Whether industrial or service, jobs become “good” only because of coordinated pressure from workers.

By Claire Goldstene

Current campaigns across the United States to unionize service workers reflect a decades-long transformation, as service-sector employment outpaces that of manufacturing. But these efforts also occur amid a common mindset that too easily associates rates of pay, benefits, and job security with the nature of a particular job. Consequently, the prevalence of low wages, a lack of benefits, and sporadic and unpredictable schedules, so characteristic of the service economy, especially as compared to factory work, are regularly explained as inherent to this kind of labor. But such a view promotes a nostalgia about manufacturing jobs devoid of historical context. Poor working conditions are not intrinsic to service work itself, just as the decent pay of mid-twentieth century factory jobs was not intrinsic to that work. Rather, it resulted from coordinated pressure to make these jobs “good.”

Stagnant, or even declining, real wages for many over the last three decades, along with the expansion of temporary employment as normal, has prompted an understandable tendency to lament the loss of industrial jobs that offered long-term financial security and that allowed parents to reasonably expect a better economic future for their children. (This wistfulness, however, routinely fails to recall the nature of manufacturing work — usually dangerous, monotonous, and physically demanding.) Yet for many years those aspects of industrial work so yearned for today did not exist. Indeed, they followed from long-fought battles on the part of workers and their progressive allies.

As the United States became an increasingly industrial nation in the years after the Civil War, and prior to the establishment of any national social safety net in the form of unemployment insurance, workers’ compensation, Social Security, or Medicare, factory work, much of it performed by newly arrived immigrants, was typically low-paying, subject to few, if any, safety regulations, often seasonal, offered little promise of advancement, and meant 10-12 hour workdays, six days a week. Laborers also experienced diminished workplace autonomy and were frequently viewed as mere appendages of a machine.

In response to these conditions, workers began to organize. Owners, of course, resisted. Nineteenth-century opponents of labor reform argued, variously, that wages were set by the free market; that proposed regulation in regard to pay and hours constituted an inappropriate, and potentially dangerous, intrusion into the natural workings of the business cycle; that government regulation of employer-employee relations undermined the liberty embodied in a contract freely entered into by two independent entities; and that meeting demands for higher pay and reduced hours, such as the 8-hour day, for example, would cripple economic progress.

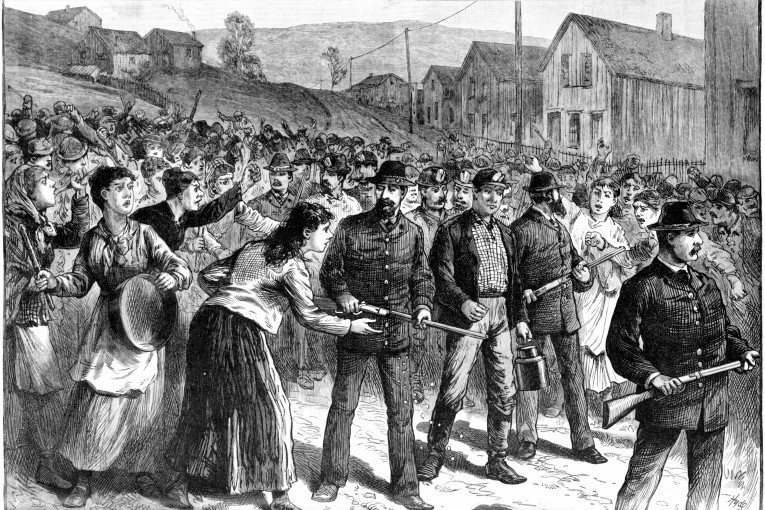

Successful efforts to remake poor and dangerous factory jobs into “good” jobs involved the formation of national labor unions, worker actions in the form of strikes and boycotts, violence between laborers and police, lobbying legislators, and galvanizing public support, which regularly entailed drawing attention to the vast disparities of income so characteristic of the American economic system. Ultimately, these goals were realized (particularly for white males) following enactment of the Wagner Act in 1935, which allowed for collective bargaining; passage of the 1938 Fair Labor Standards Act, which standardized the 40-hour work week and overtime pay, and established a minimum wage; and through a post-World War II accord among organized labor, business, and government to more broadly distribute wealth as beneficial to all. The current reminiscing about “good” factory jobs is, really, a nostalgia for the working conditions and pay made possible by decades of union struggle.

Certainly the policy choices that followed the election of Ronald Reagan in 1980 and continued through the first part of the 2000s — tax breaks for the wealthy, industry deregulation, the weakening of labor protections, and new obstacles to forming workplace unions — undid much of these gains for workers, widened the gap in wealth to levels not seen since the first Gilded Age, and saw the greatest job growth in sectors epitomized by low pay and little-or-no job security. But this part of history need not be an inevitable part of the present transition from manufacturing to service-sector employment. Just as factory jobs were made into “good” jobs in the 20th century, so too service sector jobs can be made “good” in the early years of the 21st century.

Claire Goldstene has taught United States history at the University of Maryland, the University of North Florida, and American University. The author of The Struggle for America’s Promise: Equal Opportunity at the Dawn of Corporate Capital (2014), she can be reached at claire.goldstene@yahoo.com.

“Consequently, the prevalence of low wages, a lack of benefits, and sporadic and unpredictable schedules, so characteristic of the service economy, especially as compared to factory work, are regularly explained as inherent to this kind of labor.”

It seems to me that compensation and working conditions ( especially hours and benefits) are rarely inherent to the kind of labor being performed. Nor are these conditions imposed by some kind of mythical “market force”. Market forces are merely a descriptive of the summation of the individual decisions made by business owners as to what compensation that they are willing to offer their workers. These decisions are not made by an anonymous and objective “market” based on worth, but rather they are made by individuals acting in their own best interest.

Likewise, there is nothing inherently better about the work done by a surgeon than that done by the person who sterilizes the equipment ( both jobs are essential to the well being of the patient ). What we have done is to create an arbitrarily assessed system of compensation providing vast wealth to those at the top of the economic food chain while often not providing enough to live on for those at the bottom, even if their work is a valuable contribution to the society.

There are several ways that we could address the issue of inadequate compensation to sustain those at the bottom of the economic scale, fully employed but not making enough to live on. We could do this in the traditional adversarial system in which those lower on the scale have to fight those higher up in the form of “union vs management”. Or we could choose to do this by providing a base beyond no one who is contributing to our society falls. This would provide a floor beyond which one could not fall economically not a ceiling beyond which one could not earn. I am sure that there are many other options that could be explored if we were not so ideologically wedded to the idea of “free market capitalism” as the best and only way to proceed. But of course that would involve open minds, willingness to think outside of our current economic box, and perhaps most of all, a willingness to let go of our hierarchically structured social paradigm of material wealth as the sole measure of success in our society.

Tia-Wages are paid depending on skill level. As a consumer I am willing to pay a Board certified doctor from Stanford more to operate on me than someone who dropped out of high school. That is because there is a high level of skill required to operate on someone. On the other hand I would be willing to pay them both the same amount to sterilize the equipment before the operation because of the low skill level required in completing that task. Both jobs are important, but only one is worth paying a little extra to get a well trained individual to complete. That is what they call the “mythical market force”, when a consumer is willing to pay more for a higher skilled individual to complete a task.

Sam

“Wages are paid depending on skill level.”

I completely agree that this is how wages are determined now. This is not set in stone. It is what we have done traditionally. I do not believe that this is how things have to be. I do not believe that we cannot re evaluate whether or not this produces the best outcomes for our society just because we were all taught in school and by our society that this is indeed the best. I am asking people to envision a different possibility. One that I feel would improve not only our social well being, but also our financial well being in the long run.

So we currently choose to pay based on skill level. But what if instead we chose to pay by hour contributed. Then all individuals would have a set amount of money that they could then pour back into the community in terms of their increased purchasing power since there are more lower skilled people than there are highly skilled people. With the lower income group having more discretionary purchasing power, there would be a boost to the economy as well as a decrease ( or elimination ) of people living on the economic edge through no fault of their own ( namely the lower middle class and working poor).

Just because we don’t do it, doesn’t mean that it is not possible.

I’d like to see you describe how you intend for society to make this transition.

“It seems to me that compensation and working conditions ( especially hours and benefits) are rarely inherent to the kind of labor being performed”

So you believe that people are paid by skill level, but you don’t think people are paid for the kind of labor being preformed?

Tia: here you demonstrate profound ignorance of the topic.

Workers trade their labor value for pay. Market forces set the pay level to the current market value of specific types and classifications of labor.

The same is true for commitities. Market forces set the price level to the current market value of the types and classifications of the commodity.

Workers own their skills and labor. They can trade it to the highest bidder.

Frankly: here you demonstrate profound arrogance typical of a priviledged white boomer who was given an almost free, high quality education paid for by the state and whose business now enjoys economic benefits (roads and bridges, police and fire protection, advantageous tax breaks) which benefits are still to be paid for by the X and Millenial generations.

It used to be that workers were indeed free to trade their labor value for pay. If their demands were not met by userious business people, the unions could organize and strike. Despite union busting efforts and violence waged on the workers by the rich white boys club (and please don’t try your worn out method of rewriting history to claim those atrocities never existed), organizing workers succeeded in elevating countless millions to middle-class status by the 1970s – probably your parents among them.

But then the boomers like yourself took over the generational reins in the 1970s and have been perverting the economic system to benefit them disproportionately ever since. As long as you and your business continue to suckle on the government teets though tax breaks and advantages obtained only by allowing the government to pile on debt to be paid by the next generation, please give us all a break and do not lecture others about the “rights” of workers or your perverted sense of the fairness of the “market”. It is only “fair” to [edit] like you who got in early enough to benefit from the rip-off we are shoving down the throats of the next generations.

[moderator] edited for language. Please be civil to your fellow Vanguard participants

Alan- While I agree that we should not be funding current government expenses with debt, I am bit confused why you think that people are no longer able to trade their skilled labor for pay.

Sam – The macro reasons are discussed in the article above. “the weakening of labor protections, and new obstacles to forming workplace unions — undid much of these gains for workers, widened the gap in wealth to levels not seen since the first Gilded Age, and saw the greatest job growth in sectors epitomized by low pay and little-or-no job security“

So you believe the only way to freely trade your labor skills is though a union? What about the workers ability to choose a different company to trade their labor with? I understand back when Carnegie forced his workers to work under terrible conditions there were few options for them to find employment elsewhere, but now workers can easily find information about companies including what they pay and how they treat their workers and make a choice to change jobs.

Funny – you and I agree with some of what you claim here, but you have the cause and effect all wrong. I’m no fan of Baby Boomers. I am a back-end Boomer… they pretty much strip bare the fields before I can get to them. I too am pretty pissed about what we are doing to wreck the future for young people.

But unionization as the solution? PEEAALLEEAASSEE. Unionization is a primary source of the problem.

It is the forced inelasticity of domestic labor that causes business to go elsewhere. Unfortunately underdeveloped humans get their emotions all wrapped up in their work.

Are you miserable in your job? Not paid enough relative to your value? Think the company is screwing you? Then why in the h _ _ _ don’t you quit and work somewhere that better satisfies you?

Some workers tend to be lazy and change-averse when it comes to bettering their individual circumstances. Instead they refuse to flex and instead stay put and complain and organize and attempt to force the company to adopt their inflexible position.

And so Ford moves its manufacturing to Mexico.

And now you – a good union man – blame Ford for that too.

Baby Boomers are certainly blame-able here. But unions and the politicians that support them and benefit from them are the biggest contributor to the lack of individual economic opportunity in this country. Pushing for greater unionization will just screw our kids even more.

So, Alan Pryor, are you a “boomer”? If yes, are you one of the “self-hating”/mea culpa/ other folk? Or if not, are you one of the “Gen-X”?

The word is “teats”.

Am on the tail end of the “boomers”… actually, from a ‘bust’ year, where there were more babies in the year before, AND the year later than me.

Excuse me, but “boomers like yourself took over the generational reins in the 1970s and have been perverting the economic system to benefit them disproportionately ever since. ” B*******. This (boomer) generation and those in the early part of the following, have been the most generous in supporting (and dying for) the civil rights movement, and (still) making financial contributions towards social/welfare causes. Get your head out of the appropriate orifice. (or, the now banned plastic bag)

Your comments are wrong and, quite frankly, infantile, and devoid of history.

Frankly

I do not dispute that this is the commonly held belief and the under pinning of our current system. I am not ignorant of the fact that this is how we do things now. I simply do not believe that because this is our current paradigm that it is how things have to be. Your accuse me of being change averse, and yet you are completely unwilling to consider any change to the current status of our economic system which you pretend to be fixed as opposed to chosen by our society.

Is this kind of speak allowed on the Vanguard? [edit]. Why is this allowed to remain posted?

[moderator] Missed that one completely. Thanks.

Edit: by the way, don’t hesitate to use the ‘report post’ button. It brings up an alert that I see faster than when I’m scrolling through comments.

I’ve tried the report button many times and found it useless.

Alan

“though tax breaks and advantages obtained only by allowing the government to pile on debt to be paid by the next generation”

I think that Donald Trump through his own statements has epitomized this comment. When he was asked directly about his two major bankruptcies from which he emerged financially unscathed, but which doubtless had adverse consequences for those further down the economic food chain, his response was “I took advantage of the existing laws.” He has also taken advantage of the laws which have allowed him to locate his garment production industries abroad including in China which he vilifies all the while while profiting immensely himself from cheap production costs ( aka indentured servitude of workers abroad) while stating that a goal should be to bring manufacturing jobs “back home”. We have developed a society that honors amassing vast personal wealth regardless of the cost of that process to the society as a whole.

I simply believe that it is time for a “paradigm shift” in our priorities and societal structure. I am not ignorant of what we are currently choosing to do. I am calling for a different, more humane economic system.

So you think demonizing companies for making labor decisions to lower costs to be more competitive so they can improve their bottom line so they can improve stockholder equity… much of which is public sector pension plans that need to keep making those 7.5% rates of return so their unionized pensioners get to retain those retire-at-58 millionaire retirement benefits… is the way to make things better?

There are four primary contributors to the reduction in the supply of better paying blue collar jobs:

– Automation – That is #1. What are you going to do about it?

– Globalization – That is primarily a factor of other industrialized countries catching back up to the US after having the crap knocked out of them from the wars… and other emerging economies figuring out how to leverage market forces. It is also somewhat policy related… in that the US could become more economically isolationist… basically protecting some higher paying jobs by reducing our overall GDP by killing exports and also increasing inflation because products are more costly. (And this reminds me that you, like a lot of people holding your views leave off the family economic benefits of low inflation because of globalism… except for healthcare… which by the way is made costly primarily because of the unions wages we have to pay healthcare employees… like nurses that are the highest paid and work fewer hours than in any other industrialized country). So what are you going to do about this?

– Unions – Specifically the fact that they organize and demand higher wages and cause companies to go elsewhere where they can get similar-quality labor value for a much lower cost. What are you going to do about this… sounds like you want there to be more unions and more collective bargaining. How then do you propose to force companies to keep those jobs in the US?

– Government policy – Specifically taxation and regulations on business. Interestingly enough, this is really the ONLY factor we CAN control. We can in fact reduce taxes and regulations to help offset the other three problems. But I am guessing that you are one to demand more taxes on business and more regulations to save the planet from the man-made fake crisis of man-made climate change.

You are in fact shouting at a wall while peeing in the wind and getting a mouthful of your own excrement.

Frankly, it is amazing for you to say, “So you think demonizing companies for making labor decisions to lower costs to be more competitive so they can improve their bottom line so they can improve stockholder equity… much of which is public sector pension plans that need to keep making those 7.5% rates of return so their unionized pensioners get to retain those retire-at-58 millionaire retirement benefits…”

So, it’s a bad thing for public pension plans AND 401k defined contribution plan to get 7.5% rates of return? How about 0.1% for public employees, and 8.9% for private? does that work better for you?

“millionaire retirement benefits”… if you mean having 40k in retirement, after working 35 years in a professional capacity, guess you’re right. Using the rule of thumb that you’d have to have savings/investments sufficient to pay $40K per year @ 4% withdrawal per year, guess that is a “millionaire retirement benefit”.

hpierce – Take the present value of a six figure or near six figure annual inflation-adjusted pension at 58 years old and you would need over $2 million in your 401k account to match it. So, yes, they are million-dollar pensions.

My point was that many of the same people screaming a private companies trying to maximize shareholder value are the same that are relying on those 7.5% returns to fund their pensions.

I am not talking about 401ks.

you say 6 figure… I pointed out 5… I actually came up with a number that exceeds the average AND the median for public pensions in CA (significantly!)… apples and oranges… why don’t you use the highest 2-4% of public pensions (again, I’m stretching that towards your bias) to refute me… oops… you DID!

Oh, and I conceded your point that 40K/year was a ‘million dollar pension’.

What was your refuting point again?

Note one major difference between pensions and 401ks. If you get a raise and have a pension, your pension gets an immediate raise. Compare that to a 401k where the raise only gives you a small amount more to save.

Let’s say you are 55 years old and get promoted and make another $1000 per month. If you are a public sector union guy with that pension, and have the standard 2.7% at 58, assuming your butt was in your chair for 30 years, you would get 81% of that $1000 every month every remaining year of your life… $810 per month. Compare that to the poor fool that stuck it out in the more competitive private sector and got the same $1000 per month raise. Assuming he wasn’t already maxed out from IRS rules that prevent him from investing more than $16,500 per year (government wants their money), he would have three years and a total of $12,000 each year to invest and earn some return. However, he would likely already be investing in his 401k and would cap out and not be able to invest the entire $12000 pre-tax. Without getting too deep into the assumptions and calculations, let’s say he can invest $24,000 of that and earns another $6,000 before he is 58. He now has $30,000. Divide that by $810 and he gets is for 37 months… maybe 40 months if he keeps it invested and earns some interest off of it.

He runs out at age 62. The pensioner keeps going like the energizer bunny living that millionaire life.

Frankly, get your objective facts straight. You write, “a public sector union guy with that pension, and have the standard 2.7% at 58 (misrepresentation # 1)” [fascinating you say guy, but whatever]. Standard? Never was such a plan for miscellaneous members. (Some agencies had 2.7@ 55). Old formula for Davis misc employees was/is 2.5% @ 55, and the 2.5% factor did/does not increase after age 55.The current standard for new miscellaneous (non-PS) employees is 2% @ 62 (anyone hired after Jan 1 2013). (Misrepresentation #2). The highest rate for local public safety is 2.7% @ 57 (OK, will give you that one). Not sure what the current rate is for new Davis PS employees.

Frankly doesn’t want facts to interfere with his “points”, and he may be right about relative DB programs vs. DC.

Thanks for giving me a good laugh this morning thinking about this image

[Moderator]: I would like to request less vulgar and more respectful language, please.

hpierce – Sorry I blew right past some of your points.

Yes, there are people with modest pensions that worked in the public sector at a time before the politicians gave away the store to the unions.

But isn’t it a problem that there is no cap on pension benefits which are not taxed until paid out, but there is on pre-tax 401k investment? On the surface you might make the point that income taxes are paid one way or the other. But let’s say you are at a 35% or 40% combined state and fed marginal tax rate. If you cannot invest pre-tax, instead of $1000 per month, you can only invest $600 or $650. That then eliminates the ability to earn compounding interest on that missing $350-$400.

Now, one thing I think I have to concede here… I think pension payout are taxed as ordinary income, and 401k payouts are taxed at capital gains rates. So for now there is that advantage. (Although I fully expect tax and spend government to increase capital gains and also find a way to tax 401k savings.)

In my opinion we should do away with public sector pensions and everyone should be on defined contribution plans. For one thing this would help improve partisanship and put all workers in the same shared goals category instead of pitting one against the other’s self interest.

But if we have to keep public sector pensions, we should cap the percentage of pay to 65% and also cap max benefits, and increase the retirement age to 62 for safety and those doing real physical labor, and 65 for everyone else. And if people want to retire earlier or with more money, they can do like the rest of the labor market and save for it.

“But let’s say you are at a 35% or 40% combined state and fed marginal tax rate.” If I was at a 35-40% marginal tax rate, don’t think I’d need a pension. Most people @ 100K/year are at less than a 25% State/Fed marginal tax rate. I know my marginal (combined) tax rate never got to 24%. My effective tax rate was much lower. Again, you seem to like mixing apples and oranges to make your “points”. Someone with a marginal tax rate of 35% pays significantly less in an effective tax rate. Didn’t look up Cal & Fed tax tables, but suspect you have to be doing pretty damn well to get up to a 35-40% combined marginal tax rate.

And, If I understand you correctly, no-one should get ANY (or ‘drastically reduced’, or would that be acceptable?) public pension until Age 62 (PS and physical) and age 65 thereafter. And if they die before that, PERS should keep the money and reduce City/Agency contributions. That would indeed save the public money.

Oh, with a few exceptions, if a public employee dies prior to retirement, the most the estate gets is the employee contributions (not the employer’s) in cash (not an annuity) and a minor monthly stipend based on number and age of dependents. The rest goes back to PERS… the “lion’s share”.

If some who has a 401k dies, before retirement, the estate gets the employee AND employee shares of the contributions, and can choose to take it as an annuity, not single cash payout.

Sorry I have been too busy to check this.

You are correct here. An employee can accept a lower payout amount if including spouse benefits, but this is another reason to switch to DC plans. Your money.

I was talking about the marginal tax rate of that $1000 raise. I was assuming something like a $150k family income. 28% Fed, 9.3% for state = 37.3%.

That is why I used the term “marginal tax rate”. Your marginal tax rate is what is applied to that next dollar you earn. Marginal tax rates are what job producers tend to think about. Average tax rates are what workers tend to think about. If a worker you are not risking your capital to pursue a raise. So even 5 cents on the dollar is more money and you would want it. But a job producer has to consider the risk and returns. Is it worth it to pursue business growth for 60 cents on the dollar… or 50 cents on the dollar?

But back to the 401k thing. You can by IRS rules invest up to $16,500 a year pre-tax. After that you would only be able to invest your net pay… after taxes are taken out. Then when you withdraw from the 401k you are taxed at income tax levels… not only the amount contributed but the gains too!

Take a pension that will pay $60k per year adjusted for inflation every year (and let’s not discount that benefit… it is a big deal)… someone retiring at 58 should live to 90 at projected life expectancy. 32 year of that benefit has a present value of about $2 million gross. So again, you would need $2 million in your 401k at age 58 to match it. How likely is that for most people… especially given the government limits in what you can invest in a 401k?

Close, but missed it by *this* much (with apologies to Maxwell Smart). For 2015, a married couple filing jointly doesn’t hit the 28% federal bracket until their taxable income — gross minus deductions and allowances, which can be many thousands of dollars — exceeds $151,200.00. But they hit the state 9.3% rate at $103,060.00.

Just picked up on another consideration, Frankly… if the contributions go into the 401k is post tax (as you imply), then ONLY THE EARNINGS on the investment are taxed… not the principal. so only the GROWTH is taxed at all, and then, as you say, at capital gains rates. PERS contributions are pre-tax, so both contributions (employee and employer) and gains [but it is defined benefit, so ‘kinda doesn’t matter] is taxed at ‘normal’ rates. So, if you and your employer contributed 1 MM to your 401k, (as I understand what you are saying) and it grew by 1 MM, you’d only pay capital gains on 1 MM.

Frankly

Ok so let’s say that you are completely correct in your assessment of the prospects of these two individuals. Then which is making the wiser decision for his own future, the government employee or the private sector worker ? If total lifetime earnings is our only goal, why would everyone not choose to work for the government ? After all, they are only using the system as it exists to benefit themselves. How is this philosophically and morally any different than Donald Trumps explanation that throughout his somewhat checkered private sector career he was only using the system as it exists for his own advantage ?

You seem to defend the pursuit of self interest, but only when it involves the private sector. What in your mind makes it any more ethical for a private businessman to pursue his own interest than for a public sector worker to pursue his own ?

I have a close relative who graduated from Sac State a year and a half ago. He wanted to work for the State and applied for all the posted positions that he thought he was qualified for. After almost a year of failing to get interviews, and being passed over for the jobs when he did get an interview, he decided to take a private sector job.

My point is that it’s not so easy to get a good government job. It takes persistence and a certain amount of skills in the interview. It also helps if the candidate helps the employer meet its goals for minority hiring.

Frankly

“increase the retirement age to 62 for safety and those doing real physical labor, and 65 for everyone else.”

Can you explain to me from what objective criteria or data you have derived these particular ages ?

And what proportion of the job would have to be “real physical labor” to qualify for you ? Full time factory work ? How about a nursing assistant who spends 50 % of his time lifting patients ? How about the doctor working a physically demanding job such as in an ER or intensive care unit or a surgeon ? Picking winners and losers in the retirement age lottery might be just as tricky and just as divisive as is division by public and private sector.