Back in December, a group of former and current public officials, including Senator Lois Wolk, Former Assemblymember and Supervisor Helen Thomson and Former Mayor Ann Evans, came forward to ask the council to consider a soda tax.

Senator Lois Wolk said, “I support your consideration of this issue.” She noted that, for the last four years, “we have tried to deal with this issue of either taxing sugary beverages or putting labels on these beverages. We have not been successful in getting out of either the Assembly Health Committee or sometimes the Senate Health Committee.”

Senator Wolk continued, “I think it’s time for people to have their say.” She added that these considerations offer a real opportunity for the city of Davis – for the children and the public health of Davis.

While she clearly stopped short of endorsing the soda tax, she made clear the need to put the matter on the ballot to allow the people to have their say.

For his part, Mayor Dan Wolk told me two days later, “I’m working on the soda tax. Like the idea.”

However, two weeks later Mayor Dan Wolk pushed away from the soda tax, stating, “We’re here tonight because council is concerned about the state of our community assets.”

He said that any revenue measure needs to address infrastructure, needs to have been studied and have public input, and finally needs to be successful at the ballot.

While Mayor Wolk trumpeted his record on public health concerns, he stated, “In my mind, the soda tax does not meet those three requirements,” noting, “I think we’ve had a taste of the opposition here tonight.”

Later he would push for a parks tax. The mayor during his comments noted that “we have an exacting amount of defined needs that we need in the area of parks and rec.” In expressing his concerns “over going the route of a soda tax to fund those items, it seems like it might behoove the council to look at something like an increase in our parks tax by a certain small amount or moderate amount to be able to begin to pay for some of these items as opposed to going the route of a soda tax.”

“That would be something that I’d be interested in sort of seeing,” he said. He suggested a $50 increase in the parks tax to $99 “which would be a special tax and require two-thirds vote but it [would] provide needed funds for our infrastructure.”

He added, “I don’t think we can shy away at this point from… I’m not willing to wait another year before putting something on the ballot.”

Meeting in December, Dr. Harold Goldstein, Executive Director of the California Center for Public Health Advocacy told the Vanguard that CalBev (the non-alcoholic beverage industry group in California) was already in Davis, simply based on two paragraphs in the local paper, and he expected them to spend $2 million against the soda tax in Davis.

Neil Ruud, a local activist in support of the measure, told the Vanguard, “We were told to expect the sugary beverage industry’s intimidation tactics early on in the process, but it always surprises me how much influence big money can have.” He added, “It’s good to know that Davis is a community where grassroots support is really the most important thing.”

In December the California Beverage Industry purchased ads that ran on the Vanguard and Enterprise websites with links, “The Truth About Beverage Taxes,” which included facts and testimonials along with a short video.

Now the California Center for Public Health Advocacy is fighting back with their own information brochure mailed to Davis residents.

—David M. Greenwald reporting

People already have their say. They can either choose to buy soda or not.

The issue is the voters can choose whether or not to tax themselves for the soda they can choose to buy or not.

But more importantly for this article the public health groups are fighting back against the industry spin.

No, the issue is a few local feel good social engineers want to put a soda tax on the ballot.

But there is nothing in the flyer about taxes or any other political action. This is being presented as just a consumer education effort.

If the voters disagree, then they can vote against it. What’s the harm?

It may not mention the soda tax but you can bet your sweet bippy that it’s political.

Absolutely but there are legal definitions whose hoops they jumped through here

>> If the voters disagree, then they can vote against it. What’s the harm? <<

It appears that having this choice to vote IS harmful or scary to some.

Darrelldd, it’s not scary or harmful to me at all, I hardly ever drink sugary sodas. I just don’t like local activists deciding what may or may not have to be taxed for their social engineering agenda. Would you like if a local group was pushing an ordinance that because riding a bike in the downtown area was dangerous and possibly harmful as evidenced by the number of bikers involved in ‘accidents’ that they wanted a ballot measure where all bikes would be banned from the Davis downtown core area? It would come down to a choice vote too. I’m not saying that I condone it but things like that should never come up for a vote.

There is a cost to put it on the ballot.

It takes up valuable city staff, CC and community time and distracts from the real important issues we face.

It continues to set the precedent of nannystateism.

It is just a tax money grab shrouded in a fog of social justice activism.

So, not scary, just wrong.

How much is that cost? Maybe some of the interest groups that support it would pay that cost.

Harder to quantify, I imagine. Obviously, those who support this believe that obesity and diabetes are real and important issues.

Those would be reasons for voting against it, not reasons to prevent people from having the option to vote on it.

don makes some points here. first, cost can be mitigated. in a measure r vote, the developer pays the costs, why couldn’t the groups involved here do the same? second, while i understand some people are against all taxes, others think this is social engineering, to say this isn’t an important issue is ludicrous. do you think we are not going to be able to address finances? economic development? or land use because there is a sugar tax? i just don’t buy it, different people are working on different things anyway and there is always a lot going on, so i see it as a non-issue.

I don’t see that issue addressed anywhere in the mailer.

How is a soda tax different from a tax on alcohol or tobacco? We all have the choice on whether to buy alcohol or tobacco, so there’s no infringement on anyone’s rights as far as the commodity being taxed is concerned. Taxing anything like this is just a simple way to say “You don’t really need this thing, so it shouldn’t be a problem kicking in a little extra to fund GOOD things as long as you’re paying for something that ISN’T really good for you.”

There is one big difference between soda, and alcohol and tobacco. People are allowed to purchase soda using SNAP benefits (formerly called food stamps); so we are saying that it’s perfectly OK for taxpayer money to be used by poor and disabled people to purchase soda.

It’s sort of ironic that SNAP stands for “Supplemental Nutrition Assistance Program”, but it allows purchase of sodas that have almost no nutritional value.

Funny, I received the anti-soda PHA flyer in the mail a few days ago but I have yet to have my mail box ‘intimidated’ by the beverage industry.

Are they advocating anything in the political arena or is this just a consumer education effort? I don’t see any political advocacy in their mailer.

By doing it that way, they can avoid having to file as election advocacy.

So they are not advocating anything in the political arena…is that correct?

Not explicitly. It appears to only provide information.

Topcat

“So they are not advocating anything in the political arena…is that correct?”

David’s response is correct as written. I think that it is very important to differentiate between the actions of the group that developed and distributed the flier and those who have the same goals ( improved personal and public health) but are not allied with this group. I count myself in this category. I serve as a volunteer in a number of county public health capacities and yet I am not officially affiliated with any particular advocacy group. I received this flier without pre knowledge just as everyone else did. However, I am operating in the political arena in the sense that I am a strong advocate for a vote on this issue.

A Soda tax should be used to generate revenue for parks, athletic fields (Little League, soccer, … .) and a 50 meter pool. These are all wish list items with no revenue source. I think the public would support a tax that generates revenue for these items.

Sort of funny if you think about it.

Since the thing is bad for you we don’t want you to consume it and so are going to tax it to get you to stop using it and will use the money for this tax to pay for things we want.

But with no consumption of this product there is no tax revenue derived to pay for the things we want.

So, do we really want you to stop consuming it? I don’t think so.

Maybe the true health-minded social justice crusaders do not recognize that they would be making a deal with the devil?

You have to wonder at some point when the sin tax revenue gets relied upon, are government officials working with the sin product manufacturers to collaborate on how to sell more.

Interesting that the tax on Gasoline is per gallon and not a percent of sales. So, cheaper gas that leads to more gallons of gas being purchased and burned to release more carbon in the air is actually good for government.

not that much different from alcohol or tobacco, that’s why for a sin tax, you need to fund the effects of the consumption rather than general projects.

This is when I like you, Frank Lee.

Government wouldn’t do that, Frank Lee, because the first two letters in GOvernment are the same as the first two letters in GOod and GOd, showing that government is both good and sanctioned by God.

It is actually far, far worse than you could even imagine. More efficient cars are costing the government billions annually in lost gasoline taxes, so the California government is looking additionally into a per-mile auto use tax that would follow you by GPS or have a “smart” transmitting odometer, or require you pay even when out-of-state if you refuse to be tracked. Don’t believe me? Google it! Right now, Oregon, with similar tax loses, is already running a five-method pilot program that will likely serve as the model for the California trial. The laughingly obvious flaw is that going to a per-mile fee discourages fuel conservation because the tax is the same per mile, rather than per gallon used, discouraging an incentive to decrease fuel use by consumers by acquiring more efficient cars! All because of the sacred mantra “we can’t increase fuel taxes”.

Damn, I did not know about this gasoline tax scam. Thanks for the alert AM!

Frankly

“But with no consumption of this product there is no tax revenue derived to pay for the things we want.”

I would like to present you with a different perspective on this issue. A doctor’s income ultimately depends upon patient’s coming to see her. And yet, it is the goal of a doctor to maximize a patient’s health therefore doing away with much of the need to come to see her. On the surface, it appears that she is acting against her own best interest since if the patient is healthier, the doctor will make less money in a fee for service world. And yet, is it not the highest calling of the doctor to prevent illness, insure the best health possible for her patient even in the face of the knowledge that this will result in less wealth for herself. I have always seen the ultimate goal of the physician is to do herself out of a job. I see this in much the same way. I would be absolutely delighted if the soda tax brought in less and less money as less soda was consumed since that would ultimately lead to a healthier population with less money spent in attempting to undo the bodily injured caused by the soda.

Some interesting (to me at least) things…

Where will the proceeds be spent? I’ve seen GF, Parks, health care espoused…

When is the tax imposed? Manufacture, distribution, point of sale? If the latter, when you go to a FF restaurant, you currently pay the same for a beverage, be it “sugary drink” or unsweetened iced tea… will those of us who always choose the unsweetened iced tea pay the tax?

For most FF places, you pay the same whether you buy a small, refill it 4 times, or only drink a single serving… how would the tax be “proportional”?

As it stands now… am strongly opposed to even putting a measure on the ballot (at a cost that is not necessarily insignificant) until I have definitive answers to my questions…

I agree with Hpierce. This has so many unknowns involved.

The tax is on the distributor not the customer, so the local store would have to figure out how to disperse the tax to the consumer – if they do.

Where is that written? How is it enforced? Will the local store apply it to all beverages? Wine, brandy, etc., are sugary drinks, arguably, as they are products of the fermentation of sugars.

Your response did not “answer” my questions… it has raised others…

Darn… forgot to mention beer… also a product of fermented sugars… beware of the “beer gut”… ingestion of fermented beverages can also lead to diabetes, and many other undesirable medical and behavioral things…

If there is a ballot initiative, everything will have to be spelled out, until then, nothing is in writing, I’m only going what I’m told by Dr. Goldstein. Until there is a proposal, we won’t know specific languages. I don’t believe that alcoholic beverages are covered, but gatorade, fruit juice, soda, energy drinks, etc.

DG… that last post is helpful… many questions remain… we’ll just need to wait and see if there is a concrete proposal for a measure…

It would just be part of the cost of goods to the retailer. When gas prices go up our growers often add on a fuel surcharge on top of their existing delivery charge. We pay special fees for certain products ($1 extra for patented fruit trees), but it is the grower who pays the fee to the tax agency or patent holder. There are industry associations that have enacted special assessments that are paid by the grower and passed on to us as part of the wholesale cost. The landed price of a plant at my store may involve as many as four different costs.

Even a restaurant that serves fountain drinks at a fixed price would figure out a way to pass on this cost.

As you know, the best way to pass a tax is to keep it vague what the tax spending will be all about, so that voters will imagine that it will be spent on what each person thinks taxes should be spent on. Just like the best way to land a sexual partner is to be mysterious about who you are . . . so the other person can fill in the blanks for awhile, until they learn what a conniving, manipulative a-hole you really are. Oh, and that the taxes will actually be spent on something else.

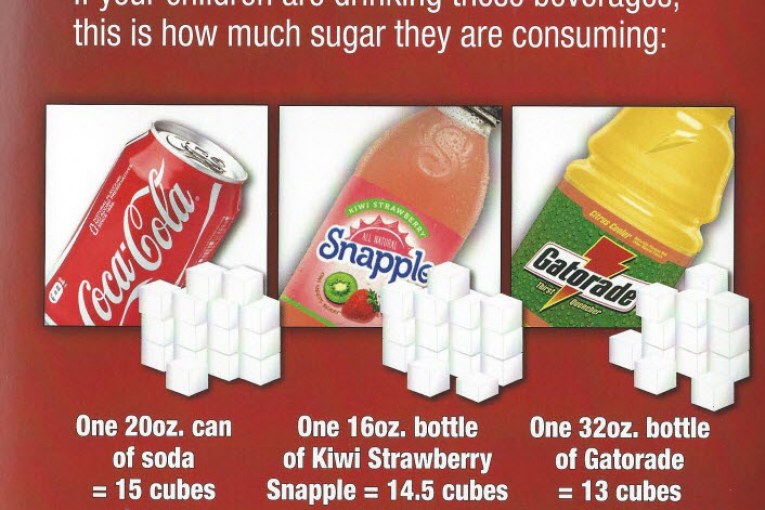

Did anyone else notice that the flyer has a photo of a 12 oz.can of soda and below it they tell you how much sugar is in a “20 oz. can of soda” (I have never seen a “20 oz. can of soda”)? My family does not drink soda so I don’t really care about the tax and I’m sure it is just another way for the government to get more money by pretending to care about fat kids. If we really want to help kids lose weight we could get rid of ALL the crappy food in schools (no more free Froot Loops, Pop Tarts and Chocolate Milk for breakfast) and require a BMI <25 to move to the next grade level (the kids with a BMI >25 would go to a summer school run healthy eating experts and Cross Fit guys)…

you’re being a little too technical here. yes, they shouldn’t have said can but 20 oz is a standard weight for both bottles and fountain so it’s not irrelevant.

What about 32 oz bottle of Gatorade? I’ve never seen those in a vending machine.

Can I get a tax exemption if I promise to only drink it on 20+ mile bike rides?

What about apple juice and oj? Jamba juice, Starbucks…..They make you fat, tax those too!

Liberals will never tax lattes because they love them too much.

32 oz bottle of gatorade is one of the standard sizes they sell at grocery stores.

True and you buy oj in 64 oz containers at the grocery store. That is 59 sugar cubes! Needs to be added to the brochure and taxed!

WTF? What kind of non-sequitur is that? The brochure is about education about sugar. Hey, public health group, go ahead and do that until the cow’s teeth come home, more power to you. It is a bit odd they talk of sugar, when many of the beverages contain non-fructose corn syrup, which is even worse. It’s also a bit odd these come out NOW to fight the beverage industry on a soda tax, instead of like, well . . . all the time, any time, to educate the public and our youth. So, given the timing, what are these people after, healthier kids, or an excuse to find a voter base to raise taxes by exploiting the “what about the children?!?!?! #whaaaa!#” knee jerks?

Frankly

“But with no consumption of this product there is no tax revenue derived to pay for the things we want.”

I would like to present you with a different perspective on this issue. A doctor’s income ultimately depends upon patient’s coming to see her. And yet, it is the goal of a doctor to maximize a patient’s health therefore doing away with much of the need to come to see her. On the surface, it appears that she is acting against her own best interest since if the patient is healthier, the doctor will make less money in a fee for service world. And yet, is it not the highest calling of the doctor to prevent illness, insure the best health possible for her patient even in the face of the knowledge that this will result in less wealth for herself. I have always seen the ultimate goal of the physician is to do herself out of a job. I see this in much the same way. I would be absolutely delighted if the soda tax brought in less and less money as less soda was consumed since that would ultimately lead to a healthier population with less money spent in attempting to undo the bodily injured caused by the soda.

Come Tia, Kaiser docs are on salary. Other docs cram more appointments and give patients less timet to drive more revenue.

Frankly

“Other docs cram more appointments and give patients less timet to drive more revenue.”

True as written. But you have neatly side stepped the point that this is a matter of choice. There is nothing to keep others from choosing to work in a Kaiser like model. There is nothing other than our individual and group choices keeping us from building a model which allows doctors to act more fully as doctors and less as businessmen and women. We certainly have the ability to build a more patient centered model of care and Kaiser has demonstrated that.

Alan

I am guessing from your comments that you are unaware of “Potter the Otter Drinks Water” and any number of educational campaigns that have been designed to get children to choose water over less health drinks. I don’t mean to call you out individually, however, it is always frustrating to me to hear those who are not involved in the endless rounds of attempting to educate on all levels including children, adults, parents, school administrators making statements implying that educational efforts have been lacking, or why don’t we just rely on education.

We in the health care community have been making educational attempts for years while all the while the population is becoming more overweight, consuming more unhealthy products, and becoming less healthy. From our point of view, we have been doing our part. What have you, specifically been doing to help with this problem ? Any of you who are opposed to this very modest proposal ? What is your specific role in this major problem in health and wellness in the community ? I suspect that the answer for many of you will be “none”, that’s not my responsibility. I disagree. I think that we are all responsible for the health and well being of our children and our community. This is one very small contribution that all of us could make.