Currently, the school district relies on the approximately $9.5 million dollars from the parcel tax to supply about 12 percent of district funding. Under the LCFF (Local Control Funding Formula), DJUSD is only an averagely funded school district for California – even with the local parcel tax funding.

Starting Tuesday morning at 8:30, and continuing to a Wednesday night meeting, the school board must approve a tax resolution by June 30 in order for Yolo County Elections Office to place the measure on the November ballot.

As we have discussed previously, the “status quo” measure would call for a $620 a year parcel tax, which would fund the current level of $9.5 million. The board was unanimous in early June for supporting a measure of at least $620. However, the board was divided on going to either $750 or $960.

The key consideration will be how much the board feels the district needs to fund current programs and potentially fund necessary additional programs, while also facing concerns about the viability of an increased tax measure.

At the June 2 meeting, consultants presented their initial findings for the viability of the parcel tax.

Their key findings were that the Davis community believes “the District is doing a very good job providing a high quality education for local students.”

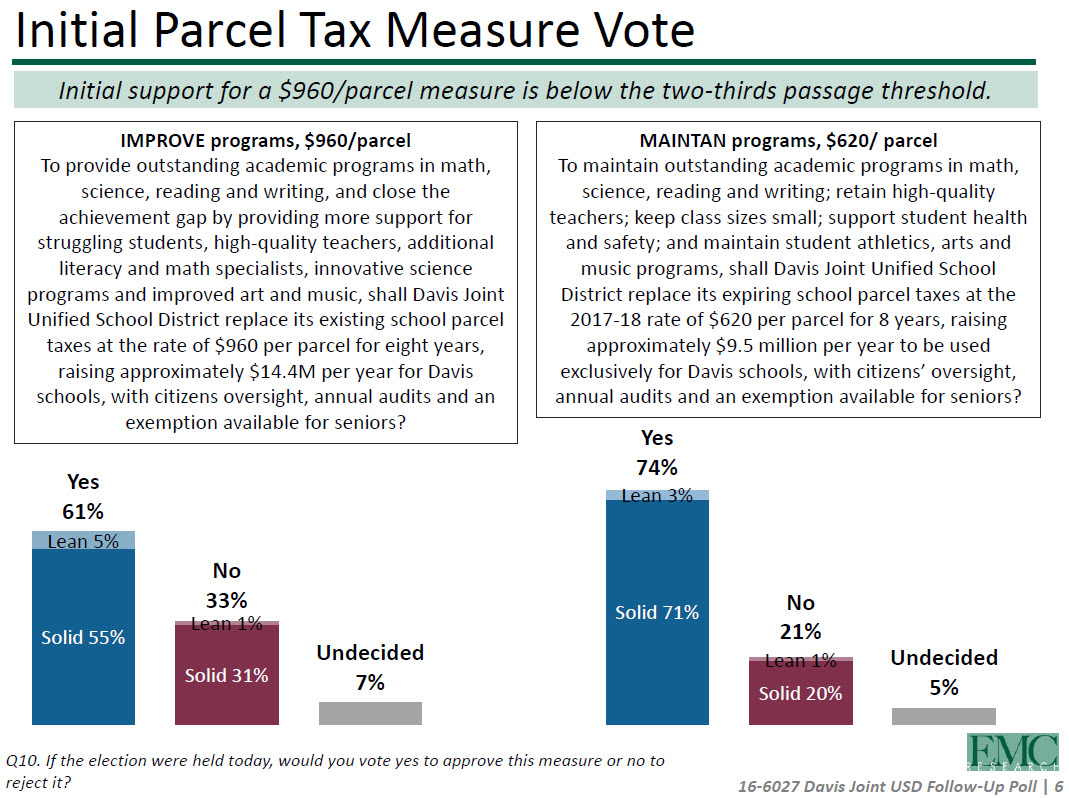

However, they found, “Initial support for a $960 parcel tax measure for the schools falls well short of the two-thirds threshold needed for passage, unlike in the earlier study that showed strong support for a $620 measure.”

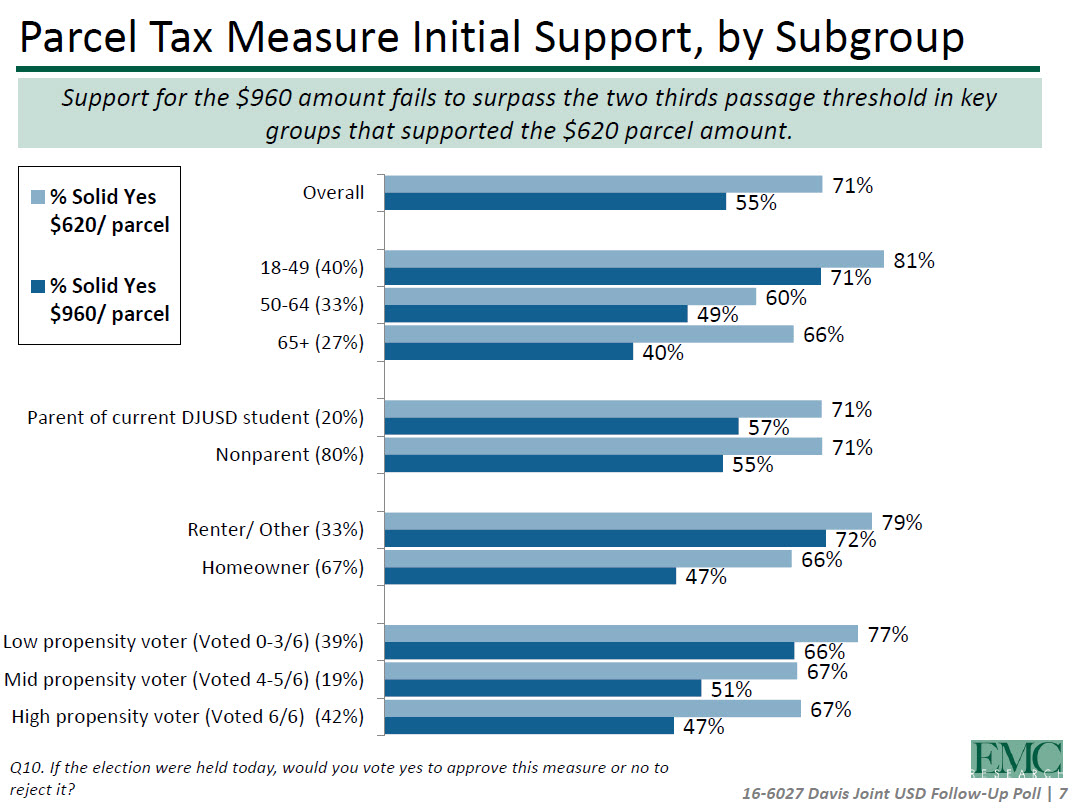

They found that “support among key subgroups such as older voters and high-propensity voters is significantly lower than the overall support level.”

They add, “With the higher dollar amount, however, support is also low among a wider audience including district parents.”

There is also this point, “Since many voters are unaware that they are currently paying a parcel tax, any measure may be risky as it appears to be a significant tax increase. However, given strong support for the schools, a November 2016 measure is feasible if it is reasonably priced.”

At the last meeting, the board directed staff to draw up two resolutions – one at $620 passed 5-0, and one at $760 passed 3-2 – with Boardmembers Barbara Archer and Tom Adams in dissent. Both resolutions would include an eight-year time frame, as opposed to the four-year time frame that the district had been using.

The resolutions are not currently available on the board meeting agenda packet.

Alan Fernandes was the most vocal at the time pushing for the higher amount, arguing that the parcel tax should include a creation of a budget stabilization account, modeled after the state’s rainy-day fund, which would allow the district to potentially have a fund set aside should the economy go south and the state funding be reduced, to enable the district to avoid funding cuts.

He argued, “It would be very regressive for us to merely renew a parcel tax (at the current level of funding) when we all know we’re going to be worse off in years ahead.”

Looking at the numbers, at a $620 level, the Yes side appears to have solid support. There is 71 percent support, with another 3 percent leaning toward support and with only a 20 percent opposition. This has been the standard formula for the last five parcel taxes with the two nuances – a longer time frame of eight years and a higher total parcel tax of $620 as opposed to two separate smaller parcel taxes.

Some have expressed concern that the longer time horizon would reduce the stakes by parental groups who will no longer be involved every four years, but rather every eight years, which means that for many parents, they will only go through one parcel tax.

While the $960 parcel tax seems to fail, it does get to 61 percent by adding in leaners. The Vanguard has argued, therefore, that a full campaign could very well increase support to the level necessary. A $750 parcel tax is seen as a middle ground and there is more confidence in its viability.

The poll breaks down support at both levels. The strongest support comes from the 18-49 group, which supports both measures. No other age group breaks the two-thirds level, although those over 65 support, at 66 percent, the lower figure.

Parental status does not seem to make a difference. Non-parents out-number parents 80 percent to 20 percent (at least in this survey), but both give 71 percent support at the $620 level, while maintaining support in the 55-57 percent level for the $960.

One interesting factor is that homeowners in this survey outnumbered renters by a two to one margin, even though we know in the general population they are roughly equal. Renters are far more likely to support the parcel tax, 79 percent at $620 and even 72 percent at $960. Meanwhile, homeowners barely reach the two-thirds threshold at $620, and are at less than 50 percent at the higher figure.

One big question not analyzed here is what the voter population looks like.

Finally, low propensity voters (probably those more likely to rent) support the parcel tax at a far higher level than mid and high propensity voters. Seventy-seven percent of low propensity voters support the $620, while only 67 percent of mid and high propensity voters do. The same pattern holds for the $960, where there is 66 percent support among low propensity voters, dropping to 51 percent for mid propensity and 47 percent for high propensity.

On the surface, those numbers look scary even for the $620, but keep in mind that the turnout was 66 percent three weeks ago and may well exceed 80 percent this fall.

Overall, the numbers appear for solid for the $620, while there is clearly work to do to get to $960.

—David M. Greenwald reporting

What are these “necessary additional programs”?

What I have wanted to see was a chart that would show on the left what programs are funded and then on the right their funding levels and whether they are funded at the various levels. That would make it easy to answer your question. Until we at least see the resolution, I can’t answer it

Not getting you at all here.

It’s either a new program or not.

What does funding levels of current programs have to do with “necessary additional programs”?

I would be interested to see what the revenue for the $620 without an opt-out would be. A;so as has been noted a COA would go a long ways towards meeting the funding needs. Would not hurt for the board to consider the desires of parents while they are at it.

Look at the language supporting the $960 parcel tax: “more support for struggling students, high quality teachers, additional math and literacy specialists, innovative science programs and improved art and music“.

1. Struggling students already have plenty of support through the Bridge program which provides individualized tutoring to struggling students and I have no doubt UCD students would provide even more volunteer tutoring if asked. At Connections Cafe we get more students tutoring that we need most evenings. URC, a retirement community, offered to provide tutoring to struggling students but were inexplicably turned down by the schools.

2. Is there an implication here that the teachers are not high quality already? How is this parcel tax going to make them more “high quality”?

3. How many additional math and literacy specialists would be funded by an increase in the parcel tax? One on one help with a volunteer tutor is much more likely to help a struggling student than one math and one literacy specialist assigned to assist an entire school and all the struggling students contained therein.

4. What innovative science programs are being referred to here that couldn’t already be devised by current faculty? I used to be a science teacher, and devised all sorts of creative science experiments to keep students interested. It isn’t that difficult.

5. Is there something inadequate about our art and music programs that they need to be improved? I find that hard to believe.

Frankly, the ballot measure trying to justify the $960 parcel task sounds like a string of amorphous ideas with little specificity as to exactly what the money would be spent on. It implies that what the schools are doing now is somehow inadequate in science, math, English, art and music. It is also insulting to current teachers by implying they are not highly qualified. But have at it – go ahead and ask for a $960 parcel tax, and see how far it gets with tax weary citizens. And of course be mindful that the city itself will most likely be asking for a parcel tax to fix roads and other crumbling infrastructure, which is in direct competition for scarce tax dollars.

The City has consistently let DJUSD go first to the dinner bowl. The City then looks to see what scraps are available. Placing a wager here… if the DJUSD manages to pass the highest assessment, the City has NO chance of passing any meaningful assessment. Takers?

I think until we see the resolution, it’s hard to judge what the program would look like. My understanding was that the current parcel tax funded art and music, perhaps WDF knows what more needs to be funded.

The big thing is that we need funding to do the STEM stuff.

“Is there an implication here that the teachers are not high quality already? How is this parcel tax going to make them more “high quality”?”

I think the idea is hiring more teachers who are high quality.

nameless: 5. Is there something inadequate about our art and music programs that they need to be improved? I find that hard to believe.

Art and music are not guaranteed subjects at the elementary level. It depends on whether the classroom teacher chooses to offer units in art and music or not. Or it depends on whether the school site PTA/O decides to fundraise and support music/art programs and activities, a choir teacher for instance, or an art specialist. A student can go from grades K-12 and not get any direct classroom experience doing art or music or performing art. In high school there is an “arts” requirement for graduation, but that can be fulfilled by taking art history or music appreciation, which involves talking about art and music rather than doing it. Strings and band are offered as elective options in elementary grades (funded by the current school parcel tax), but not choir. But if a student has never had any prior experience with music, then how would that kid or his/her parents know if that student has any affinity for music?

Davis elementary schools used to have music teachers and art teachers that gave instruction to *all* students, and not just on an elective basis. Those positions were cut as emphasis focused more on ‘testable’ subjects (that you can give a multiple choice standardized test for) like math and English. It maybe that you don’t see music and art as worthwhile to fund. I think providing a diversity of accessible curricula to all students provides the best results and outcomes. I believe that diversity of curricula in this context is at odds with current views of education policy that are handed down from the state and federal government. Local funding is the best guaranteed antidote.

I learned the words to the national anthem and other patriotic songs from elementary music class that our entire class had once/week. My kids did not learn the words to the national anthem from school, and that’s pretty typical across school districts in California. Did yours?

When I go to a sporting event and everyone stands for the national anthem, I see very few attendees who seem to know the words. If standing for the national anthem is a worthwhile act of respect and patriotism, then why not have students learn to sing the national anthem and engage them more in events like that? Wouldn’t that be worth learning in school?

Artistic skill/ability is a major component of many professions — graphic design, industrial design, interior design, marketing, architecture, landscape design. Students who don’t have the chance to explore and develop their artistic skills early on are not likely to have access to those professions.

In recent years, the quality of school instruction is measured by federal and state mandates through standardized test scores in math and English, not art and music (or theater and dance). What is your position?

More training, presumably. I don’t assume that’s free.

nameless: 1. Struggling students already have plenty of support through the Bridge program which provides individualized tutoring to struggling students and I have no doubt UCD students would provide even more volunteer tutoring if asked. At Connections Cafe we get more students tutoring that we need most evenings. URC, a retirement community, offered to provide tutoring to struggling students but were inexplicably turned down by the schools.

Bridge is only offered regularly (4 days/week, when UCD students are around) at Montgomery Elementary and Harper JH because that’s where the highest concentration of higher needs students attend. It isn’t a volunteer program as far as most UCD tutors are concerned. Most UCD student tutors are paid as part of a federal work study program. It costs for the district to manage and supervise the program; it doesn’t just run by itself. The limits on the number of UCD student tutors in the program is usually the amount of work study funds available. DJUSD isn’t the only school district pulling on UCD student tutors, either. Surrounding school districts also compete for UCD tutors, including Woodland and Esparto, two districts who have even higher concentrations of high needs students that Davis.

$960 has no chance the school board would be crazy to even propose it. The polling doesn’t support it. Why do the poll and then completely ignore the outcome? They should go for renewal of the $620 and add a small annual cola. Otherwise they will get their butts handed to them at the ballot box.