves. BART has the most-ridiculously-overpaid transit employees in the country. In addition, wasteful investment projects like the deep-bore under San Jose, the Chinatown light-rail and BART to the airport (in the way it was built, not the concept) fleece taxpayers of millions, while cheaper solutions are ignored. On top of that, Biden’s billions sustained transit systems nationwide at far too high a level of service when it wasn’t needed — as a jobs program pushed by the public-employee unions — and those billions are running out as just as transit ridership is recovering and the service is needed. The whole thing is going off a cliff in a flaming, catastrophic fail.

Without massive reform, which is probably impossible due to the unions, I can’t see the public supporting this tax on top of the other tax increases and on top of inflation (which is a massive, indirect tax). My passion is public transit, but I can’t see this tax passing, and I don’t know that it’s appropriate to bail out the continued waste and the embracing of a suicidal jobs program that was doomed to long-term failure. Unfortunately, the service cuts will render the systems unusable as convenient transit and result in a revenue death spiral. I don’t see this ending well for public transit.