The biggest issue facing Davis, as we approach the 2018 elections – which will feature among other things ten council candidates, a possible land use project, and two city revenue measures – is the issue of student housing.

This week, UC Davis released its annual survey commissioned by Student Housing and Dining Services at UC Davis which found that the vacancy rate remains dangerously low.

According to the fall survey, 13 apartments, or 0.2 percent, of 8,122 leased by unit were vacant, the same percentage as last year.

Among the 1,266 units leased by the bed, 74, or 1.6 percent, of the 4,504 beds were vacant. Last year, 1.0 percent were vacant. The number of apartments leased by the bed increased by 29 percent over last fall.

UC Davis uses these surveys “to assess the current housing market conditions faced by UC Davis students and faculty and determine the feasibility of proposed housing projects. Similar surveys have been conducted on an annual, or biennial basis, since at least 1975, documenting long-term historical trends.

“Since 2013, the survey has been administered in partnership with BAE Urban Economics, a private real estate consulting firm with offices in downtown Davis.”

UC Davis has already announced that, in addition to the 6200 beds they had previously promised to provide over the next ten years on campus, they will expand that to 8500.

As Chancellor Gary May acknowledged in a statement a few weeks ago when the changes were announced: “Housing market changes cannot be resolved by UC Davis alone. We want to continue to work cooperatively with the Davis community, City Council and other local communities to encourage smart and responsible development drawing on the careful and innovative history of planning in the city of Davis.”

These represent the final numbers before the council votes on whether to approve projects like Lincoln40 and Plaza 2555, as well as Nishi as soon as two weeks from now.

The city has identified five percent as a goal for the vacancy rate, and these numbers suggest we have a long way to go.

The survey notes that the market is shifting as more apartment complexes (even existing ones) are moving toward bed leases versus unit leases.

The report notes: “One of the more complex dynamics of the local rental housing market is the practice of renting out individual apartment units to multiple tenants using multiple lease agreements. Under this type of arrangement, known as a ‘bed lease,’ each bed or bedroom in an apartment is associated with a separate lease agreement.”

Still, 87 percent of the units are rented under unit lease arrangements.

The unit leases have a low vacancy rate. They found “a vacancy rate of 0.2 percent, which is roughly comparable to the vacancy rate documented through both the 2016 and 2015 surveys.”

Meanwhile, 13 percent are now rented under bed lease arrangements. “1226 units were reportedly rented under bed lease arrangements… this represents an increase from 950 units in 2016.” This is before bed lease developments like Sterling Apartments have been built or Lincoln40 approved.

The report does not delve into this, but this is suggestive that the market is moving toward the direction of bed leases anyway, and that the type of leases are fluid even absent new development.

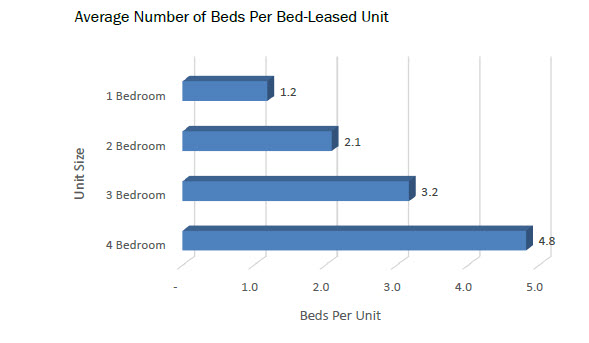

The bed leases tend to be larger in terms of number of bedrooms, where two-thirds of the bed-leased apartments are four bedrooms compared to 51 percent of the unit-leased apartments.

Also, “Four-bedroom bed-leased apartments have a higher prevalence of ‘double-ups,’ with an average of 4.8 beds per unit.”

Bed-leased spaces are more likely to be vacant, however, than unit-leased, although that would seem to make sense if you are talking about a vacant or available bed versus a full unit.

Still, the vacancy rate even for bed leases spaces is absurdly low. There were a reported 74 bed-leased spaces available in 2017, for a vacancy rate of 1.6 percent. “This represents a modest increase from 32 vacant beds in 2016, when the vacancy rate was 1.0 percent. Vacancies were spread among all unit sizes, with the majority (i.e., 50 units) concentrated in units with four-bedrooms.”

That leads them to the blended vacancy rate: “To estimate a citywide vacancy rate for all lease types, BAE combined the unit lease and bed lease vacancy rates, to generate a combined or ‘blended’ vacancy estimate.”

What they found: “The blended vacancy rate for all rental units equals to 0.4 percent. For comparison purposes, BAE also calculated a blended vacancy rate of 0.3 percent in 2016 and 0.6 percent in 2015.”

In other words, the conditions are slightly better than in 2016, but worse than 2015. Perhaps some of that simply reflects the higher percentage of bed leases in 2017 than 2016.

The vacancy rate is of course half the equation. The other part is the rental rate. They found: “All survey respondents reported static or increasing rents, relative to 2016. None of the respondent complexes reported lowering rents in 2017 in order to fill vacancies.”

The cost of rent continues to rise. The weighted average for a studio is $1035. That increases to $1270 for a one-bedroom, $1660 for a two-bedroom, $2270 for a three-bedroom and $2858 for a four-bedroom.

In bed leases, the per bed charge seems to average just under $900 for a bed.

The cost of renting a unit went up 6.2 percent from 2016 to 2017, going on average from $1576 to $1673 (although it is not clear that’s the best way to calculate rental rates, but at least that gives us a ballpark figure).

The cost of bed leases, however, went up more modestly at 1.9 percent from $875 to $892 a month.

The BAE also looked at utilities and amenities. The 2017 survey incorporated additional questions regarding utilities and amenities that were made available to tenants at no additional charge.

They found of the unit-leased apartments: “79 percent reported that they include trash collection, while 76 percent include sewer service, and 72 percent include water service. Meanwhile, 27 percent offer internet or Wi-Fi at no additional charge. Of the nine respondents that offered bed-leased units, 78 percent reported that they include trash collection and sewer service, 56 percent include water service, and 44 percent include internet or Wi-Fi service. Twenty two percent include electricity at no additional charge for bed-leased units.”

Conclusions:

Until there is an increase in supply, the market is not going to improve. There is not enough data about the bed leases versus unit leases, but the data we have suggest that it might be that bed leases will allow for a higher vacancy rate and the leases allow for a slower rise in rental rate.

The city of Davis has already approved Sterling Apartments. Construction is underway. The campus is planning for Orchard Park, which now includes 1400 additional students, and further expansion of West Village to include 3800 students which could be online by 2020 if things go smoothly.

The city is planning potential additional units at Lincoln40, Plaza 2555 and Nishi, which could along with university commitments push the total new housing to 13,000 or so new beds. That has the real ability to change the market.

However, that will take voter approval of the 2200 beds at Nishi, along with council approval at Lincoln40 and Plaza 2555, to make it happen.

—David M. Greenwald reporting