The public has focused during this budget cycle, to the extent that they have focused at all, on the impact of the nine layoffs of DCEA (Davis City Employees Association) employees and, in particular, the tree trimmers. However, while the council unanimously moved forward with a heavily austere budget, the most alarming piece of news was on the OPEB (Other Post-Employment Benefits) front.

The public has focused during this budget cycle, to the extent that they have focused at all, on the impact of the nine layoffs of DCEA (Davis City Employees Association) employees and, in particular, the tree trimmers. However, while the council unanimously moved forward with a heavily austere budget, the most alarming piece of news was on the OPEB (Other Post-Employment Benefits) front.

For some time, the city has been working to deal with its $60 million unfunded liability on retiree health care benefits, after new accounting practices under GASB-45 showed that the city’s liability, by simply paying for the benefits as the bills come due, would push the city heavily toward bankruptcy by 2030.

Instead, the city has been trying to pay its way into fully funding the liability in advance. This year, for the first time, the city will be paying enough to get us into the position to have the fund fully funded within twenty years.

However, rising health care prices are threatening to undo that, and for the first time, the city manager on Tuesday announced that while the city had reached the 20% percent level, a level that will enable us to reach full funding, this number will have to rise.

Currently, almost two-thirds of what we pay are going toward existing retirees.

“We have some daunting obligations for the 200 plus employees who are already receiving benefits,” City Manager Steve Pinkerton told the city council on Tuesday night.

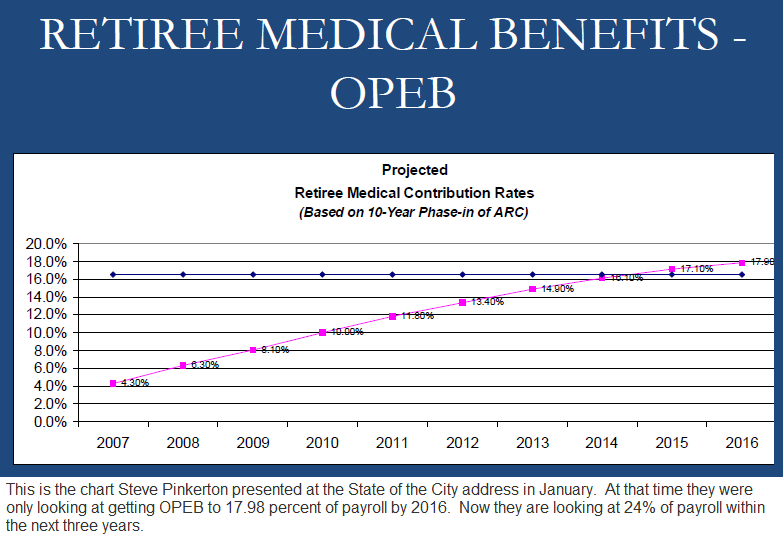

“Unfortunately, 20% of payroll is probably not going to cut it in the future,” he said. “We’ve been ramping this up, the council has been responsible and doing the right thing for the last three or four years by beginning to take on retiree medical, ramping it up each year from 6% to 8% to 10%, last year it was 12% of payroll, the original plan was to go 14%…”

“We’re recommending based on some input we got earlier this year to go all the way up to 20%,” he continued. “The reality is that you’re probably going to see a discussion soon where we’re going to have to ramp it up eventually to closer to 23-24 percent.”

According to the city manager, 17% of payroll under that scenario would go toward existing retirees while another 7% would be put away for future retirees in an effort to eventually fully fund the plan.

The problem is, we are talking about nearly one-quarter of the payroll going toward funding health care for retirees.

That percentage is likely to rise as the city continues to contract payroll.

One of the real questions is whether this is really a sustainable practice.

The Vanguard received from the city manager breakdowns of the current obligations, which can be seen twofold.

First, the city pays the full health insurance plan for retirees who are not Medicare-eligible. That means that they are under the age of 65.

Second, the city supplements the Medicare plan with its own plan as well.

The individual plans vary, but at the basic level the city pays up to $1587.14 a month for those under 65 and $833.43 for those eligible for Medicare.

The more typical rate for those under 65 is considerably lower, however. The typical premium for those under 65 is $600 for single, $1100 for couple and $1500 for family. However, some singles opt for a plan that is a little over $1000 per month.

Typical premiums for Medicare-eligible are $400 for single, $770 for a couple and $1150 for family.

Currently, the city is paying for 135 pre-Medicare retirees, which includes 52 single, 56 couple and 27 family.

The city also has 83 Medicare retirees, including 41 single, 38 couple and 4 family. Also, there are 21 retirees not on a plan. Many of those are covered by a spouse.

According to an email from City Manager Pinkerton, “Current 10-year projection for percent of payroll for full amortization is estimated at 23% to 25% of total payroll at stabilization. Exact number will fluctuate depending on interest return on money that has been set aside each year and in actual change in payroll.”

The total OPEB liability is now estimated at $65 million with $40 million of that for existing retirees.

The Vanguard believes that paying nearly one-quarter of payroll for health care for those who have retired or will retire is unsustainable in the long term.

If the public wants to focus on the level of service that the city provides, if is concerned about cutting the budget for tree trimmers, then it needs to look more closely at how we spend our money.

These numbers show the glaring need for reform. There appear to be two areas where the city could save money on this.

We have often mentioned the age of retirement with regard to pensions. Currently, the city has set the retirement age at 50 for public safety officials and 55 for the rest.

CalPERS (California Public Employees’ Retirement System) then calculates pensions based on years of service multiplied by the ending salary. If one retires at the age of 50 or 55, that leaves the employee a certain amount of years for which they are given that pension based on the formulaic calculations.

As people’s longevity has increased, the pressure on the fund has increased as well. By delaying the age of retirement, however, the pressure can be reduced.

With regard to health care, the calculation is more straightforward. Raising the retirement age means reducing the number of years that the city would have to cover the employee before Medicare kicks in at 65.

Raising the retirement age, even by just five years, would cut the obligation of the city to non-safety employees in half, and to safety employees by one-third.

The other question is whether the amount the city pays to Medicare-eligible employees is optimal.

We are talking about a huge chunk of money that the city is having to pay to honor past obligations that were not funded by past city management or councils. We do not believe that a vital city can continue to put that large a percentage of money into retirement benefits to its employees.

That is money that is not going directly to services and is contributing to the need to lay off current employees in order to pay the health care of past employees.

That is a policy that desperately needs reform.

—David M. Greenwald reporting

The problem clearly starts here: $1587.14/month. That number is way too high. It is astoninshing to me that there is opposition to health care reform. I’m not advocating for one type of reform over the other, but it’s obvious to me that we as a society must drive that number down. How can anyone, or any organization, afford it? We’re paying just as much for healthcare as housing.

-Michael Bisch

[quote]Currently the city has set the retirement age at 50 for public safety officials and 55 for the rest.[/quote]This is somewhat untrue. PERS sets the ‘eligible for retirement’ age. It is 50 years of age. For non-safety city employees, they have less than a 2.5 % benefit factor, unless they retire at 55 or older.

[quote]If one retires at the age of 50 or 55, that leaves the employee [b]a certain amount of years[/b] for which they are given that pension[/quote]Untrue. The benefit ends when the retiree ends. No sooner [and if the retiree chose a reduced benefit to provide for a spouse, it continues until the spouse passes].

It is interesting to note that you do not touch on the fact that, up until 2009, the city would only pay 50% from retirement to age 60, when the 100% contribution kicked in. And, if an employee separated from the city prior to retirement, they would have NO city contribution toward the retiree medical when they did, in fact, retire.

[quote]It is interesting to note that you do not touch on the fact that, up until 2009, the city would only pay 50% from retirement to age 60, when the 100% contribution kicked in.[/quote]The forgoing is true for employees hired AFTER ~ 1986. Pre-’86 employees had their 100% contribution begin upon retirement, regardless of age.

The current MOU’s have complicated provisions, until 2014

[quote]With regards to health care, the calculation is more straight forward. Raising the retirement age, means reducing the number of years that the city would have to cover the employee before Medicare kicks in at 65.[/quote]

Perhaps I don’t understand, which is entirely possible. But if the city has to pay for an employee’s health insurance when they are employed, or if they are retired, I’m not getting how changing the retirement age would save the city money. Help me to understand…

Why would the city NEED to pay for a Medicare eligible retiree’s FAMILY? Doesn’t make sense. Also supplemental Medicare rates you stated seem very high.

I found it interesting that so much public comment and CC angst was about the tree trimmers. Although sympathetic I think the others who make up the 29 layoffs are tragic also. Is it just that we don’t know the detail about them yet? And do any of the 29 include management?

[quote]The problem clearly starts here: $1587.14/month. That number is way too high. It is astoninshing to me that there is opposition to health care reform. I’m not advocating for one type of reform over the other, but it’s obvious to me that we as a society must drive that number down. How can anyone, or any organization, afford it? We’re paying just as much for healthcare as housing. [/quote]

I had the same reaction. Part of the problem is that health insurance plans usually have relatively small deductibles, say $250 or $500. The monthly costs can be reduced dramatically and become much more affordable with higher deductibles of $1000 or so.

Michael B raises some interesting issues: the cost of medical car; the profits of insurers; the fact that the medical system needs to make up the cost of care for the uninsured, by putting that money into the unit costs for those who have insurance; the fact that the PERS plans do not exclude pre-existing conditions… how many morbidly obese public employees, or smokers, etc. are in the “pool” of those insured by PERS?

Health Care Reform seems to have survived the Supreme Court. That is great news!

To the Other Downtown Michael: Agree with your comments

Anyone wishing to discuss the SCOTUS decision can go here: Bulletin Board Topic Thread ([url]https://davisvanguard.org/index.php?option=com_kunena&func=view&catid=2&id=683&Itemid=192#683[/url])

[i]”Raising the retirement age means reducing the number of years that the city would have to cover the employee before Medicare kicks in at 65.”[/i]

Here is the solution I have suggested to Mayor Krovoza and others on the Council to solve about 75% of the $60 million OPEB liability:

1. If someone retires at age 65 or later, his or her medical premium (single, couple or family) is paid for entirely by Medicare and the City’s subsidy for the rest of the retiree’s life;

2. If someone (who is not disabled on the job) retires under 65 and is eligible for a PERS pension, the City will contribute the minimum amount ($117/mo.) for the retiree toward his or her CalPERS medical plan, but the retiree is responsible for every dollar over the minimum amount. Once these young retirees reach age 65, they will be treated the same as those who retired at 65 or later. This change gets rid of 95% of the cost of OPEB for all of our retirees who are under 65.

Perhaps the most important aspect of this change in terms is that it will discourage early retirements.

[i]”Raising the retirement age, even by just five years, would cut the obligation of the city to non-safety employees in half, and to safety employees by one-third.”[/i]

I infer from this statement you mean to say that we need a new second tier pension formula for new hires. For safety, move them from 3% at 50 to 2% at 55; and for non-safety new hires, move them from 2.5% at 55 to 2% at 60.

That is the only way the City can “raise the retirement age.” I agree with this reform. It is one of the many I have put forward.

However, keep in mind that these formulas don’t set a retirement age per se. They simply set an eligibility limit for receiving a pension. And they are not exactly what they seem. A person who is on 2.5% at 55 does not have to retire at 55. She could stay on to 65 or 70, if she wants to and can still do her job. Or, on the other hand, there are plenty of cops and firefighters on 3% at 50 who, when they get to about age 48, they purchase 2 years of “air time,” and they can then retire, even though they are still 2 years under 50. What most of these “retirees” then do, is they go to work for other public safety employers who are not a part of the CalPERS system. Locally, Sacramento County is a good example. A Davis cop could “retire” very young and could start getting his full pension and his medical benefits and at the same time make an even larger full salary from Sacramento County as, say, an investigator for the Sacramento DA’s office.

Elaine” [i]”But if the city has to pay for an employee’s health insurance when he is employed, or if he is retired, I’m not getting how changing the retirement age would save the city money.”[/i]

The reason is the City now has to pay the full medical costs for the retiree and for the person who replaces him. And if the person who replaces him is say 50 years old and retires 5 years later, the City will likely have to cover this expense for the first retiree, the second retiree and the last employee, all at the same time.

That added expense is avoided if the original worker would not have retired so young.

Moreover, there are a lot of institutional costs to rapid turnover of the workforce brought on by early retirements. Think about police investigators. They learn a hell of a lot on the job as patrol officers and doing other duties over 20 years or more on the force. But if we encourage them to retire at age 50, we are getting rid of the people who are best qualified to investigate crimes, and probably to pass on community and technical knowledge to all the younger officers. And I am sure such knowledge gained with age is lost in many other departments where the employees are encouraged to retire before they are too old to do the jobs they do.

[quote]The reason is the City now has to pay the full medical costs for the retiree and for the person who replaces him. And if the person who replaces him is say 50 years old and retires 5 years later, the City will likely have to cover this expense for the first retiree, the second retiree and the last employee, all at the same time. [/quote]

How often does this scenario happen?

Probably not so often. Particularly since the last several rounds of retirees have not been replaced.

[i]” Particularly since the last several rounds of retirees have not been replaced.”[/i]

Yes and no. Every public safety retiree–the ones most likely to retire young–has been replaced.

When you think of the person who is currently working and is receiving a salary and a large medical benefit and will stay employed for the City of Davis for 30 years. At the same time you think of the retiree who had his same job and will live for another 30 years and now gets a full pension and he gets a full medical benefit. When you put those two together, you get the idea that the taxpayers are paying twice for the same position.

If, on the other hand, the retiree stayed on the job for another 10 years, that gets rid of a lot of the cost.

Agree with Rifkin’s retirement adjustment proposal; except I would raise the eligibility age by 10 years, not 5.

Also; if your eligibility age is 65; you are welcome to retire at age 60 or sooner; but will not start receiving pension benefits until age 65. Better have some savings or find other work until age 65, like the rest of us.

Rich: [i]” For safety, move them from 3% at 50 to 2% at 55; and for non-safety new hires, move them from 2.5% at 55 to 2% at 60.”[/i]

Jimt: [i]”Agree with Rifkin’s retirement adjustment proposal; except I would raise the eligibility age by 10 years, not 5.”[/i]

One thing to keep in mind is what it means to go back* to 2% per year, as opposed to 3% for safety and 2.5% for non-safety. A reason why a cop would choose to retire at age 50 (assuming he was hired first at age 20) is that he has reached his max pension of 90% (that is, 30 years x 3%/year = 90% of his highest yearly salary**). But if that cop were on a 2% at 55 formula, his pension at age 55 would start at 70% (35 years x 2%) of his highest salary. That is still good, but it’s not quite the incentive to leave work as a max pension is. So the cop on 2% at 55 is more likely to want to stay on the job to age 60 (where he’d get an 80% pension) or even 65 (90%).

*Under state law (I am told) it is illegal to reduce the pension formula for existing employees. So once we give someone 3% at 50, we cannot change that to 3% at 55 or 2% at 50 or to anything less generous than 3% at 50. All we have the power to do is to reduce the formulas for new hires, and that, of course, needs to be done in the labor contracts.

**In Davis, we no longer base the starting pension on the highest year of salary. That was amended last year in all contracts (but maybe not DCEA) to the average of the highest three years. The idea is to avoid pension spiking, a problem we have not had in Davis from what I have seen. Here is the new language from one contract: [quote] … effective March 1, 2011, CITY and EMPLOYEES agree to amend the miscellaneous 25 employees’ CalPERS Contract to reflect Highest Three-Year Average PERSable compensation as the basis for calculating retirement benefits (instead of the single highest one year). [/quote]

The only REAL problem with health care in this country other than denial of coverage for pre-existing conditions which enjoys bipartisan support for fixing, is that it is TOO EXPENSIVE.

Reduce the cost, including improved choice for affordable insurance plans, fix the damn economy so more people are working…. presto, we solve 80% of the problems. And the Pareto Principle says that we will likely never make our health care system more than 80% perfect.

Of course there are several reasons it is expensive. A primary one is the fact that we have the most advanced and accessible system in the world with a strong population of people with the means to pay for good health insurance. Another is the geographic dispersion of a large population expecting top levels of quality and access. A third is a large population of poor people that don’t pay for health care and have higher than average utilization of emergency rooms. A forth is an aging population. A fifth is a boatload of suffocating government regulations. A sixth is our hyper-active-lawsuit tort system that causes medical malpractice premiums to be the highest in the industrialized world. A seventh is the higher education requirements to become a practicing medical doctor. An eighth is the lack of competition among insurance carriers, and limited choice of plans.

The ninth is one that gets little attention… it is the inflated cost of union labor in the medical industry. The cost for nurses, technicians and administrative staff has skyrocketed. Thinking about the irony that unionized employees in the medical industry are driving up costs from pay and benefit inflation far exceeding the CPI, and other public-sector union employees find their health care benefits at risk because of this combined with the fact that their pay and benefits have also inflated much greater than the CPI.

On a related note, I read that the federal Government Accounting Standards Board is about to release revamped rules causing public pension funds to have to count costs sooner, and to use more conservative estimates. They take effect in 2013. I don’t know what the impact will be to the State, but from what I can tell, it is another potential hit to our city finances.

Re: Social Misfit:

“The cost for nurses, technicians and administrative staff has skyrocketed.”

Would be interesting to see some stats on that; I wasn’t aware of it (but I don’t doubt it).

I remember hearing somewhere that the vast insurance company involvement in the health care loop ends up accounting for about 1/3 of the costs of healthcare in the USA. Can any Vanguard readers confirm or refute this?

jimt,

First, I am giving up SocialMisfit and going back to my real name. I think once a person posts with their real name, it is not too satisfying doing so with a fake name. Besides, my writing style is not easy to mask at this point.

I don’t think you are correct on the point about insurance costs taking 33% of the total. I think the last I read was that insurance accounted for about 6% net costs.

I am old enough to remember the first discussions about health care costs escalating. It was the late 1970s and early 80s and HMOs grew and knocked the rates down for a while. Managed care was the way we all thought costs could be contained. And it was for a while. Now it accounts for about 6% of the total cost.

The big ticket items are hospitals (31%), physicians/clinical services (20%), and prescriptions drugs (10%).

US nurses make the highest compensation of all nurses globally. They also work the fewest hours. US medical technicians are also the highest paid in the world. I will look for references and post them.

Frankly, everywhere we look it is the high cost of labor that is killing us. Health care and education are two labor-intensive professions. So is law enforcement and firefighting. I argue that these industries have rejected automation and efficiency improvements while also leveraging collective bargaining and union-funded politicking to ramp up compensation. They have done this while private-sector labor has done exactly the opposite. Medwoman argues that private sector labor has had pay and benefits deflated from greed at the top, and if those greedy CEOs were paying labor what they should, there would not be a discrepancy between private-sector and public-sector pay. The problem with that argument are two-fold:

1 – [b]It ignores global competition[/b]… the fact that US labor has to compete on price, and larger global markets produce greater profits simply from economies of scale. For example, J. K. Rowling made billions instead of millions selling books internationally instead of primarily relying on her domestic market sales. Of course today authors are seeing their pay per book reduce from the change to electronic book sales. Eventually more books will be sold electronically, and the most popular publications will probably even make more money for the top authors… even as fewer people will be employed in the publication industry.

2 – [b]It is unsustainable[/b]… It would be one thing if the compensation of public-sector labor simply kept up with inflation while private-sector compensation declined. However, it escalated at a much higher rate than the CPI. Our state revenue per GDP has remained about flat. At a national and state level government is taking about the same percent from the economy as we have been for the last 60 years. However, as the economy has expanded, government has collected a lot more dollars. The problem is that government has continued to spend more than it has taken in.

For reasons I don’t completely understand, the medical industry runs more like government than it does a private-sector industry. There is limited consumer choice. There is limited competition between insurance carriers and health care providers. Labor is over-compensated and resistant to constantly revamping and re-engineering service delivery to a lower price-point.

Kaiser has an interesting business model that pays lower compensation to employees and constantly innovates its service delivery model. However, most other providers seem to operate without a similar strategy. Like other public-sector business, they try to hold on to the status quo until it crashes all around them… and us.

Jeff,

Good to have you back as Jeff!

Interesting stats on health care; I guess I was misinformed about net insurance costs; although if I have time I’ll see if I can find a thorough independent (3rd party) economic analysis of this.

re:’ For reasons I don’t completely understand, the medical industry runs more like government than it does a private-sector industry.’

It seems to me some possible reasons for this are: (1) cumbersome and byzantine system of regulations that have developed over the years (2) same for liability (3) the insurance companies and health care providers are each effective oligopolies; and have a lot of political pull.

Perhaps revamp and streamlining of regulations, and some tort reform are called for; to deal with (1) and (2).

I think dealing with (3) is more problematic. One thing about “Obama’s” health care package; it ensures the insurance companies (and health care providers) get more paying customers.

Jeff,

Forgot to mention that the insurance and health care giants might not want to address problems (1) and (2) in my post above; in fact that may benefit from increased complexity. Having such a horrendously complex health care system constitutes a very high hurdle for any newcomers to the health care market; such a high hurdle that I suspect it keeps most potential competition away (except in niche markets; specialized clinics, etc.).